• The debate between Bitcoin and Gold as the ultimate safe haven has reached a tipping point

• Gold has an established $18 trillion market cap

• Bitcoin has seen a meteoric rise to a $1 trillion market share

The debate between Bitcoin and Gold as the ultimate safe haven has reached a tipping point. With Gold’s established $18 trillion market cap and Bitcoin’s meteoric rise to a $1 trillion market share, the financial world is watching closely to see which asset will dominate the future of finance.

The Growing Clash: Bitcoin vs. Gold

Gold, the traditional “safe haven,” has long been trusted for its stability and role as a hedge against inflation. However, Bitcoin has evolved from a speculative experiment into a powerful digital asset with solid fundamentals.

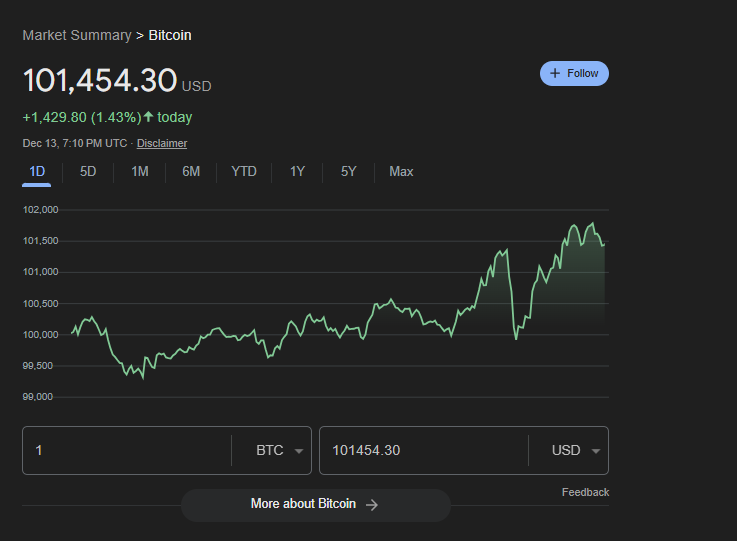

In the past decade, the cryptocurrency market has skyrocketed from $7 billion to $3.68 trillion, with Bitcoin leading the charge. As institutional adoption grows and Bitcoin reaches historic milestones like $100K, the comparison to Gold becomes more relevant than ever.

A Critical Test Looming for Bitcoin

Bitcoin’s rise over the past 15 years has been nothing short of extraordinary. From its speculative beginnings, it has transformed into a globally recognized digital currency adopted by major economies, inclubding the U.S., China, and the U.K. With Bitcoin ETFs and mining infrastructures established worldwide, its credibility continues to grow.

The economic policies of President-elect Trump will soon test Bitcoin’s resilience. High-stakes tariffs, changes in tax laws, and DOGE’s unexpected role in debt management could all influence the Federal Reserve’s next rate decisions. Historically, such uncertainty has driven investors to Gold and bonds, but Bitcoin’s ability to navigate these challenges will be closely monitored.

Gold’s Modest Role Amid Bitcoin’s Surge

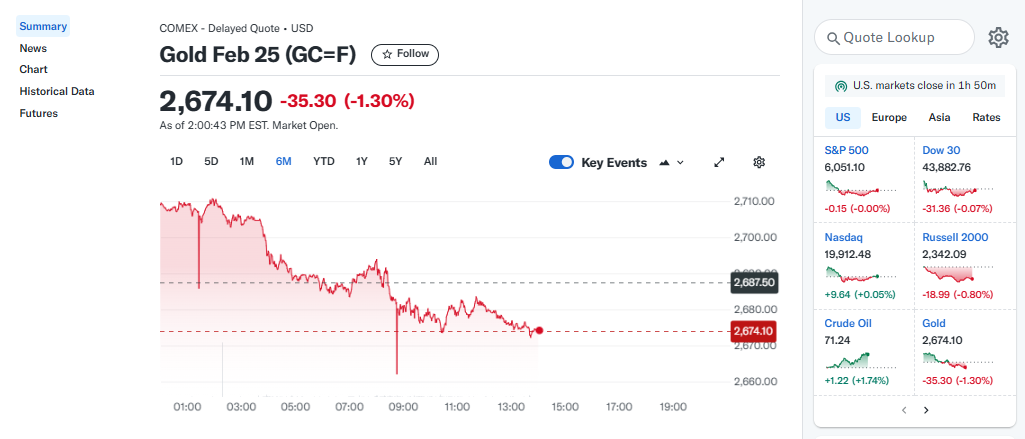

Four months ago, Bitcoin was trading between $50K and $70K. Today, it has surged to $100K, marking a 42.86% increase. Gold, in contrast, experienced a modest 10% rise, reaching $2,632.

The “election pump” played a key role in Bitcoin’s gains, attracting $114 billion into the crypto market over the past month. This influx of capital pushed the Bitcoin/Gold ratio to an all-time high of 38. Historically, such peaks have been precursors to significant shifts in investment preferences.

Potential for a Financial Revolution

Bitcoin’s growing appeal challenges Gold’s status as the go-to safe haven. As economic uncertainty persists, more investors are turning to Bitcoin, signaling a shift in the financial landscape.

The U.S. Treasury’s recent acknowledgment of Bitcoin’s potential underscores this transition. While Gold remains a trusted store of value, Bitcoin’s rapid growth suggests it could emerge as a modern alternative, aligning its value closer to Gold’s over time.

The Road Ahead: Bitcoin’s Next Milestone

The “Trump pump” has proven Bitcoin’s resilience and value, propelling it toward its next target of $150K. With increasing FOMO, both new and experienced investors are expected to pour capital into Bitcoin, further solidifying its market dominance.

Despite potential Q1 volatility, the U.S. Treasury’s report highlights the untapped potential of Bitcoin in household and industrial use. This presents a massive opportunity for Bitcoin to integrate further into the global economy, cementing its role as “digital gold.”

The coming months will be pivotal for Bitcoin as it continues to rival Gold as a safe haven asset. With growing adoption, institutional support, and its status as a digital asset, Bitcoin is poised to redefine the financial landscape, challenging Gold’s long-held position and potentially emerging as the preferred choice for investors worldwide.