- XRP is struggling to hold the $2.8 support level as whales dump around $50 million worth of tokens daily, creating heavy selling pressure.

- Despite persistent outflows, analyst EGRAG Crypto remains bullish, citing strong RSI momentum and an upward price trend.

- A breakout above $3 could open the path toward $4, marking a potential reversal if whales slow their selling.

Ripple’s XRP is under pressure again. After multiple failed attempts to stay above $3, the token has slipped back to around $2.8, where it’s now fighting to hold the line. The culprit? Whales — lots of them. On-chain data shows that large holders have been unloading roughly $50 million worth of XRP every day, keeping the price pinned down despite overall bullish signals on the charts.

It’s been a frustrating few weeks for XRP traders. Every time the price gets close to $3, selling kicks in and wipes out momentum. For now, $2.8 has become the key support zone everyone’s watching — lose that, and things could turn ugly fast. But as odd as it sounds, some analysts still believe XRP’s setting up for a big rally once the selling slows down.

Whale Activity Adds Pressure to XRP

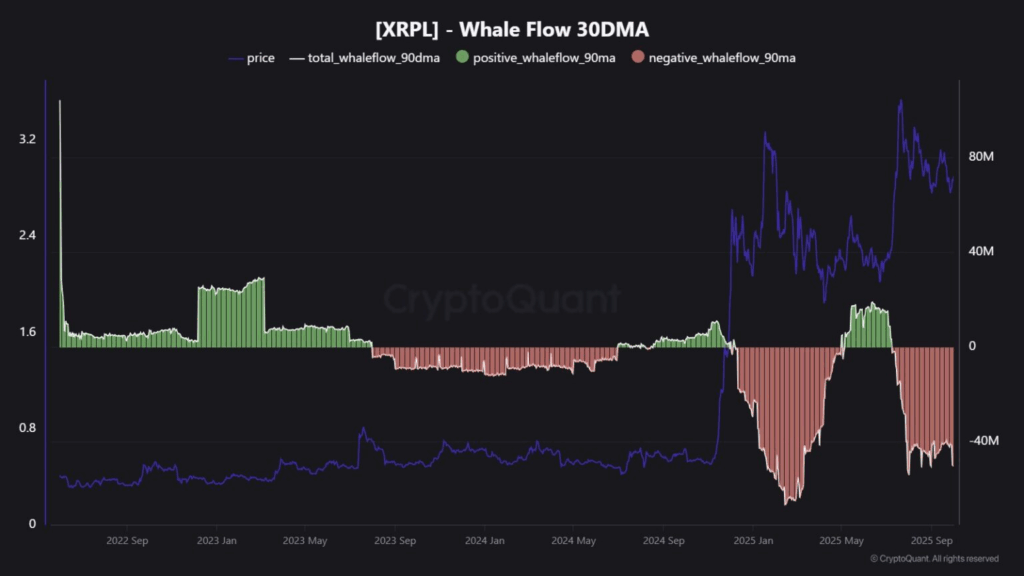

Over the past month, Ripple’s native token has lost its footing in the rankings, dropping to the 5th largest crypto after being overtaken by Binance Coin (BNB). The broader market has cooled off, and XRP’s whales seem to be taking profits or simply rotating out for now. According to Whale Flow data, accounts holding over 1,000 XRP have been moving tens of millions of dollars worth of tokens off wallets each day.

That’s about $50 million in daily outflows based on a 30-day moving average. CryptoQuant’s flow charts confirm steady selling since early 2024, painting a picture of whales cashing out rather than accumulating. The constant supply pressure has left traders hesitant, especially with macro uncertainty — things like Fed policy shifts and new regulatory updates — hanging over the market.

Even so, analysts like EGRAG Crypto think the selling might just be noise in a larger bullish structure. “XRP is still holding its key slope,” he noted, pointing out that technical indicators remain healthy. He added that the RSI and price trend lines are both angled upward, which often signals continued momentum despite short-term weakness.

Analysts Still See a Rally Ahead

EGRAG Crypto remains one of the more optimistic voices in the XRP community. According to his analysis, both price and RSI show no divergence — meaning the trend is still aligned and strong. “The slope of the price line sits around 7, and RSI is around 9 or 10,” he said, describing that as a sign of growing strength under the surface.

If XRP manages to close above $4 in the coming weeks, EGRAG says it could mark the start of a new bullish phase — maybe even a long-overdue run toward higher highs. But to get there, the token first needs to break through $3 resistance and convince whales to stop dumping.

For now, $2.8 remains the battleground. Bulls are holding firm, but one more wave of whale selling could test their conviction. Either way, XRP’s next few moves might determine whether this is just another cooldown — or the start of a bigger comeback.