- Inflation across the developing and developed worlds remains high, making it more attractive to hold dollars- a positive for stablecoins.

- New use cases continue to emerge in the DeFi space as developers keep bringing new applications- a plus for DeFi.

- Number of NFT users continues to grow as transactions and holders increase- and is likely to accelerate across 2023.

The year 2022 was defined by a series of scandals in the crypto field, starting with the fall of the Terra Ecosystem due to the de-pegging of its algorithmic stablecoin Terra USD (UST), the collapse of Three Arrows Capital (3AC), t, and the implosion of crypto exchange FTX under the leadership of Sam Bankman-Fried (SBF).

These events have been detrimental to the broader crypto market. Consequently, altcoins have dipped by over 90%, with the likes of Solana (SOL) falling 84% while Bitcoin (BTC) is down 51%, and Ethereum (ETH) is down 53% over the past year. The total market cap of all cryptocurrencies has also plummeted over 75% from the $3 trillion recorded in 2021 to $1.03 trillion today, January 17, 2023.

The events above, among others that tarnished 2022, changed the crypto landscape forever, potentially influencing regulation and investor behavior for the next several years. With that in mind, the following is a discussion about the 2023 crypto outlook for stablecoins, DeFi, and NFTs, looking at the data with incredible insights by Lucas Outumuro from IntoTheBlock.

Will Stablecoins, DeFi, and NFTs Drive Crypto Growth?

Stablecoins

In 2022, dollar-pegged tokens recorded a strong performance, and while the total market cap of the most significant four stablecoins reduced slightly, their transaction volume achieved new highs.

As regards wider adoption, the number of addresses holding stablecoins has increased between 2022 and 2023, as the number of transactions surged in tandem.

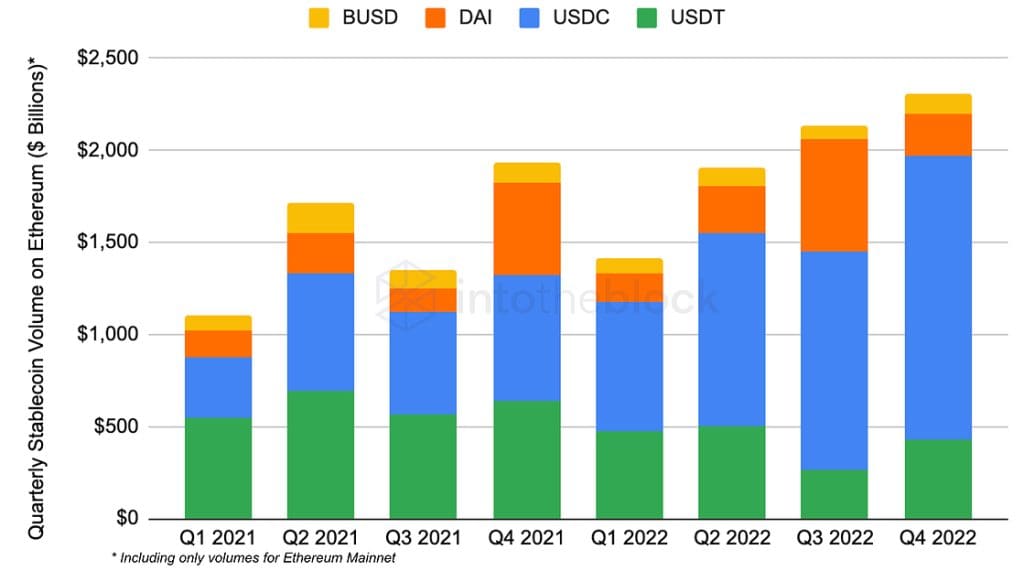

In 2022, up to $7.75 trillion in stablecoin volume happened just on Ethereum, with the total across chains likely reaching the $10 trillion mark. Comparatively, the largest credit network, Visa, handled $14.1 trillion in the same year. This came as USDC stablecoin dominated transactional volumes on Ethereum across the decentralized finance (DeFi) space, surpassing USDT despite Tether’s more significant market share in centralized exchange (CEX) volume.

