- ZEC rallied above $300 but slipped back below after Bitcoin rejected near $70.9K, showing how closely ZEC tracks broader risk sentiment.

- On-chain data shows privacy narrative growth in 2025 coincided with rising shielded transaction activity and higher network usage.

- Shielded supply grew from 3.2M to 5M ZEC in 2025, representing about 30% of circulating supply, signaling stronger privacy-driven adoption.

ZCash has been a volatility machine lately, with price swinging hard and traders getting pulled in both directions. In recent coverage, AMBCrypto noted that the defense of the $187 level was a key moment, because it acted as an important weekly retracement support. And once that level held, ZEC didn’t just bounce. It launched.

Zooming in, the past few days saw ZEC rip above $300, pushing into the kind of price territory that usually drags attention back to the privacy coin narrative. But that strength didn’t last long. After Bitcoin was rejected near $70.9K on Sunday, February 15, ZEC slipped back under the $300 psychological level and also dropped below a 4-hour imbalance zone around that same area.

Earlier expectations suggested ZEC bulls still had the short-term strength to target $360. At the same time though, the warning was clear: if BTC weakens, ZEC tends to feel it fast. And that’s exactly what played out. ZEC’s spot selling pressure remained active, with the Spot Taker CVD showing taker sell dominance, meaning sellers were hitting bids more aggressively than buyers were lifting asks.

So the short-term situation looks mixed. But the bigger question is more interesting: why did ZCash begin such a massive rally in September 2025 in the first place, and what would need to happen for a repeat?

The September 2025 ZEC Rally Wasn’t Just Random

The rally wasn’t built purely on technicals. A big driver was narrative. Starting in August 2025, the privacy coin theme began gaining serious mindshare, and by October it had become one of the hottest discussions in crypto. As that narrative caught fire, on-chain usage also increased.

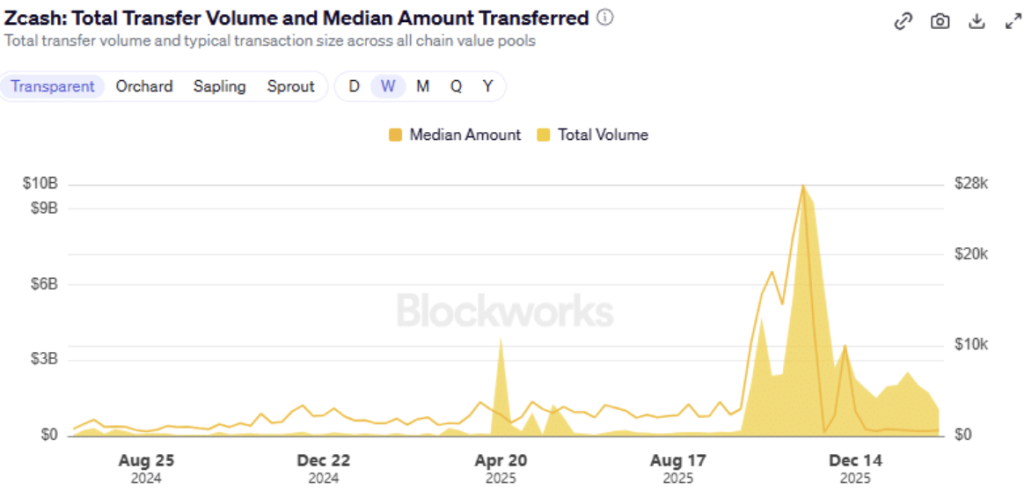

ZecHub transfer volume data showed total transfer activity rising, particularly in unshielded transactions. That alone signals more network movement and more users engaging with ZEC. But it didn’t stop there. Privacy-focused usage also increased, and that’s where shielded transactions become the key piece.

Shielded transactions encrypt transaction details such as sender, receiver, and amount using zero-knowledge proofs. This is basically ZCash’s core differentiator, the reason it exists. When shielded usage rises, it’s a sign the privacy narrative isn’t just being talked about. It’s being used.

