- Bitcoin will break the $200,000 barrier, and Ethereum will reach $7,000 in 2025

- Coinbase will surpass Charles Schwab as the most valuable brokerage globally, with its stock exceeding $700 per share

- At least five crypto unicorns, including Circle, Kraken, Figure, Anchorage, and Chainalysis, are expected to go public in 2025

As the year 2024 slowly draws to a close, the world of cryptocurrency is buzzing with excitement and optimism. Bitwise Asset Management, a renowned player in the digital asset domain, has recently put forth its top 10 predictions for the year 2025. Labelled as the “Golden Age of Crypto”, the report foresees unparalleled milestones, regulatory breakthroughs, and a surge in adoption. Here, we delve into what the future of crypto might look like.

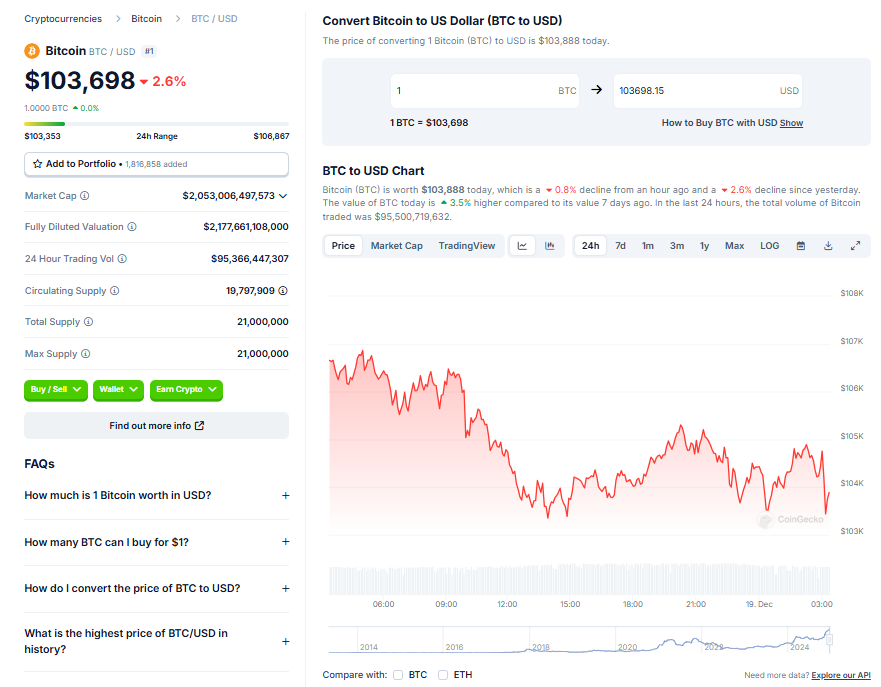

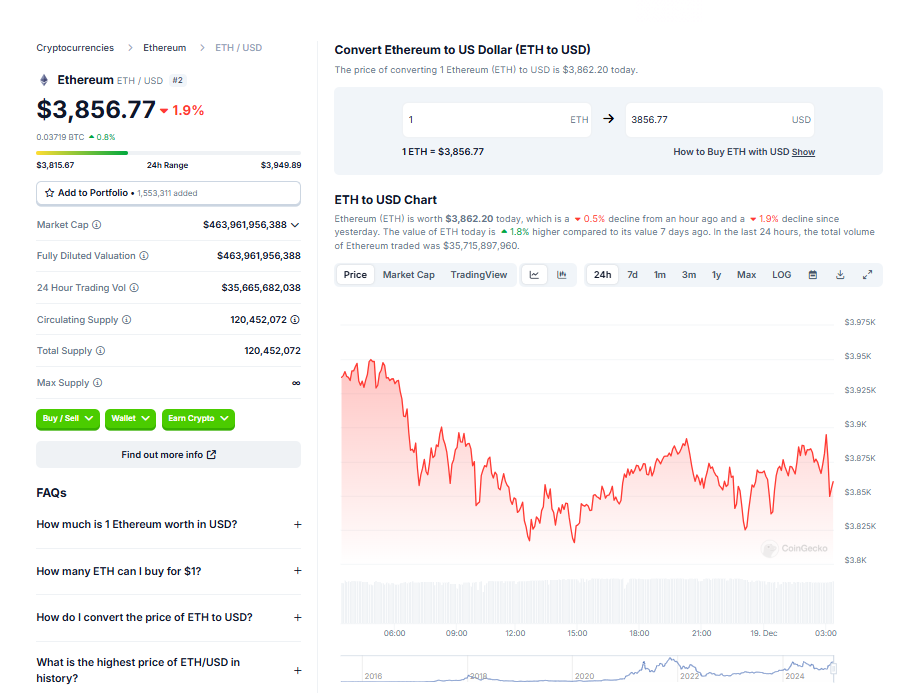

A Leap into Uncharted Territory: Bitcoin and Ethereum

Bitwise anticipates that Bitcoin will cross the $200,000 threshold, driven by a reduction in supply due to the 2024 halving, increased institutional interest, and potential government involvement such as the US setting up a strategic Bitcoin reserve.

Ethereum too is predicted to experience a resurgence, with a projected price of $7,000. Key factors include the growth of Layer 2 networks like Starknet and Base, influx of funds from Ethereum ETFs, and the rising investor confidence in Solana leading to its expected surge to $750.

Bitcoin ETFs: Outstripping 2024 Inflows

The launch of spot Bitcoin ETFs in 2024 broke records with $33.6 billion in inflows. However, Bitwise postulates that 2025 could outdo this figure. Historical analogies to gold ETFs suggest that second-year inflows often surpass the initial year. As more traditional financial institutions integrate crypto ETFs into their offerings, the momentum for these financial instruments seems unstoppable.

Coinbase: The New Leader in the Brokerage World

Coinbase, a key player in the cryptocurrency market, is forecasted to outdo Charles Schwab as the most valuable brokerage globally. Bitwise foresees Coinbase’s stock exceeding $700 per share, propelled by the growth of its stablecoin business, its Layer 2 network Base, and staking and custody services.

