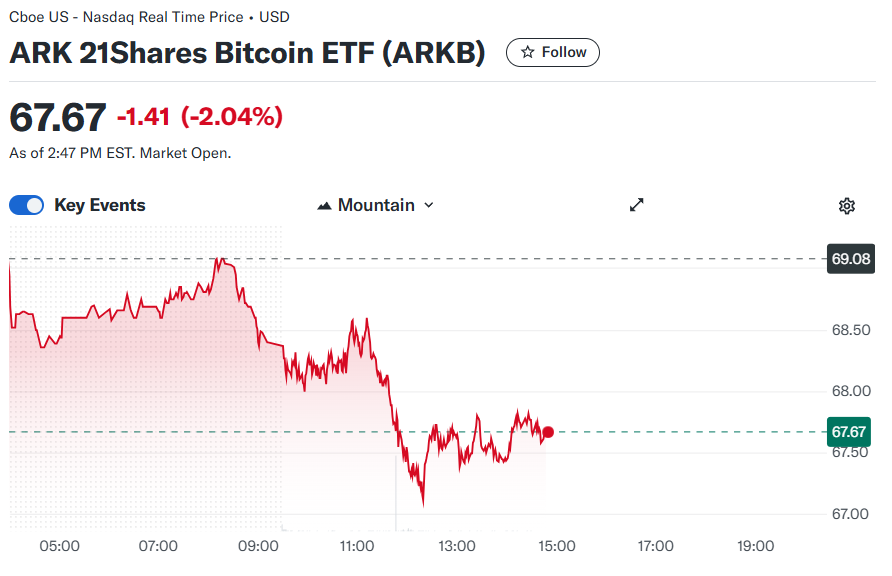

- The State of Michigan pension fund disclosed a $6.9 million investment into the ARK Bitcoin ETF in an SEC filing.

- The filing shows the fund currently owns 110,000 shares in the Bitcoin ETF.

- 2024 has seen a surge in institutional interest in Bitcoin and crypto, with several states investing in Bitcoin ETFs.

The State of Michigan has made history by becoming one of the first public pension funds to invest directly in Bitcoin. A recent SEC filing revealed that the state’s pension fund now holds $6.9 million worth of shares in the ARK Bitcoin ETF. This bold move signals growing institutional adoption of cryptocurrencies.

Background on Michigan’s Pension Fund

The State of Michigan retirement system provides pension benefits to over 200,000 current and former public employees. The fund is overseen by the Office of Retirement Services and had net assets totaling $80 billion as of September 2022.

Up until now, the pension fund had little to no exposure to digital assets. The new $6.9 million allocation represents less than 0.01% of the fund’s total assets. However, it marks a major symbolic shift towards embracing Bitcoin’s role in institutional portfolios.

Details of the Bitcoin ETF Investment

According to the SEC filing, Michigan’s pension fund owns 110,000 shares of the ARK Bitcoin ETF, worth $6,981,700 as of September 30.

The ARK Bitcoin ETF is an exchange-traded fund that provides exposure to Bitcoin without having to directly hold the cryptocurrency. It tracks Bitcoin’s market price using a mix of cash bitcoin and bitcoin futures contracts.

ARK Invest, the fund’s sponsor, has been a vocal proponent of Bitcoin and views it as “one of the most important innovations of our lifetime.” The ETF offers an easy way for institutions to gain Bitcoin exposure through traditional investment vehicles.

Wider Institutional Adoption Trend

Michigan is joining a growing list of public pension funds opting to invest in Bitcoin and crypto-focused ETFs. In 2021, Fairfax County’s Police Officer’s Retirement System allocated part of its $1.9 billion fund to blockchain technology and Bitcoin mining stocks.

Other funds diving into crypto include the Houston Firefighters’ Relief and Retirement Fund ($5.5 billion AUM) and the Houston Municipal Employees Pension System ($3.9 billion AUM).

Conclusion

Michigan’s pension fund is leading the charge with its pioneering Bitcoin ETF allocation. As more institutional dominoes fall, it will continue fueling mainstream adoption of digital assets. The SEC’s approval of Bitcoin ETF products has opened the floodgates to trillions in capital waiting on the sidelines.