- Bitcoin’s latest high at over $93,000 sparks concerns of overextended momentum, with analysts advising caution.

- Heavy sell-side liquidity at key levels creates barriers to further immediate gains for BTC.

- Market watchers anticipate a consolidation phase, with potential for new resistance near $100,000

Bitcoin’s recent surge has brought it to an all-time high above $93,000, but its climb is meeting resistance as market analysts urge caution. Data shows that after multiple attempts, Bitcoin briefly broke through the $93,000 mark, only to see a pullback shortly after.

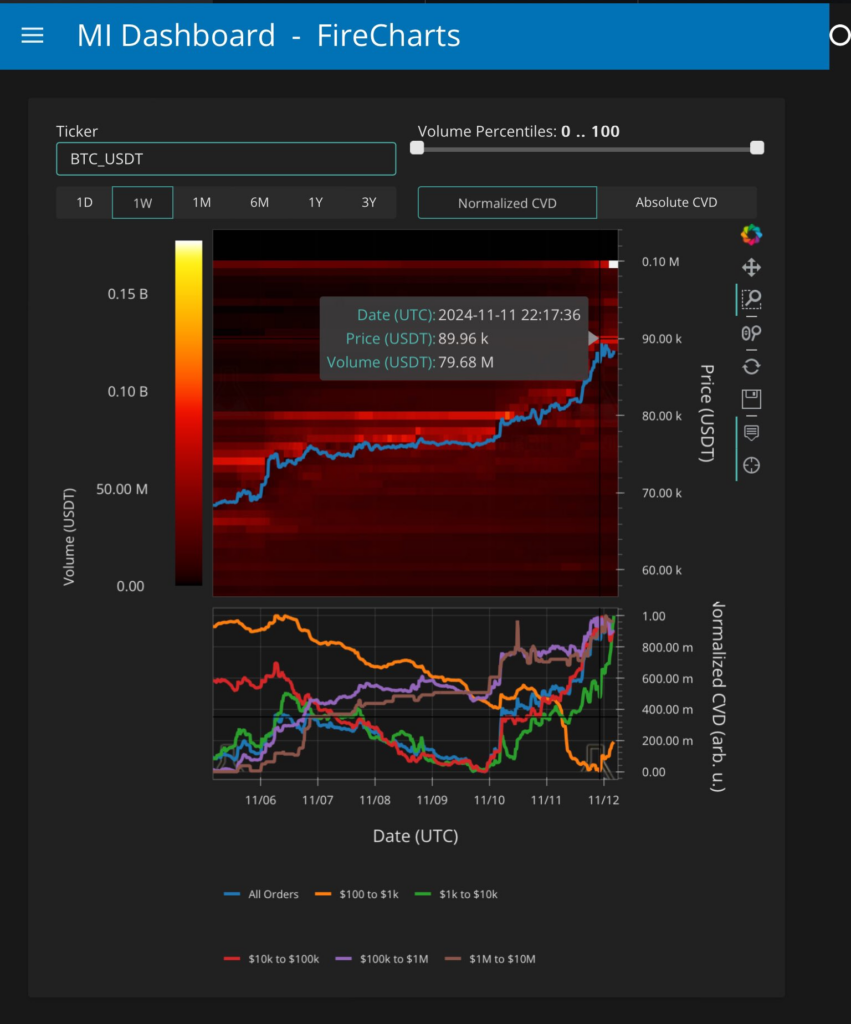

The push upward has encountered substantial sell-side liquidity, with approximately $80 million in orders stacked from $90,000 to $95,000 and an additional $177 million in anticipated sell orders at the $100,000 level. Material Indicators co-founder Keith Alan remarked on the need for Bitcoin to build structural support, highlighting that further progress might stall if the market overheats.

Source: Keith Alan

Analysts Caution Bitcoin’s Next Moves

Monitoring tools from Material Indicators are signaling a possible short-term price adjustment, indicating that Bitcoin may not reach new heights immediately. Market participants are now bracing for potential fluctuations within the $70,000 to $90,000 range. Another trader, Credible Crypto, has warned of a potential crash to lower levels, underscoring the possibility of either a continued rally or a short-term market trap.

Resistance Points Signal New Market Phase

Further insights from statistician Willy Woo suggest that Fibonacci levels could serve as guides in this phase. Woo explained that the recent high aligns with both Fibonacci and market liquidation data, hinting that $88,000 to $91,000 may form a consolidation zone. The next significant resistance could be at $102,000, a key level based on historical cycle trends. Woo’s analysis indicates that for Bitcoin to approach six figures, stability within these resistance points will be crucial.

Bitcoin’s latest climb has sparked interest and caution alike, as its market path continues to be influenced by liquidity trends and technical levels that define the cryptocurrency’s next moves.