- XRP remains within a long-term ascending channel that dates back to 2014

- Analysts point to historical structure rather than short-term price action

- Extreme upside scenarios are considered low probability, not base expectations

XRP has spent the past few weeks moving sideways to lower, weighed down by the same market fatigue affecting most digital assets right now. Price action hasn’t been inspiring, and short-term sentiment remains cautious at best. Still, some longer-term technical views suggest the asset’s broader structure hasn’t actually broken, even if momentum feels thin at the moment.

One of the more widely discussed frameworks focuses on a long-standing price channel that has guided XRP’s behavior for more than a decade. Under very specific conditions, this structure leaves room for significant upside, though not without several hurdles along the way.

A Decade-Long Price Channel Still in Play

According to this analysis, XRP continues to trade within an ascending channel that first became visible back in 2014. This channel has historically acted as a rough roadmap for both major rallies and extended pullbacks, offering context that short-term charts often miss. Support and resistance within this structure have repeatedly shaped XRP’s biggest moves over multiple cycles.

Despite the recent weakness, supporters of this view argue that XRP has not violated the channel’s boundaries. The current pullback is seen less as a breakdown and more as a retracement within an ongoing, though slow-moving, upward structure. From that lens, the bigger trend technically remains intact, even if it feels uncomfortable right now.

Monthly Structure Suggests No Structural Breakdown

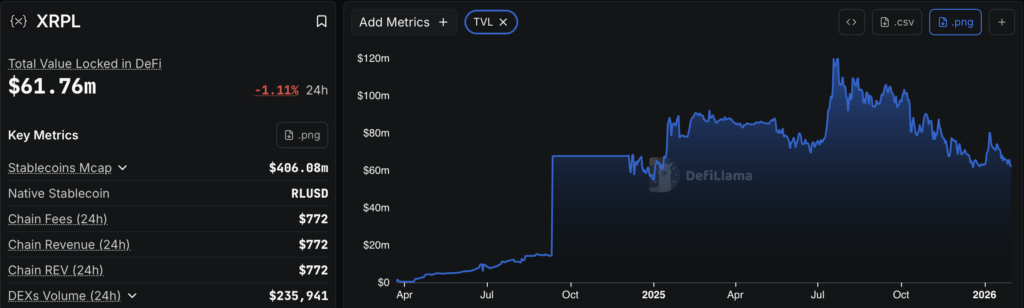

Market watcher EGRAG Crypto recently revisited this channel using monthly data, deliberately filtering out short-term volatility. From this angle, XRP’s decline after its local high earlier in the year mirrors broader market behavior rather than asset-specific failure. Price has drifted toward the lower half of the channel, but long-term diagonal support is still holding.

At around $1.84, XRP remains well above the channel’s historical base. Analysts who lean on this model argue that staying within these bounds keeps the door open for renewed upside once market conditions improve. The assumption, of course, is that this long-term structure continues to matter, just as it did in previous cycles, which isn’t guaranteed, but hasn’t been disproven either.

Echoes of the 2017 Cycle

Historical context plays a big role in this thesis. In 2017, XRP traded in a similar relative position within the same channel before launching into a powerful expansion. During that cycle, price pushed through multiple resistance zones, eventually reaching the upper boundary of the channel. After a brief pause, XRP overshot that boundary and went on to print its all-time high in early 2018.

Analysts are careful to note that this comparison isn’t about copying price action step by step. Instead, it’s about relative positioning within the structure. Market conditions today are very different, but structurally, the setup shows similarities that some believe are worth paying attention to.

Step-by-Step Targets Before Any Extreme Scenario

Rather than jumping straight to dramatic outcomes, the framework outlines several milestones that would need to be cleared first. Initial resistance sits in the mid-single-digit range, followed by a more challenging zone near double digits. Clearing those levels would already imply a major shift in market sentiment and liquidity.

Beyond that, the upper boundary of the channel currently projects into the high $20 range. Some analysts see this area as a realistic cycle ceiling under strong conditions. Only if XRP were to decisively break and extend beyond that zone would discussions of much higher levels even make sense.

Why the $200 Scenario Stays on the Fringe

The most aggressive projection tied to this model places XRP near $200, based on the size of the 2017 overshoot above the channel top and applying a similar proportional extension today. Even proponents of the analysis admit this outcome carries a relatively low probability. It’s framed as a macro extension scenario, not a base case.

A move to $200 would imply gains of more than ten thousand percent from current prices, which puts it firmly in the realm of extraordinary market conditions. As a result, it’s usually treated as a theoretical upper boundary rather than something to expect or plan around.

In the end, the channel-based view doesn’t claim XRP is destined for extreme prices. It simply argues that, from a long-term structural standpoint, the framework that supported past rallies hasn’t been invalidated yet. Whether XRP can build momentum again will depend on broader market strength, liquidity returning, and sustained demand over time, none of which can be forced.