- Bitcoin fell below $69,000, triggering $200 million in liquidated long positions as volatility looms.

- Analysts see key support at $66,200, with potential for further declines before a rebound.

- Market interest remains strong with increased open interest in futures and options amid U.S. election concerns.

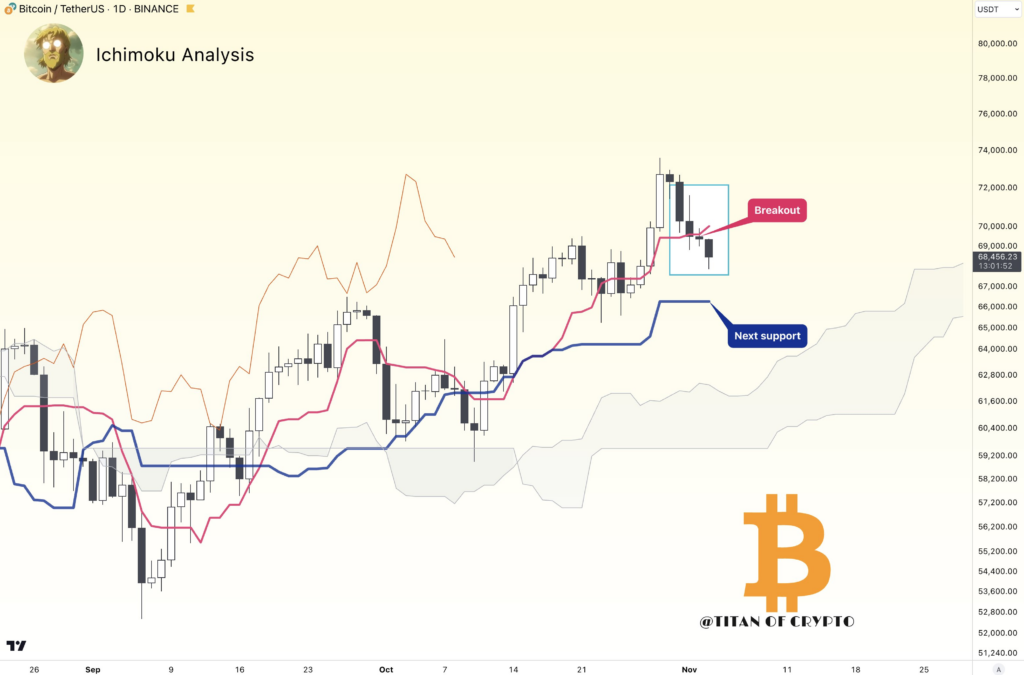

Bitcoin is facing potential pressure as traders observe further corrective movements following a price dip that liquidated long positions worth $200 million. The latest analysis from Titan of Crypto highlighted that Bitcoin, after nearing all-time highs of $73,800, may undergo a deeper correction. Market sentiment has become cautious with the added complexity of the upcoming U.S. presidential election and high open interest in trading markets.

Source: Titan of Crypto on X

Key Support Levels and Analyst Projections

Titan of Crypto shared insights, showing that Bitcoin’s price struggled to close above the Tenkan-sen, a trend line within the Ichimoku cloud indicator. This failure indicates that Bitcoin might move toward the Kijun level at approximately $66,200, a point that could act as a temporary floor before any potential rebound.

On November 3, Credible Crypto emphasized the area between $65,000 and $69,000 as critical, mentioning that a bounce in this range is essential to avert a deeper slide. The recent high was noted as possibly being an upward deviation that may not hold.

Volatility and Market Dynamics

The past week’s decline, including a drop under $68,000, came with only a limited recovery, prompting traders to predict further downside. Alan Tardigrade pointed out that Bitcoin had touched the 0.618 Fibonacci level, often considered a healthy retracement point, suggesting a possible path for an upward move if support holds.

Trading firm QCP Capital indicated that interest in Bitcoin remains robust, with open interest for futures and options rising by 24.2% and 36.76% since early October. The firm noted that 7-day implied volatility has climbed to 74.4%, compared to the realized volatility of 41.4% over the past week, reflecting a risk premium as the election week approaches.