• Bitcoin’s price plunged by $5,000 in minutes after briefly surpassing $100,000

• Over 120,000 traders were liquidated, resulting in almost $400 million in liquidations

• Altcoins like Ethereum, XRP, Solana, Dogecoin, Avalanche, and others suffered even steeper declines

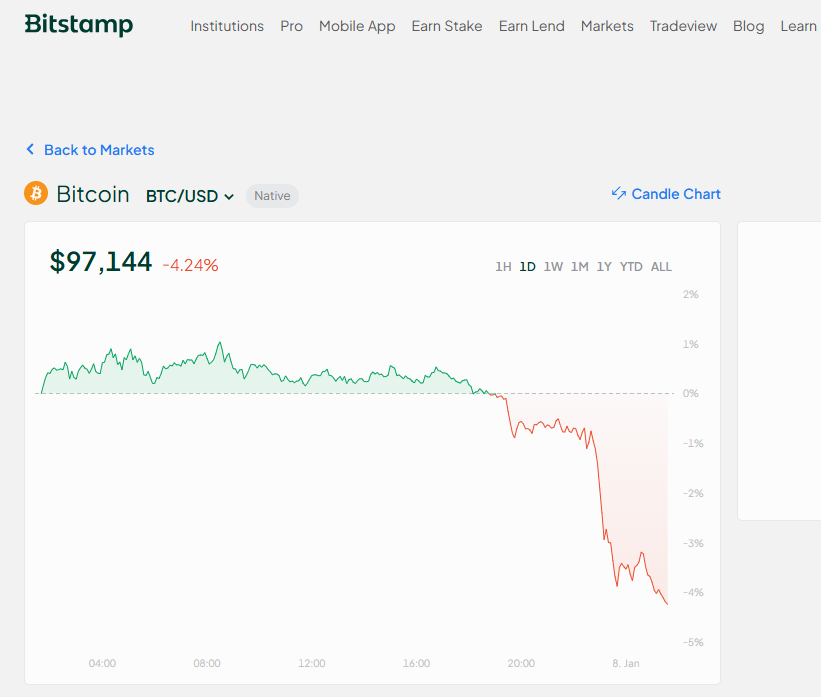

Bitcoin’s journey above the $100,000 benchmark was a fleeting victory, with the asset diving below this significant level approximately 24 hours after surpassing it. This abrupt drop followed a bullish momentum that had been triggered by MicroStrategy‘s latest Bitcoin purchase. The cryptocurrency continued to climb, peaking at just under $103,000 during the Tuesday morning Asian trading session.

The Unfortunate Market Correction

Unfortunately, Bitcoin couldn’t maintain its upward trajectory and began to lose value gradually. It hovered around $102,000 later that day before market bears seized control, causing Bitcoin to shed almost $5,000 and slump to $97,160 on Bitstamp.

Altcoins Feel the Heat

Altcoins suffered even more. Ethereum took a 7% hit and is now grappling with a critical support-turned-resistance level of $3,500. XRP and SOL experienced similar fall rates, dropping to under $23 and $210 respectively. Other cryptocurrencies such as DOGE, SUI, AVAX, LINK, XLM, SHIB, DOT, BCH, and PEPE have seen their prices plummet by up to 11%.

The Liquidation Consequence

This heightened volatility has wreaked havoc on over-leveraged traders. More than 130,000 such market participants were wrecked in the past day. The total value of liquidations has skyrocketed to $390 million on a daily scale, with over $200 million liquidated in the past hour alone. The single largest liquidated position occurred on Binance and was worth $12 million.

Conclusion

While this plunge may be a devastating blow to many traders, it’s crucial to remember the volatile nature of cryptocurrency markets. These extreme market fluctuations should serve as a reminder for traders to maintain a balanced and diversified portfolio to mitigate potential losses.