• The crypto market had a rough Tuesday morning

• Bitcoin (BTC) slipped over 4%

• Major altcoins like ETH and SOL tumbled between 6%-9%

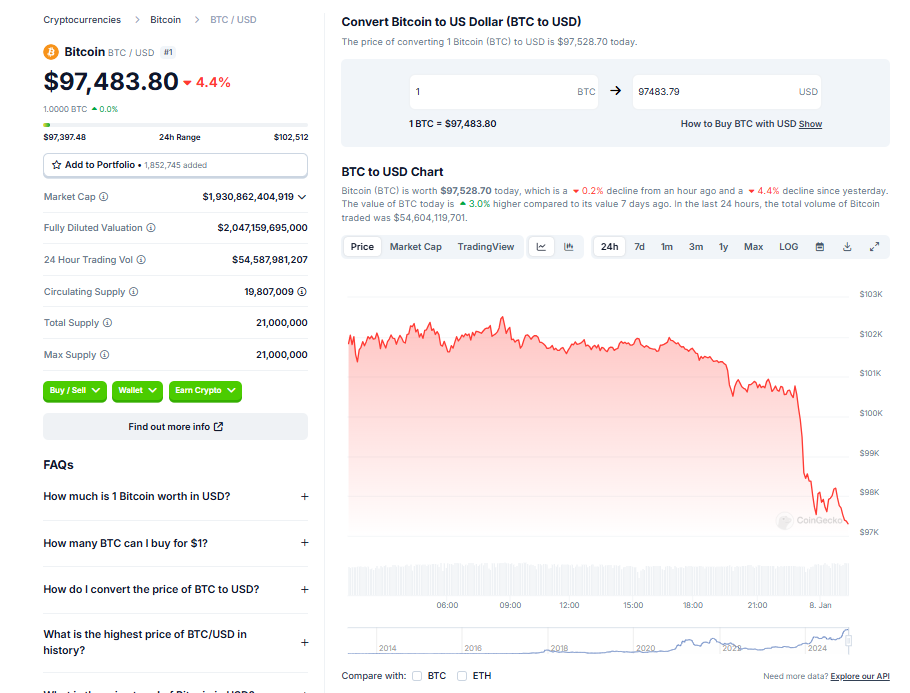

The crypto market had a rough Tuesday morning, with Bitcoin (BTC) slipping over 4% and major altcoins like ETH and SOL tumbling between 6%-9%. The culprit? Stronger-than-expected U.S. economic data, which sent bond yields soaring and dimmed hopes for Federal Reserve rate cuts this year.

Stronger U.S. Economic Reports Shake Markets

Two key economic reports released Tuesday surprised analysts and rattled financial markets.

First, the Bureau of Labor Statistics’ JOLTS job openings report showed job vacancies rising to 8.1 million in November—well above the 7.7 million expected and last month’s 7.8 million. At the same time, the ISM Services PMI for December came in at 54.1, exceeding forecasts of 53.3 and climbing from November’s 52.1.

The real kicker? The Prices Paid subindex spiked to 64.4, a red-hot figure compared to the expected 57.5. While neither report typically moves markets significantly, the combination of strong data sent shockwaves through bond markets, driving the 10-year U.S. Treasury yield to 4.68%—just shy of multi-year highs.

Crypto Prices Take a Hit

Unsurprisingly, the rising bond yields and stronger economic data weighed heavily on risk assets, including crypto. BTC, which had hovered just below $101K earlier in the day, dipped to $97,800 by mid-morning. That’s a 4% drop in just 24 hours.

Altcoins fared even worse. Ethereum’s ETH and Solana’s SOL dropped 6%-7%, while Avalanche (AVAX) and Chainlink (LINK) sank 8%-9%.

Massive Liquidations Hit the Market

This sudden sell-off triggered a wave of liquidations across the crypto derivatives markets. According to CoinGlass, nearly $300 million in long positions—bets on rising prices—were wiped out. It’s the first major leverage flush of the year, and it hit traders hard.

Rate Cut Hopes Fizzle

The strong economic data has also put the brakes on hopes for Federal Reserve rate cuts in 2025.

While no one expected a rate cut at the Fed’s January meeting, the odds of a March cut have dropped to just 37%, down from nearly 50% last week, according to the CME FedWatch tool. Even the chances of a May cut have plummeted. For the entire year, investors are now only pricing in one 25 basis point rate cut, according to Kyle Chapman of Ballinger Group.

The takeaway? The crypto market, like broader financial markets, is in a delicate balancing act. Strong economic data may be great for the economy but can spell trouble for risk assets like Bitcoin and altcoins. Buckle up; it looks like 2025 could be a bumpy ride.