- $100 billion asset manager VanEck has set a Bitcoin price target of $180,000 for this cycle amid its ongoing bull run.

- VanEck’s Head of Digital Research, Matthew Sigel, described Bitcoin’s current performance as “blue sky territory” with no technical resistance.

- Sigel predicted that Bitcoin will enjoy repeated all-time highs over the next two quarters, following a similar pattern from four years ago.

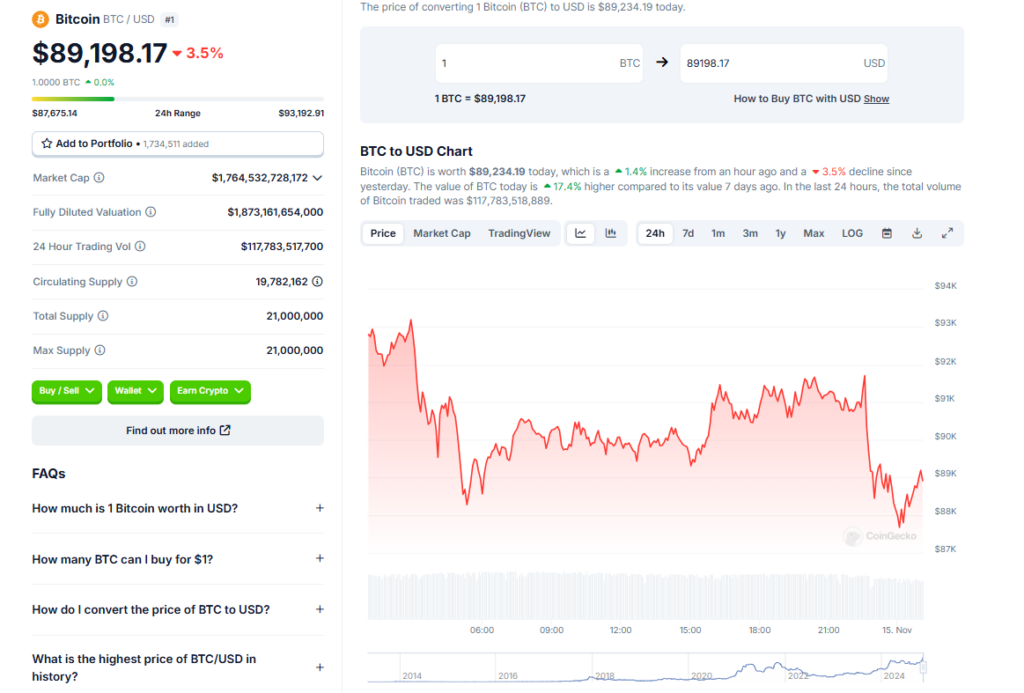

The price of Bitcoin has exploded in recent weeks, reaching an all-time high of $93,000. Asset manager VanEck believes there is much more room to grow, setting a price target of $180,000 for this cycle.

VanEck’s Bull

VanEck, which oversees $100 billion in assets, made the bold prediction through its digital asset research head Matthew Sigel. Appearing on CNBC, Sigel stated “we’re in price discovery mode” for Bitcoin as it enters “blue sky territory.”

Sigel pointed to Bitcoin’s previous peak in 2017, noting a similar pattern emerging. He expects new all-time highs over the next two quarters as momentum builds.

Driving Bitcoin’s Surge

Several factors are propelling Bitcoin’s surge:

- Momentum from Trump’s election victory

- Increasing institutional adoption

- Mainstream interest and media coverage

- Limited supply and “halvings”

- Growing reputation as “digital gold”

Bitcoin’s market cap recently exceeded $2 trillion. If Sigel’s prediction is accurate, there is much more upside ahead as the asset cements itself as a core holding for investors.

The Road Ahead

While an ambitious target, VanEck’s $180,000 forecast doesn’t seem unfathomable given Bitcoin’s parabolic rise. As the cryptocurrency gains broader acceptance, its volatility should moderate. That makes a march towards $200,000 over the next year certainly feasible. Of course, a major trend reversal could derail the rally. But for now, Bitcoin seems to be in price discovery mode with its long-term outlook as positive as ever.

Conclusion

VanEck has laid down a clear marker for Bitcoin to hit $180,000 this cycle. It’s a bold target, but current momentum shows no signs of slowing. With rapidly rising adoption and limited supply, Bitcoin appears poised to reach new heights.