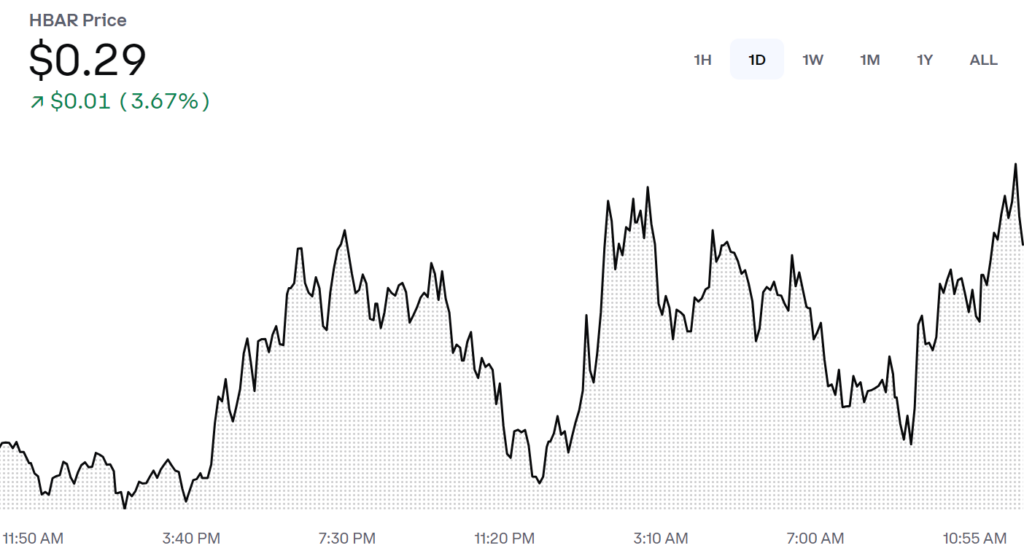

- Hedera HBAR price climbed 3.67% to $0.29, reflecting improved short-term market sentiment.

- Strong buying pressure pushed HBAR upward, marking steady gains through the trading session.

- Broader market recovery and interest in Hedera’s utility drive positive performance for the token.

Hedera HBAR ended its trading session with a 3.67% increase, reaching $0.29. The day began with modest trading activity, but demand for the token picked up during the latter hours. Hedera saw upward momentum, maintaining its gains even with occasional pullbacks, signaling buyer strength in the market.

The Coinbase chart reflects a gradual rise in price, interrupted by minor dips but supported by renewed buying interest. This steady uptrend points to improved short-term sentiment, aligning with overall market recovery seen across several major cryptocurrencies. Analysts note that HBAR’s consistent climb underscores the renewed confidence among investors seeking opportunities in utility-driven tokens.

Rising Interest and Buyer Activity Boost Performance

Hedera HBAR’s price performance comes on the back of broader market stabilization, which has provided opportunities for select digital assets to climb higher. Over the past 24 hours, the token traded within a defined range, with consistent upward movements. Key resistance levels were tested as buying volume grew, signaling potential for further price advances.

The positive momentum reflects renewed interest in the utility of the Hedera network. Known for its energy-efficient and scalable distributed ledger technology, Hedera has continued to attract attention from enterprises and developers. The network’s appeal lies in its ability to support fast and low-cost transactions, which has been a differentiating factor in the competitive blockchain ecosystem.

Hedera’s trading volume remained robust during the session, suggesting strong investor interest. Analysts highlight that the network’s ongoing developments, partnerships, and use cases are key drivers behind the token’s growing demand.

Short-Term Outlook for HBAR

While HBAR’s price movement signals optimism, traders remain cautious of external market conditions that may impact its trajectory. If buying pressure continues, the token could test further resistance around the $0.30 mark. However, analysts also caution that pullbacks remain a possibility if profit-taking emerges.

HBAR’s steady climb reflects underlying investor confidence in the project’s long-term utility. Market observers will continue to monitor Hedera’s ecosystem developments, which may provide further support for the token’s upward momentum.

Hedera’s recent price action highlights its growing resilience in a volatile market. As the broader cryptocurrency sector shows signs of recovery, HBAR stands well-positioned to capitalize on its expanding utility and network activity.