• Zcash surged 45% this week, flipping Monero to become the top privacy cryptocurrency.

• Arthur Hayes’ $10,000 price target fueled retail FOMO and renewed institutional attention.

• Whale wallets are trimming holdings, but retail participation continues to climb.

While most of the crypto market continues to cool, Zcash (ZEC) has staged one of the most surprising rallies of the year. The privacy-focused token surged 45% this week, soaring to an eight-year high of $388 and overtaking Monero (XMR) as the most valuable privacy cryptocurrency with a $6.2 billion market cap.

This move comes at a time when Bitcoin and other major assets are consolidating after trade talks between the U.S. and China failed to deliver a clear deal. Yet, as the broader market hesitated, Zcash broke out — signaling renewed investor demand for privacy-oriented coins that prioritize anonymity and untraceable transactions.

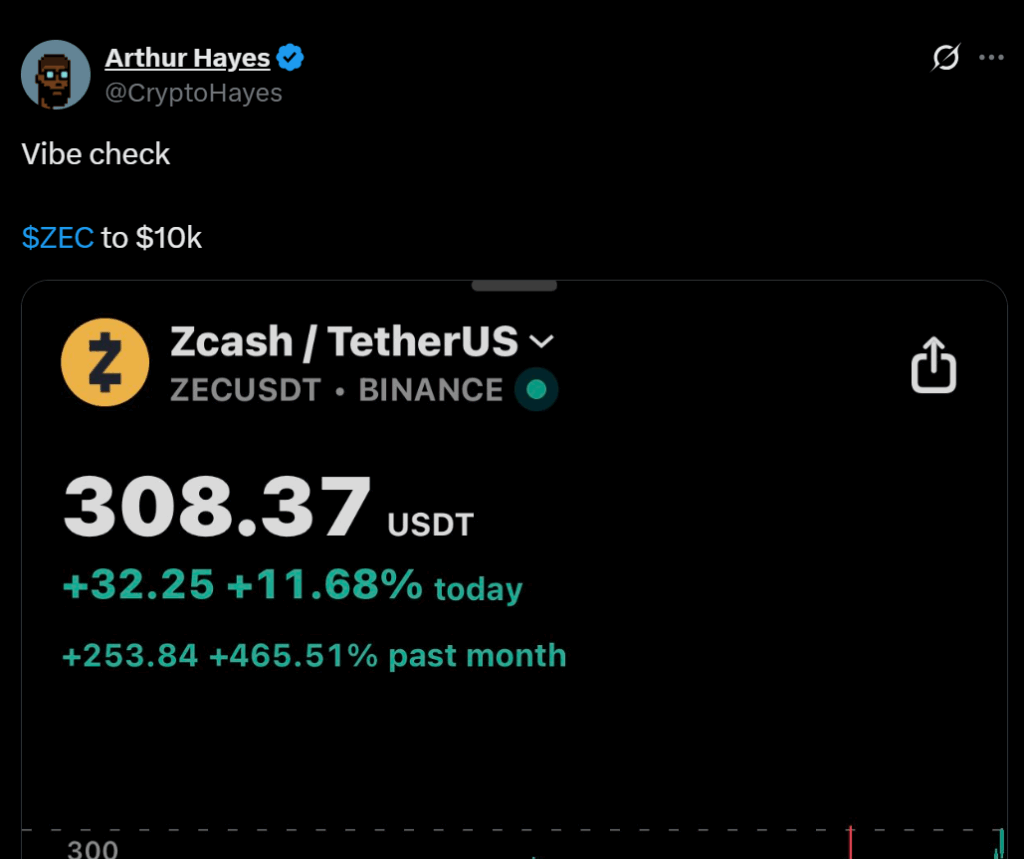

Hayes’ $10,000 Call Ignites ZEC Mania

The latest leg of Zcash’s rally can be traced back to BitMEX co-founder Arthur Hayes, who predicted that ZEC could rally to $10,000. His bullish call set off a wave of buying, propelling prices from around $272 to $355 within hours. That kind of momentum hasn’t been seen in the privacy sector in years.

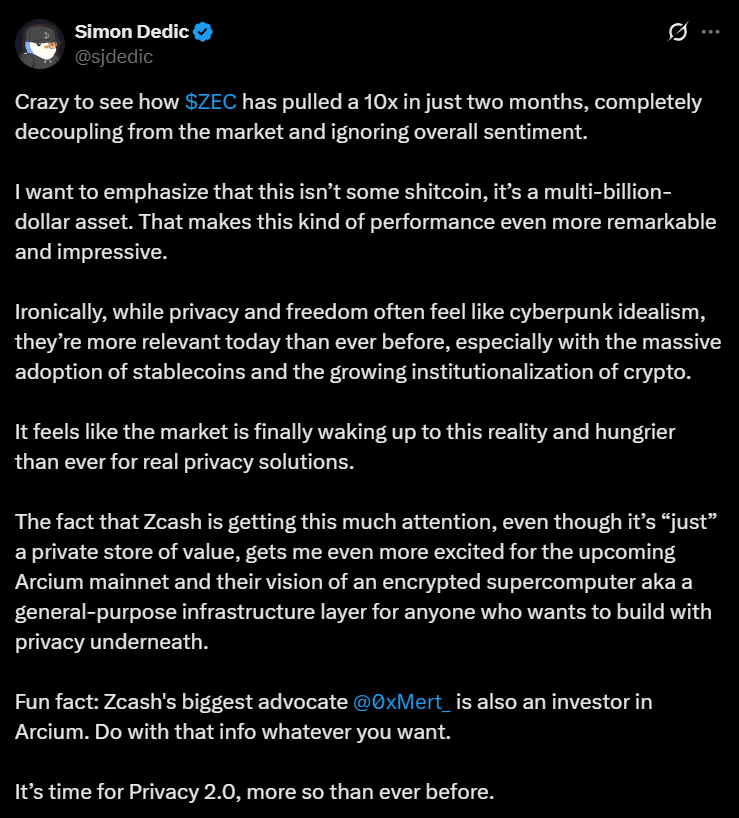

ZEC’s sharp rise mirrors the speculative surges that fueled earlier crypto bull cycles, but this time it’s backed by renewed attention on data protection and financial privacy, especially as regulators tighten surveillance on blockchain transactions. As Moonrock Capital’s Simon Dedic noted, “It’s crazy to see how $ZEC has pulled a 10x in just two months, completely decoupling from the market… this isn’t some memecoin — it’s a multibillion-dollar asset.”

Whale Activity and Retail Frenzy

Even as retail investors flood in, whale wallets have started to take profits. Data from Nansen shows that large holders sold roughly $702,000 in ZEC tokens this week, even as the number of unique Zcash wallets rose 63% to 1,968. The combination of new inflows and selective whale selling suggests that short-term volatility could remain high, but overall sentiment still leans bullish.

For now, Zcash’s fundamentals — limited supply, real use case in privacy preservation, and growing on-chain activity — are providing a foundation that supports speculative enthusiasm. The token’s ability to hold gains while the rest of the market stumbles has made it the clear leader in the privacy coin space.

Can Zcash Maintain Its Lead?

ZEC’s breakout above $350 has placed it in uncharted territory not seen since 2018. If the momentum continues, traders are watching for a potential push toward $400–$420 resistance levels, with Hayes’ $10,000 projection serving as a distant but psychological target.

Still, with privacy coins often facing regulatory headwinds, Zcash’s next challenge will be sustaining mainstream interest while navigating compliance pressures. Whether this is a short-term hype cycle or the start of a lasting comeback will depend on how well Zcash can balance growth with privacy in a more regulated crypto landscape.