- Over $261 million in crypto liquidations occurred on October 23, mostly from long bets.

- Ethereum saw its largest liquidation day, with $77 million in long positions wiped out.

- Despite volatility, U.S. Bitcoin ETFs saw $198.5 million in net inflows on October 23.

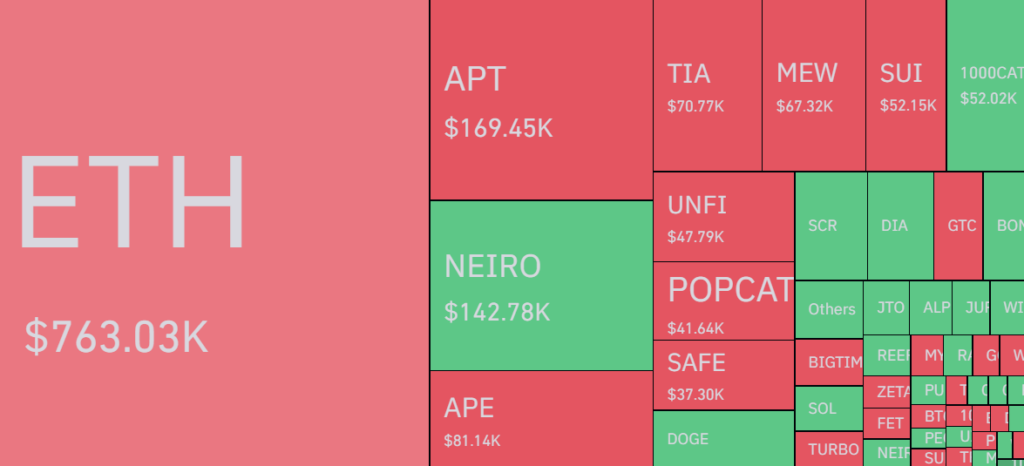

October 23 proved challenging for crypto bulls, as total liquidations in the cryptocurrency market reached $261 million. Bitcoin’s recent pullback, after nearing the $70,000 mark, contributed to the second-largest day of liquidations for October. Data from CoinGlass revealed that over $203.5 million in long positions were wiped out, with Ethereum (ETH) and Bitcoin (BTC) leading the losses.

Source: CoinGlass

Major Liquidations as Bitcoin Fails to Hold $70K

Bitcoin had approached a three-month high of nearly $70,000 on October 21, giving traders hope for further gains. However, the momentum didn’t hold, and BTC dropped to $65,500 on October 23 before recovering slightly. This price action triggered a wave of liquidations, with Ethereum seeing its largest single-day liquidation for the month — over $77 million in long bets were erased as ETH dropped 1.7% to $2,552.

The total crypto liquidations for the day trailed only those from October 1, when Bitcoin’s 5% price drop led to $450.8 million in long positions being liquidated. Ethereum, in particular, has been hit by declining demand for staking, as high transaction fees on its blockchain are discouraging activity, further dampening investor sentiment.

Bitcoin ETFs See Strong Inflows Despite Market Volatility

Even as the market experienced turbulence, U.S. Bitcoin exchange-traded funds (ETFs) continued to attract investments. On October 23, the 11 U.S.-based spot Bitcoin ETFs recorded a combined net inflow of $198.5 million. BlackRock’s iShares Bitcoin Trust ETF led the pack with a $323.6 million inflow, although these gains were offset by outflows from the ARK 21Shares and Bitwise Bitcoin ETFs.

Although Bitcoin ETFs saw their seven-day inflow streak break on October 22, with an $87.9 million outflow, investor interest remains strong, signaling continued institutional confidence in Bitcoin as a key asset in the cryptocurrency space.