- Zcash surged over 30% in late December, flipping Solana in perpetual futures volume.

- Privacy tokens dominated 2025 performance, while memecoins suffered heavy losses.

- Rising shielded ZEC supply and exchange outflows support further upside, with $600+ in focus.

Zcash caught the market off guard with a sharp Santa rally, climbing roughly 30% even as Bitcoin drifted sideways and broader momentum stayed muted. On December 27 alone, ZEC jumped 17% to around $515, capping off a 43% recovery for the month and wiping out nearly half of its Q4 losses. It was one of those moves that feels sudden, but not entirely random.

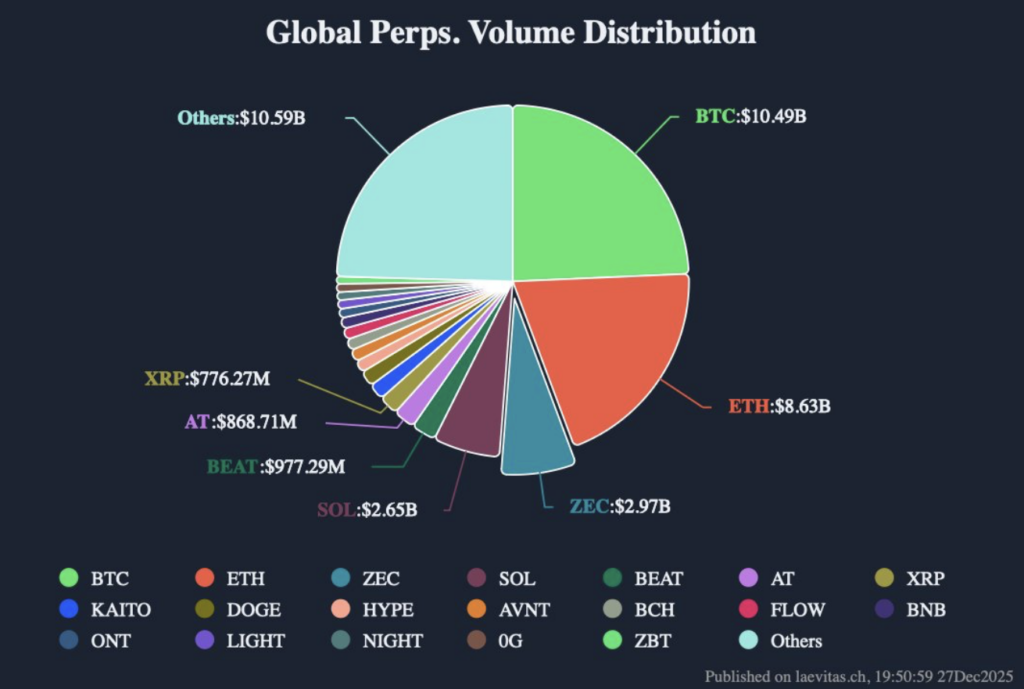

What really stood out was where the activity showed up. In the futures market, Zcash quietly overtook Solana in global perpetual volume, a clear sign that speculative interest had shifted. Over the past 24 hours, ZEC’s perp volume reached about $2.9 billion, giving it roughly a 7% share of the total market and placing it third behind Ethereum and Bitcoin. SOL, for once, slipped to fourth.

Privacy Narrative Overtakes the Meme Trade

The strength in ZEC isn’t just about derivatives. Data from Artemis shows that the privacy narrative emerged as the top-performing theme of 2025, led by Zcash, Monero, and related assets. On average, privacy-focused tokens delivered annual returns north of 250%, a staggering number compared to most other sectors.

Memecoins, by contrast, had a rough year. Dominated largely by the Solana ecosystem, that category ranked near the bottom, posting an average annual loss of around 62%. The shift was pretty stark, and it didn’t help SOL’s performance either. In a year where narratives mattered, privacy clearly won the rotation.

Usage Growth Backs Up the Price Action

Beyond price and speculation, Zcash has also seen real usage growth. By late 2025, the amount of shielded ZEC supply climbed to around 5 million tokens, nearly doubling in just a few months. That steady expansion suggests growing demand for private transactions, not just short-term trading.

Analyst Peter Costi framed the move bluntly, arguing that people are becoming more aware of how broken current systems feel and how much personal data gets stripped away daily. In his view, the expanding shielded pool is the real story, while the price rally is more of a second-order effect. Price followed usage, not the other way around, which is rare in crypto.

Momentum Builds, but Key Levels Still Matter

Looking ahead, exchange data shows notable accumulation over the past week, with more ZEC leaving exchanges than entering. That typically points to longer-term positioning rather than quick flips. If momentum holds, recovery targets around $600, or even $750, start to look realistic. The recent December push also reclaimed the 50-day moving average, tilting the technical picture back in favor of bulls.

Still, risk hasn’t vanished. A drop back below the $450 short-term support could quickly derail the recovery and shake confidence. For now though, ZEC has momentum, narrative support, and improving on-chain signals, a combination that’s hard to ignore.