- Metaplanet plans to raise $62 million by issuing Stock Acquisition Rights (SARs) to fund its growing Bitcoin reserves.

- The Japanese firm aims to expand its Bitcoin holdings, viewing the cryptocurrency as a hedge against the weakening yen and a stable investment.

- Metaplanet has embraced a Bitcoin-centric strategy, drawing comparisons to MicroStrategy’s massive Bitcoin investments, earning it the nickname “Asia’s MicroStrategy.”

Metaplanet, a Japanese investment firm, has announced plans to issue new stock acquisition rights (SARs) worth $62 million. The company will use the funds raised to purchase more Bitcoin as part of its treasury management strategy. This move highlights Metaplanet’s focus on using Bitcoin as a hedge against economic uncertainty.

Details of the Proposed SAR Deal

Metaplanet will offer 29,000 SAR units to EVO FUND, a Cayman Islands investment firm. Each unit provides the right to purchase 100 Metaplanet shares at 614 yen per share. If EVO FUND exercises all the rights by December 16, 2024, it will give Metaplanet 95 billion yen, or $62 million, to invest in Bitcoin. The deal requires approval under Japanese financial regulations.

Metaplanet’s Ongoing Bitcoin Acquisition Efforts

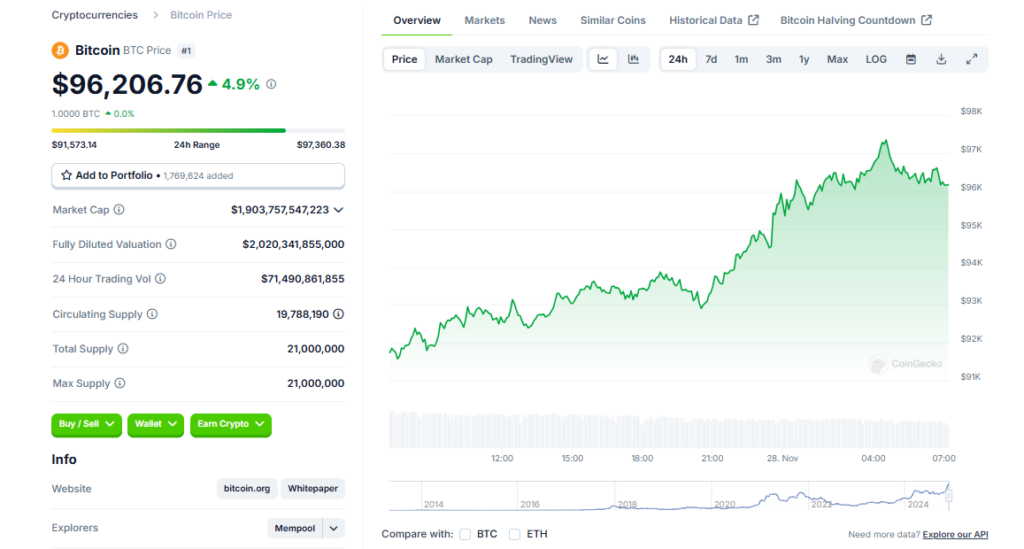

This SAR deal is the latest in Metaplanet’s efforts to expand its Bitcoin reserves. Last month, the company raised 66 million through its 11th round of SARs. Throughout 2022, Metaplanet has used debt and equity offerings to fund Bitcoin purchases. The company currently holds 1,142 Bitcoin worth $109 million.

Rationale for Metaplanet’s Bitcoin Focus

Metaplanet views Bitcoin as an essential hedge against currency devaluation and economic uncertainty. As the yen declines and Bitcoin’s value climbs, the company aims to capitalize on Bitcoin’s growth potential. Metaplanet also seeks to position itself as a leader in promoting Bitcoin adoption in Japan.

Conclusion

With the proposed $62 million SAR deal, Metaplanet reaffirms its strategy of acquiring Bitcoin to stabilize and grow its balance sheet. This approach mirrors other institutional investors like MicroStrategy and Tesla. By continually expanding its Bitcoin reserves, Metaplanet aims to cement its status as a major cryptocurrency player.