Top cryptos have typically flashed green over the past 24 hours, with several cryptocurrencies reclaiming key support areas. However, there was a sudden negative retracement as the total crypto market capitalization shrunk from around $1 trillion to $940 billion, down 0.2% on the day – according to data from CoinMarketCap.

Bitcoin (BTC) is trading with a bullish bias after rising from its low of below $18,500 on Wednesday to the current price of around $19,446. The big crypto lacked the necessary support to push it to $20,000. After rising above $19,700, the flagship cryptocurrency retreated to intraday lows of around $18,845. This was after a 4.87% drop.

Bitcoin is now more than 70% below its peak of $69,000, reached in November 2021. Its market capitalization stands at $372 billion with a market dominance of 39.62%, decreasing by 0.17% over the day.

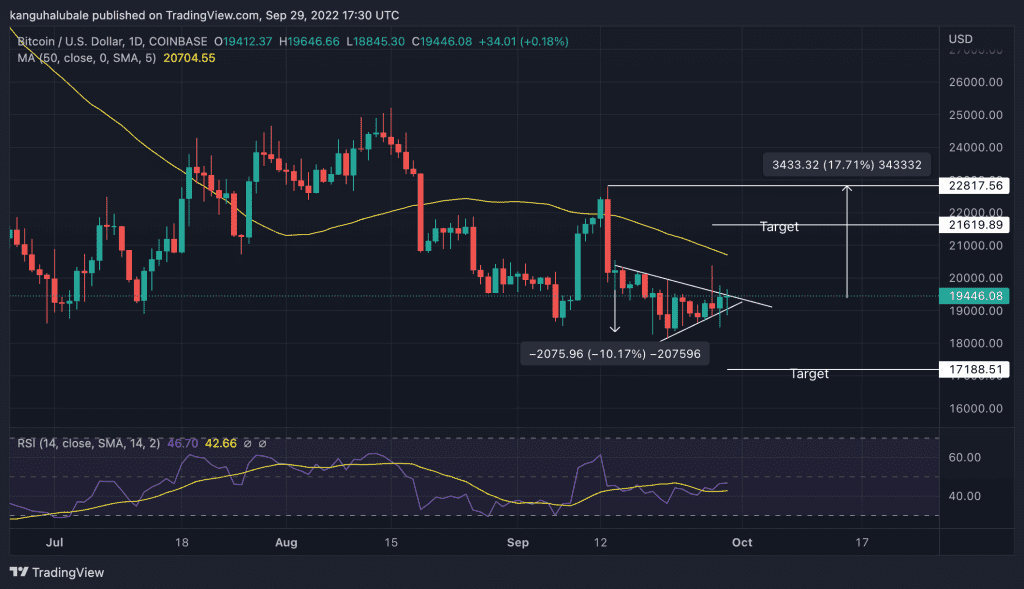

Bitcoin Price Paints A Bearish Pennant

Over the last two weeks, Bitcoin’s price recorded a series of lower highs and higher lows as it consolidated in a triangle pattern otherwise referred to as a pennant. As illustrated on the daily chart, a bearish pennant pattern forms similar to a symmetrical triangle pattern but distinguishes itself by having precise bullish or bearish biases.

In line with that, Bitcoin’s price was likely to revisit lower levels toward $17,000. Cementing the sellers’ presence in the market is the negative outlook of the relative strength index (RSI). If this oscillating indicator remains negative, odds will continue favoring the bears. In addition, downward momentum will likely intensify if support at $19,000 crumbles.

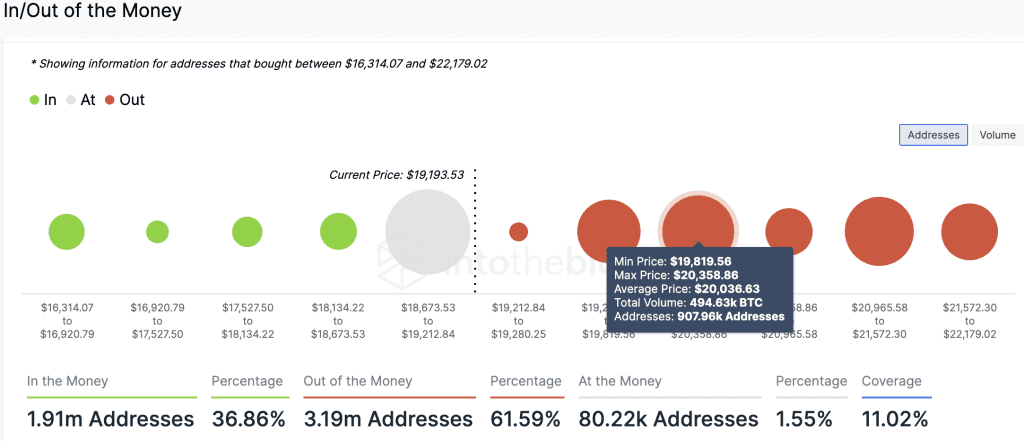

At the same time, the IOMAP on-chain model from IntoTheBlock shed light on a stiff resistance zone running from $19,819 to $20,358. Here, 907,960 addresses have previously scooped up around 494,630 BTC. If broken, Bitcoin’s price might quickly advance to highs around $21,600.

On the other side, the lack of solid support areas means that declines to $17,200 could quickly escalate. The only medium reprieve lies between $18,000 and $18,700, where roughly 168,700 addresses have previously purchased about 68,410 BTC.

In addition to the relatively weak support, BTC’s trading volume has plummeted. Bitcoin’s 24-hour trading volume currently sits at over $42 billion, 21% down on the day.

On-chain data from Santiment, blockchain insights, and market analysis firm shed light on the pump and dump situation displayed by Bitcoin’s price action. According to Santiment, the market is experiencing a decrease in trading volumes, especially Bitcoin, amid a slight price surge. The decline in trading volume has been gradual within the year following its highest in November. The on-chain data firm also cited that the BTC price peaked on Tuesday, which came for the first time since June 14.

Impact Of Macro-Economic Factors On Bitcoin Price

With rising inflation rates, the macro environment has been pulling BTC prices down. This situation has a negative impact even as U.S. equities, bonds, stocks, and commodities continue to fight volatility.

Cryptocurrencies tried to shake off pressure associated with their correlation to U.S. equities, but they could not sustain it. As such, the global macro environment, through the strengthening dollar, rising interest rates, high consumer prices, and fears of an economic recession, are currently affecting Bitcoin and other cryptocurrencies.