2025: The Year of the Crypto IPO

A significant surge in public offerings is expected, with at least five crypto unicorns likely to go public. This surge reflects the maturing crypto ecosystem and the growing investor demand for blockchain-based solutions.

MemeCoin Mania: The AI Revolution

The MemeCoin frenzy of 2024 is expected to pale in comparison to the AI-driven boom expected in 2025. Autonomous agents like Clanker, which can deploy tokens with minimal human intervention, are set to drive this trend.

Governments Doubling Down on Bitcoin

Currently, nine nations hold Bitcoin reserves. By the end of 2025, Bitwise predicts this number will double, with more governments racing to secure a stake in the digital gold of the 21st century.

Mainstream Indexes Welcoming Crypto

Coinbase and MicroStrategy are likely to find their way into the S&P 500 and Nasdaq-100 respectively, thereby introducing crypto exposure to nearly every US investor’s portfolio.

Opening the 401K Plans to Crypto

The US Department of Labor is expected to relax its guidance against crypto in retirement plans, potentially unlocking billions in fresh investment.

Stablecoins: The Next Big Boom

The stablecoin market, currently valued at $200 billion, is poised to double as the US passes long-awaited regulatory clarity.

Tokenized Real-World Assets (RWAs) Surpassing $50 Billion

Tokenization is transforming real-world assets, offering instant settlement, reduced costs, and enhanced transparency. By 2025, Bitwise projects the RWA market will exceed $50 billion.

The Bright Horizon of Crypto: 2025 and Beyond

Bitwise’s report concludes with a bold long-term prediction: Bitcoin surpassing the $1 million mark by 2029, overtaking gold’s market capitalization.

These forecasts highlight a pivotal year ahead where regulation, innovation, and adoption converge to propel crypto into new realms. For investors, builders, and enthusiasts, 2025 promises to be a landmark chapter in the ongoing digital revolution.