Shielded Transactions Climbed, Even If It Looked “Small” on Paper

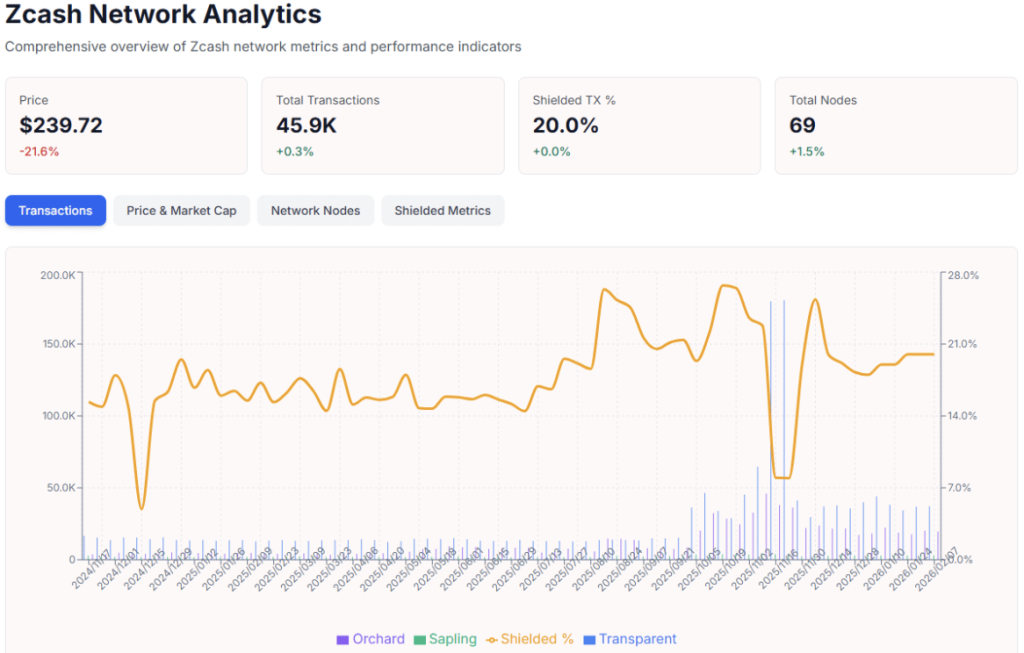

ZecHub shielded stats show that the percentage of shielded transactions stayed around 14.5% to 19.6% between April and July 2025. Then it started lifting. In August, shielded transactions hit a local peak around 26.3%, and in October, they reached about 26.7%.

On paper, that doesn’t sound like a crazy jump. But in real terms, it matters a lot. When a network already has a large base of transactions, even a few percentage points represent a meaningful wave of users shifting into privacy-preserving activity. It’s not just a number. It’s behavior changing.

And when behavior changes at the same time the narrative gets loud, price tends to respond.

Shielded Supply Growth Is the Bigger Signal

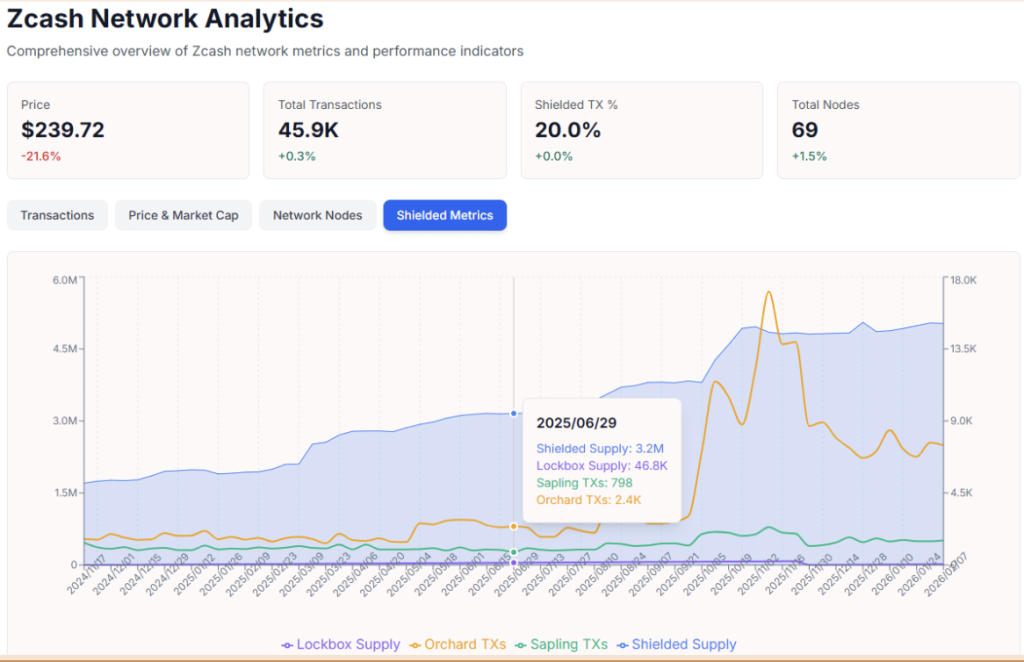

The most striking metric is shielded supply, which represents the ZEC held inside privacy-preserving Sapling and Orchard pools. In June 2025, shielded supply sat around 3.2 million ZEC. By November, it had climbed to 5 million, and it remained around that level at the time of writing.

That’s a big shift.

ZEC, like Bitcoin, has a fixed max supply of 21 million. So 5 million ZEC in shielded pools represents roughly 30.24% of circulating supply. That’s dramatic growth compared to November 2024, when the shielded supply figure was around 11.25%.

In other words, a much larger chunk of the network’s supply has moved into privacy-preserving pools over the past year. That’s not something you see if people are only speculating. That’s long-term usage and storage behavior.

What Needs to Align for Another ZEC Run?

If ZCash is going to repeat a September-style rally, the conditions likely need to line up again. The privacy narrative has to regain mindshare. Shielded usage has to continue growing, not just staying flat. And Bitcoin needs to cooperate, because BTC weakness tends to create risk-off conditions where high-volatility altcoins get sold first.

There are also a couple of broader catalysts that could matter. The 2024 halving and the narrative shift appear to be the main fundamental changes ZCash has seen over the past year. But a bigger market-level development, like spot ETF offerings or broader regulatory changes around privacy coins, could change the landscape entirely.

For now, ZEC remains a market that moves in bursts. When the narrative hits, it hits hard. But when Bitcoin turns weak, ZEC rarely gets a free pass.