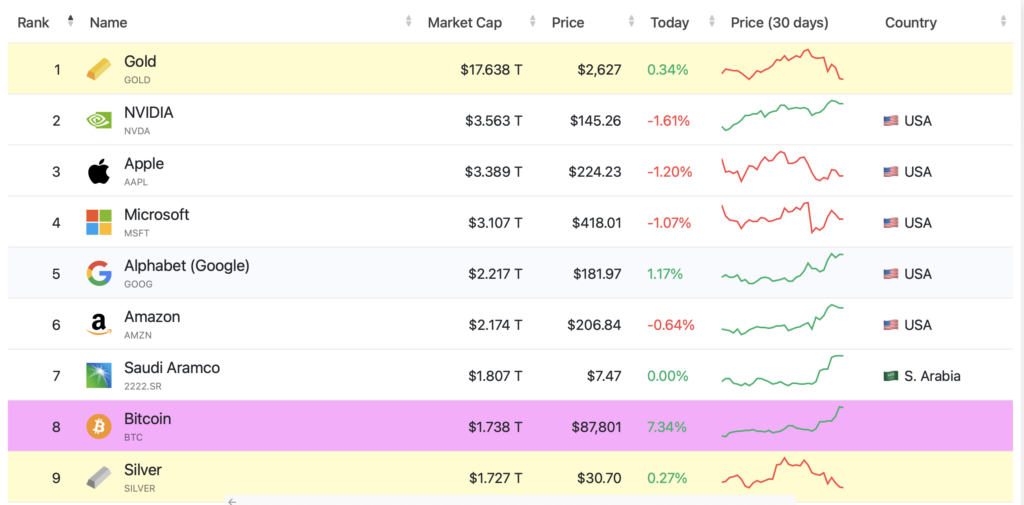

- Bitcoin’s market capitalization has surpassed that of silver, making it the eighth-largest asset in the world.

- Bitcoin’s price has risen more than 9% in a single day, breaching $89,000, driven by strong institutional demand and interest in spot Bitcoin ETFs.

- This marks the second time this year that Bitcoin has overtaken silver’s market cap, signaling a shift in perception of Bitcoin from a speculative asset to one embraced by traditional investors.

Bitcoin has overtaken silver’s total market cap to become the eighth-largest asset in the world by market capitalization. This comes as Bitcoin breached $89,000 on Monday before dropping back below that level. The cryptocurrency has jumped over 9% on the day following strong institutional demand and interest in Bitcoin ETFs in recent weeks.

Bitcoin Rally Reflects Broader Investor Sentiment

Bitcoin’s rally reflects a broader shift in investor sentiment following the U.S. midterm elections. The election results have signaled both opportunity and optimism in the markets, with potential regulatory support expected as pro-crypto lawmakers take power.

Bitcoin Options Trading Reaches Yearly High

Bitcoin options trading has swelled as institutional investors bank on the asset’s continual rise amid a broader crypto market rally triggered by the election results. Bitcoin’s open interest for options contracts reached just below $25 billion on Monday, following the exchange’s previous yearly peak of roughly $24 billion on November 7.

Bitcoin Market Cap Overtakes Silver

Bitcoin’s market capitalization overtook silver on Monday evening, reaching $1.75 trillion to secure its position as the world’s eighth-largest asset. Meanwhile, silver has witnessed a 6.24% decline over the past week, bringing its market cap to $1.732 trillion. In comparison, Bitcoin is up by roughly 30% over the same period.

Bitcoin vs Gold Market Caps

While gold remains over 10 times larger than Bitcoin in terms of market capitalization, Bitcoin’s scarcity narrative continues to attract investors seeking an alternative to traditional assets. The fact that gold is still 10 times larger shows how big gold is, but also illustrates Bitcoin’s growth potential.

Bitcoin Boosts Adjacent Assets

Bitcoin’s strong performance this past week has also helped bolster related assets as investors seek high-risk plays compared to traditional markets. The Bitcoin Industrial Complex index, which includes Bitcoin ETFs, MicroStrategy and Coinbase, achieved a record $38 billion in trading volume this week.

Conclusion

Bitcoin now trails only seven global assets in terms of market capitalization, cementing its position as a top performing asset. While some skepticism remains, Bitcoin’s latest rally signals growing mainstream adoption. If current trends continue, Bitcoin could someday surpass more traditional assets.