- Bitcoin (BTC) has achieved a new all-time high (ATH) of $88,440, surpassing silver’s market capitalization of $1.729 trillion.

- The latest BTC rally has been fueled by factors like rising institutional demand, increasing spot Bitcoin Exchange-Traded Fund (ETF) inflows, the US Federal Reserve’s rate cut, and speculation around a potential US BTC reserve.

- MicroStrategy announced the purchase of an additional 27,200 BTC worth $2.03 billion, increasing its total holdings to 279,420 BTC valued at $11.9 billion.

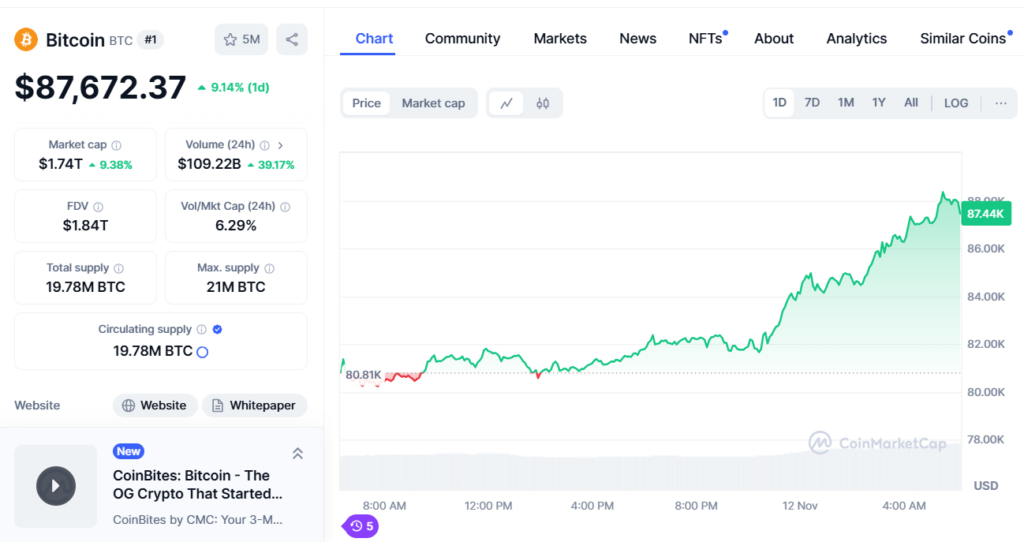

Bitcoin has achieved a monumental milestone, surpassing silver’s market capitalization for the first time. The flagship cryptocurrency now holds a market cap of $1.74 trillion after reaching a new all-time high of $88,440.

Reasons Behind Bitcoin’s Price Surge

Several factors have fueled Bitcoin’s latest rally, including:

- Rising institutional demand

- Increasing spot Bitcoin Exchange-Traded Fund (ETF) inflows

- The US Federal Reserve‘s 25 basis points rate cut

- Pro-crypto Donald Trump‘s presidential victory

However, analysts caution the gains may face resistance ahead due to indicators like elevated funding rates and basis yields. Key events like US inflation data and the Fed’s meeting this week could impact market sentiment.

Bitcoin Overtakes Silver in Market Cap

On November 11, Bitcoin officially surpassed silver’s market cap of $1.729 trillion. While an impressive milestone, Bitcoin still lags far behind gold’s market cap of over $17.594 trillion.

Institutional Interest Fuels Bitcoin’s Rise

Spot Bitcoin ETFs saw massive inflows of $22.9 billion in just three days, signaling growing institutional interest. MicroStrategy’s additional $2 billion BTC purchase on November 11 also contributed to Bitcoin’s rise. The company now holds 279,420 BTC worth $11.9 billion.

At the time of writing, Bitcoin gained 10.49% to $88,103 on Monday, November 11. While profit-taking has kept volatility in check, robust inflows and institutional interest is expected to further support Bitcoin’s upward trajectory.