- Fidelity says governments, nation-states, central banks, and sovereign wealth funds are likely to buy Bitcoin in 2025.

- The ongoing macroeconomic factors like inflation and fiscal deficits have made investing in Bitcoin a smart play for governments, according to Fidelity.

- The U.S. is considering establishing a strategic Bitcoin reserve, with former President Donald Trump being an advocate of the asset class.

As Bitcoin continues to dominate the crypto realm, Fidelity, a prominent asset manager with a portfolio worth 54 trillion, anticipates that by 2025, governmental bodies might become significant investors in Bitcoin. The intense popularity surge of this digital asset has sparked conversations about strategic Bitcoin reserves in many nations, including the US, where President-elect Donald Trump has expressed strong support for the asset class.

Bitcoin’s Unprecedented Growth and Fidelity’s Expectations for 2025

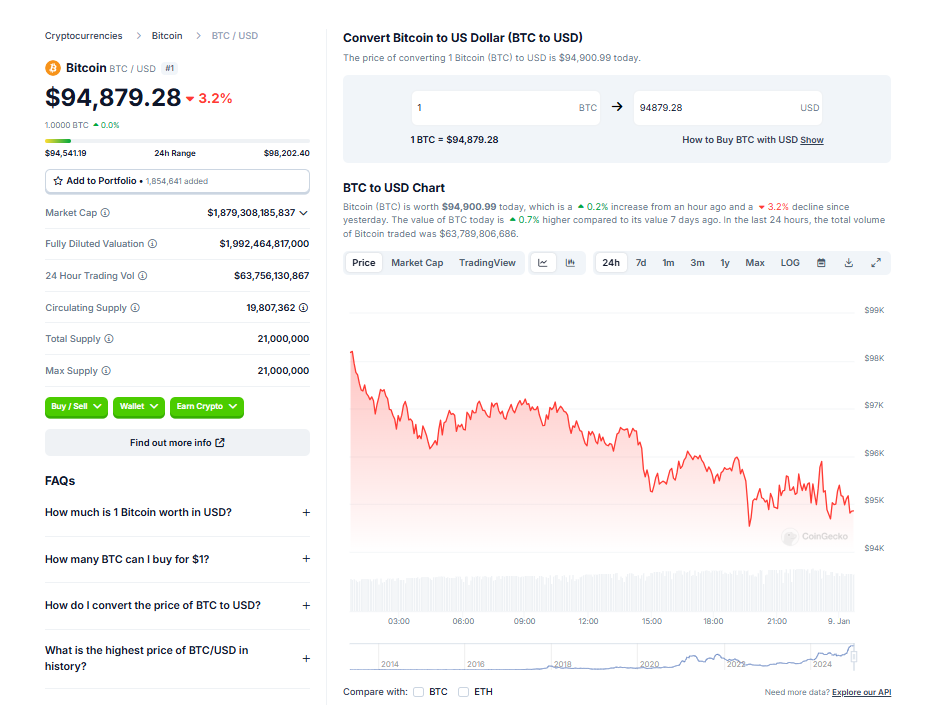

The year 2024 marked a significant milestone in the history of Bitcoin. It became the first crypto-based Exchange Traded Fund (ETF) in the United States in January and reached a six-figure price for the first time by November. However, Fidelity predicts an even more promising 2025. As per their analysis, governments may emerge as the next major investors in Bitcoin, given the looming inflation and fiscal deficits worldwide.

Potential Shifts in National and International Financial Policies

Fidelity analyst, Matt Hogan, in his latest research report suggests that several nation-states, central banks, sovereign wealth funds, and government treasuries are likely to establish strategic positions in Bitcoin. He emphasizes that the current macroeconomic factors make investing in Bitcoin a wise strategy. He further argues that not allocating resources to Bitcoin could be riskier. This notion is supported by US Senator Cynthia Lummis who introduced the BITCOIN Act and is believed to be in discussion with the Trump administration for a strategic Bitcoin reserve plan.

Conclusion

As the world grapples with economic uncertainties, the shift towards digital assets like Bitcoin seems more plausible than ever. Fidelity’s report underlines this potential global trend, indicating a future where Bitcoin may not just be a preferred investment for individuals but also for nations. It will be interesting to observe how this prediction unfolds in the coming years.