Outlook: Stablecoins and the institutions backing them could record a growing momentum in 2023. Validating this thesis is inflation rates which remain high across the developing and already developed worlds, making it more attractive to hold dollars. Similarly, entities like Circle that back stablecoins are bringing record profits as the interest rate earned due to treasury bills on dollar deposits remains high and is likely to continue surging in 2023.

DeFi

In the wake of the FTX implosion, crypto has witnessed a reappearance of its original character. This comes as the industry relearns the “not your keys, not your crypto” adage, rendering decentralized finance (DeFi) the much-needed difference maker.

DeFi having a non-custodial and transparent nature, passes as the ideal alternative with the potential to thrive better than the centralized alternative.

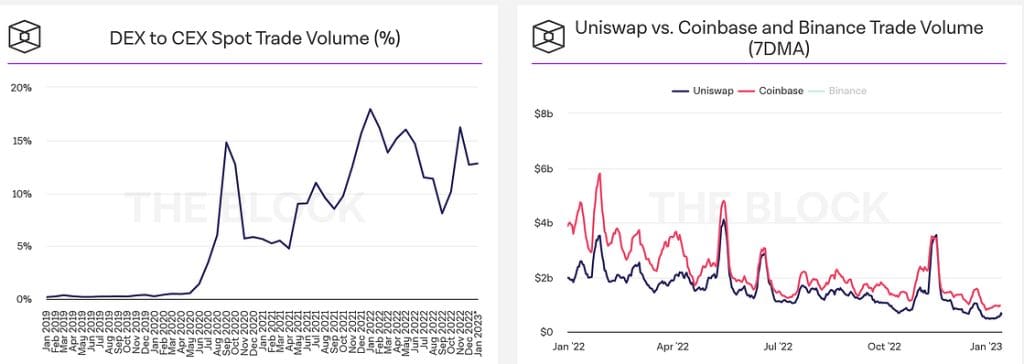

Decentralized exchanges (DEXs) have maintained relatively high market shares with signs of continued growth as Layer 2s increase in affordability and accessibility. Recording fees are as low as 0.01% for stablecoins and 0.05% for regular tokens. The likes of Uniswap could out-market Coinbase.

Similarly, lending on centralized markets is almost dead following the collapse of CEXs like Genesis, BlockFi, and Celsius. Accordingly, despite their over-collateralization demands, Aave and other lending DEXs can leverage this gap. DeFi derivatives could also take off in 2023 with the launch of dYdX Chain and Ribbon’s Aevo for perpetual swaps and options.

Also, new use cases continue to emerge as developers keep bringing new DeFi apps. For instance, real estate derivatives marketplace Parcl launched recently on Solana. Treasury-bill-backed stablecoins are also due for launching from Ondo Finance, enabling holders to earn bond returns on-chain. The number of protocols approaching lending protocols and DECs is also increasing.

Outlook: DeFi applications are poised for increased adoption in 2023.

NFTs

Non-fungible tokens (NFTs) will continue growing in 2023, even without people realizing they are holders.

Despite recording lower volumes, the number of NFT users continues to grow, as evidenced by increasing transactions and holders, and is likely to accelerate across 2023.

Recently, daily NFT sales approached an all-time high of 140k transfers. Reddit’s avatar marketplace has also attracted over 4 million addresses into NFTs despite no mention of “NFT” on the platform. Loyalty program users for Starbucks’ Odyssey will also earn journey stamps (benefit-unlocking NFTs). Instagram is also testing creator capacity for selling NFTs directly on the platform.

Also, New and existing NFT collections like BAYC, Azuki and Doodles, Pudgy Penguins, and gaming NFTs like Axie Infinity plan to expand the possibilities of crypto.

Outlook: These developments, among others, are likely to dramatically increase the number of NFT holders, thereby expanding the NFT market in 2023.