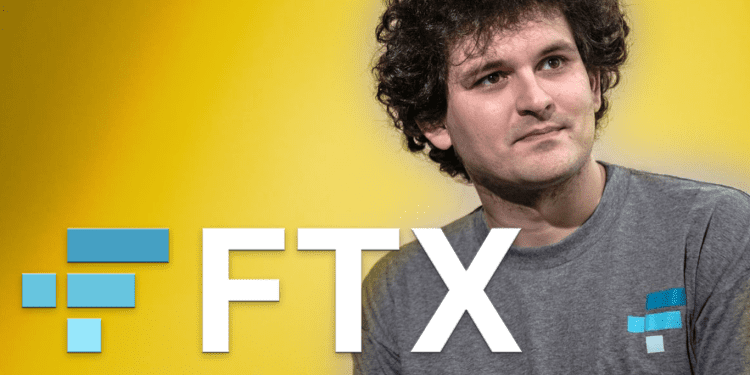

FTX and Sam Bankman-Fried are single-handedly coming to the rescue of many crypto-centric companies. Sam Bankman-Fried, who I will refer to as SBF from here on out, and FTX are sure to become household names if they weren’t already. Not familiar? FTX is a popular centralized exchange that specializes in derivatives and leveraged products. Founded by SBF and Gary Wang in May of 2019, the company has worked hard to solidify itself as a significant player in the space.

If you missed it, in March of 2021, FTX paid $135 million for naming rights for FTX Arena in Miami, and by June of that year, it was fully renamed. For the non-basketball fans, this is where the Miami Heat play. But FTX didn’t stop there; straight out of the left-field, they also made a deal with Major League Baseball for marketing agreements. Beyond all the fancy marketing plays, FTX is valued at $32 billion and is clearly of significant stature.

Here we will examine how SBF and its companies are coming to the rescue. Earlier this year, SBF purchased a 7.6% stake in Robinhood, the popular investment app with over 20 million users, through his holding company Emergent Fidelity Investments. This investment totaled a cool $246 million. There are no plans for him or FTX to buy out Robinhood; however, this stake is hefty and is certainly something to keep an eye on as things can change fast.

More recently, FTX came to the rescue of BlockFi, another centralized crypto-finance company, by giving them $250 million via a revolving credit facility. This credit can be used, repaid, and then used again. BlockFi additionally had to lay off about 20% of its entire workforce.

Yet another example of overexposure was brought to light by these challenging market conditions. It doesn’t stop there. Voyager Digital, a publicly-traded mobile crypto broker, had to cut withdrawal limits from $25,000 to $10,000 per day. Voyager ended up here via an overexposed $660 million loan given to Dubai-based Three Arrows Capital. And there is good reason to believe that they may not be repaid on this loan hence the bailout by SBF’s quantitative cryptocurrency trading firm Alameda Research.

Another noteworthy happening. After announcing 0% commission stock trading, FTX is set to acquire equities clearing startup Embed Financial, an accredited broker-dealer. With this, FTX will provide white-label brokerage services for its US customers. They don’t seem to be slowing down with these strategic plays. They are paving the way to be a one-stop-shop for many investing services. Pairing that with how they are approaching the aspect of crypto education, they have an excellent opportunity to integrate lifelong customers vertically.

This is important as it shows which financial companies look to be in good health during these harsh times. Not only by showing us who needs the help but who is doing the helping. These bailouts and investments that FTX is making a show that they are a pillar in the space are managed well and have the means to assist during hard times. This also gives them significant exposure to competitors and competing products as they further solidify themselves in the space and diversify by investing in their peers’ success.

I have seen this in other industries where better-positioned companies provide bailouts and structured support to their counterparts in the space. About a year ago, I remembered reading that FTX could someday absorb or buy out financial giant Goldman Sachs.

This is if FTX ever gets big enough to do something of this stature. Could a play like this manifest? At the time, SBF had stated the potentiality was “not out of the question.” This seems like a wild idea to entertain, but he might just be setting up for something like this in a roundabout way. Time will tell, but FTX/SBF sure are making moves to be prominent leaders in the space, setting themselves up for long-term success. All the while coming to the rescue of what seems like the entirety of the crypto space. Carry on, Sam, carry on, we’ll be watching!