- About $300 million in crypto liquidations hit after Trump threatened a 50% tariff on the EU.

- Most losses came from long positions as BTC reversed sharply after touching $110K.

- Analysts say the liquidation reflects a correction after overheating near all-time highs.

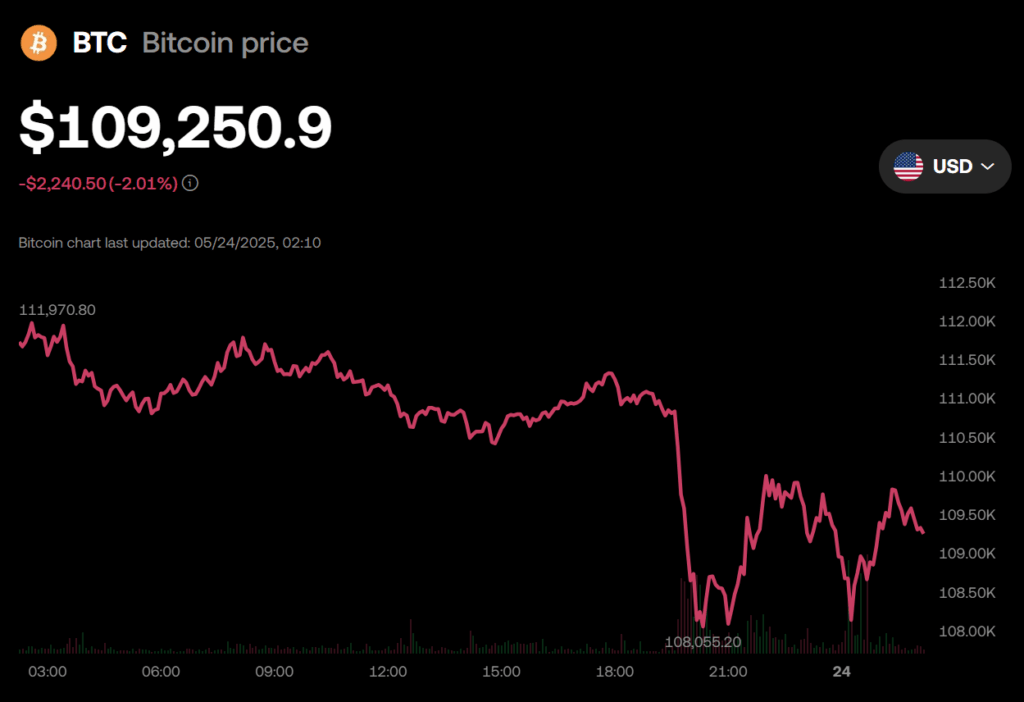

Things got messy in the crypto market this week. On May 23, around $300 million in forced liquidations swept across major exchanges—right after U.S. President Donald Trump dropped a surprise 50% tariff threat on the European Union. The shock announcement didn’t just shake global stock markets—it hit crypto hard, too.

Longs Got Wrecked as BTC Tumbled Off $110K

Data from CoinGlass shows the majority of the losses came from long positions, meaning traders who were betting prices would keep going up. Many jumped in after Bitcoin (BTC) and Ethereum (ETH) surged—only to get slammed when the market turned.

Bitcoin, which briefly touched $110,000, reversed hard. That single drop liquidated a wave of bulls who had gone long during the hype. Ethereum didn’t fare much better, pulling back sharply just minutes later.

“This is one of the biggest liquidation events of the month,” CoinGlass noted.

Tariff Talk + Market Highs = Instant Overheat

Analysts say this move came at a sensitive time—right as the market had been pushing new all-time highs. “Trump’s comments created a spike in geopolitical uncertainty,” one analyst said. “Risk appetite shrank quickly, and crypto got caught in the middle.”

Many see this as a correction—maybe overdue—after weeks of parabolic gains. Timing-wise? Not ideal. But in a market that runs hot, sometimes all it takes is a tweet (or in this case, a trade threat) to cool things off fast.