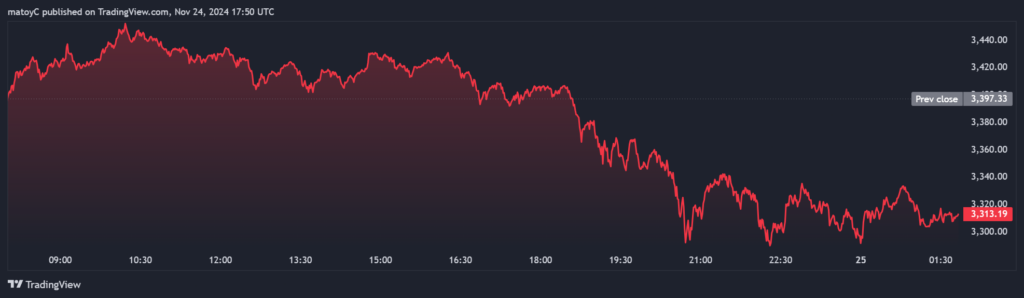

- Ethereum (ETH) saw a 2.45% dip in the past day, trading at $3,312.69 as of now.

- Over the past week, ETH has gained 5.77%, highlighting sustained bullish sentiment amid broader market activity.

- Year-to-date performance shows a 45.23% increase, reflecting Ethereum’s resilience despite recent volatility.

Ethereum has experienced a slight decline of 2.45% over the past 24 hours, trading at $3,312.69. This comes as part of a broader market pullback following an extended period of upward momentum. Despite this daily dip, Ethereum has maintained a steady upward trajectory over the past month, with gains of 30.84%.

The current correction reflects normal market behavior, where short-term profit-taking activities and reduced buying pressure impact price movement. However, Ethereum’s consistent growth throughout November has kept it among the top-performing assets in the crypto space.

Long-Term Trends Signal Strength

On a broader scale, Ethereum has demonstrated remarkable resilience, gaining 45.23% year-to-date and 59.25% over the past year. These figures highlight its continued relevance in the blockchain ecosystem, supported by its central role in DeFi, NFTs, and layer-2 scaling solutions.

Looking ahead, Ethereum’s ability to break past critical resistance levels near $3,400 could determine its next move. Sustained bullish sentiment and increased activity on the network could propel ETH toward $3,500 or higher.

Key Support and Resistance Levels

The $3,300 price level serves as an important support, with any significant breach potentially leading to a further decline toward $3,200. On the upside, breaking through $3,400 could renew bullish momentum, allowing Ethereum to target $3,600 in the near term.

As Ethereum continues to lead the market in innovation and adoption, traders and investors will closely monitor its ability to maintain current support levels and capitalize on emerging opportunities within the crypto market.