- • Czech National Bank governor Aleš Michl is considering investing in a small amount of Bitcoin for diversification of the bank’s foreign exchange reserves.

- • The potential Bitcoin investment would need approval from the bank’s seven-member board.

- • While open to Bitcoin in the future, the bank currently plans to increase its gold holdings to around 5% of total assets by 2028.

The governor of the Czech National Bank, Aleš Michl, has recently expressed interest in the potential of Bitcoin as a part of the bank’s future reserve strategy. Despite the bank’s continued investment in gold, the possibility of a small Bitcoin investment may not be too far in the future.

Bitcoin as a Diversification Strategy

Aleš Michl, the governor of the Czech National Bank, has been considering the incorporation of Bitcoin into the country’s foreign exchange reserves. This consideration points to the increasing interest of the government in cryptocurrency as a tool for saving. In a recent conversation with CNN Prima News, Michl mentioned that while acquiring Bitcoin wouldn’t signify a significant investment for the bank, it could serve as a means of diversification.

The Approval Process

Before the bank can acquire Bitcoin, the decision would need to be approved by the Czech National Bank’s board, which is composed of seven members. Janis Aliapulios, an adviser to the board, confirmed that while there are no current plans for a Bitcoin investment, the possibility remains open for future consideration.

The Ongoing Diversification Plan

Despite the potential interest in Bitcoin, the bank is set to continue its diversification plan through gold investments. The plan is to increase gold holdings to about 5% of its total assets by 2028. However, Bitcoin could potentially become a significant reserve asset alongside gold, due to its robust yearly returns.

The Double-Edged Sword of Bitcoin

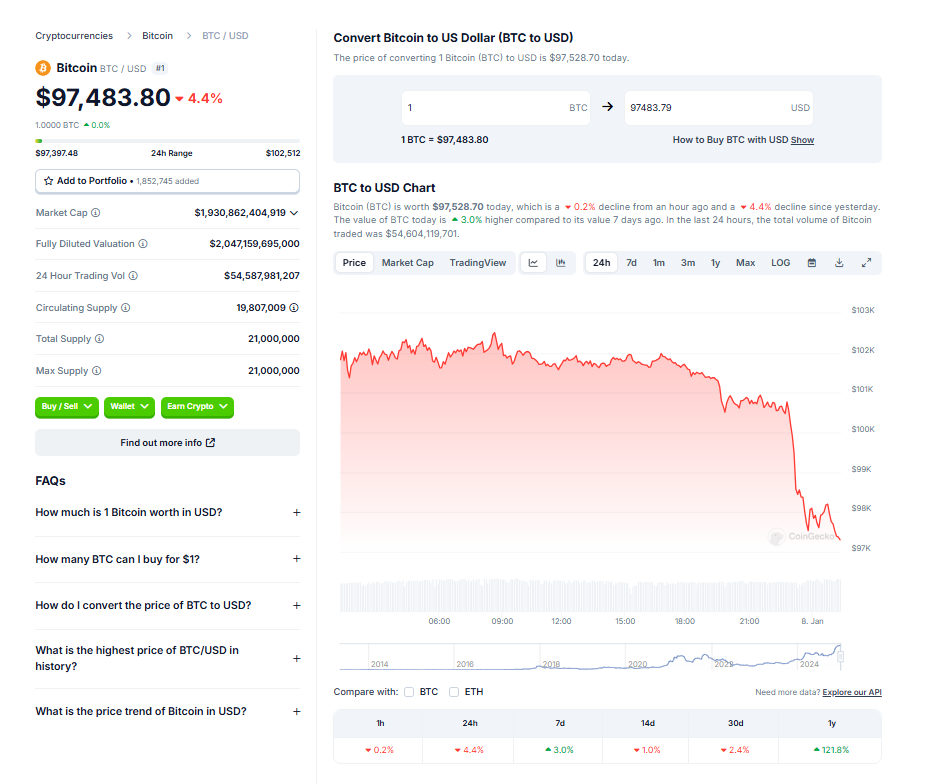

As Bitcoin’s yearly returns continue to outperform other assets, more governments and institutions are reevaluating their financial strategies to include Bitcoin. However, Bitcoin’s price volatility may also be a double-edged sword for national reserves, which could lead to wider financial swings.

US Bitcoin Act and the Future of Bitcoin

In the United States, Bitcoin’s status as a savings technology is gaining traction. The Bitcoin Act, proposed by Wyoming Senator Cynthia Lummis, suggests the creation of a strategic Bitcoin reserve. If accepted by US lawmakers, this could potentially push Bitcoin’s price tag past the 1 million mark.

Conclusion

As the world continues to navigate the digital landscape, the potential of Bitcoin and other cryptocurrencies cannot be ignored. The interest shown by the governor of the Czech National Bank signifies a shift in perspective and a recognition of the potential that Bitcoin holds for the future of the global financial system.