• Rumble’s Board of Directors approved a strategy to allocate a portion of the company’s excess cash reserves to Bitcoin

• Rumble believes Bitcoin is a valuable tool for strategic planning and this move is designed to accelerate the company’s expansion into cryptocurrency

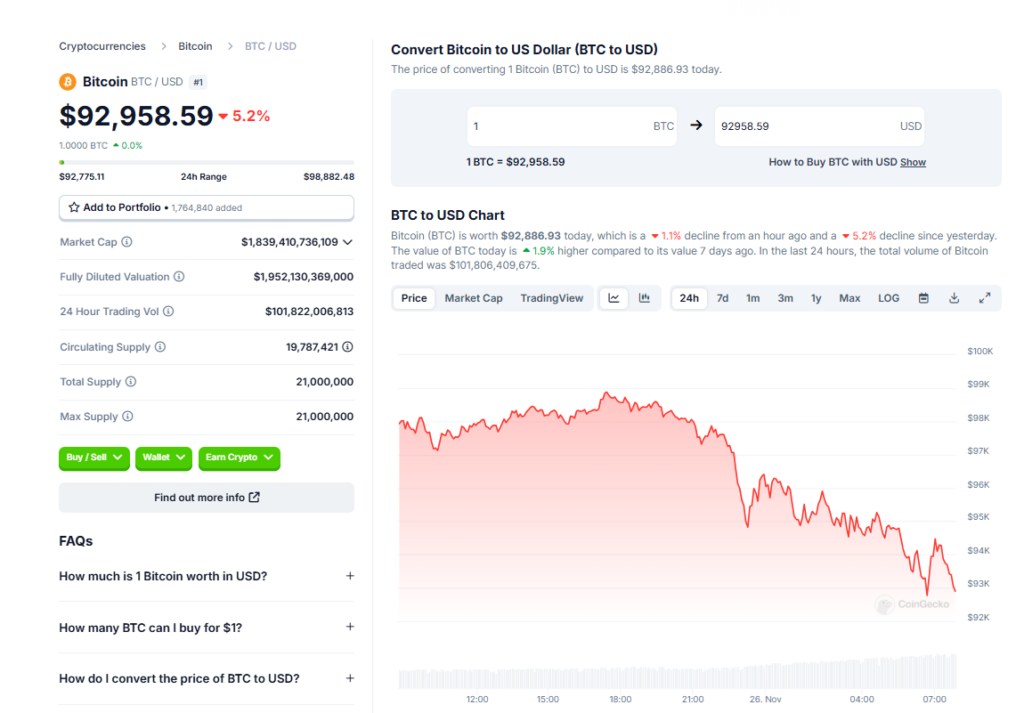

• The actual timing and value of Bitcoin purchases will be determined by management based on several factors including market conditions, Bitcoin’s trading price, and Rumble’s anticipated cash needs

Rumble, the video-sharing platform and cloud services provider, announced a new corporate treasury diversification strategy to allocate a portion of excess cash reserves to Bitcoin. This announcement emphasizes Rumble’s belief in Bitcoin as a valuable planning tool and accelerates the company’s expansion into cryptocurrency.

Rationale Behind Bitcoin Allocation Strategy

Rumble believes the world is still in the early adoption phase of Bitcoin, which has recently accelerated with a crypto-friendly US administration and increased institutional adoption. Unlike government-issued currencies subject to dilution through money printing, Bitcoin offers an inflation hedge and is an excellent treasury addition, said Rumble Chairman and CEO Chris Pavlovski. Rumble is also excited to strengthen ties with crypto and become the leading video and cloud platform for the crypto community.

Details of the Bitcoin Allocation Strategy

The timing and value of Bitcoin purchases under this new allocation strategy will be determined by management and depend on several factors. These include general market and business conditions, the trading price of Bitcoin, and Rumble’s anticipated cash needs. The allocation strategy may be suspended, discontinued or modified at any time for any reason.

About Rumble

Rumble is a high-growth video platform and cloud services provider creating an independent infrastructure. Rumble’s mission is to restore the internet to its free and open roots. For more information, visit corp.rumble.com.

Forward-Looking Statements

This press release contains forward-looking statements about Rumble’s new corporate treasury diversification strategy allocating excess cash reserves to Bitcoin. Actual timing and value of Bitcoin purchases may differ materially from expectations due to various risk factors. Refer to Rumble’s SEC filings for a discussion of risks that may affect actual results.