- XRP fell below $3 alongside a broader crypto market pullback, with Bitcoin and Ethereum also dropping.

- Institutional investors have accumulated over $3 billion in XRP futures and added $37.7 million into XRP funds in Q1 2025.

- Analysts suggest XRP could climb toward $8, though heavy institutional sell-offs remain a key risk.

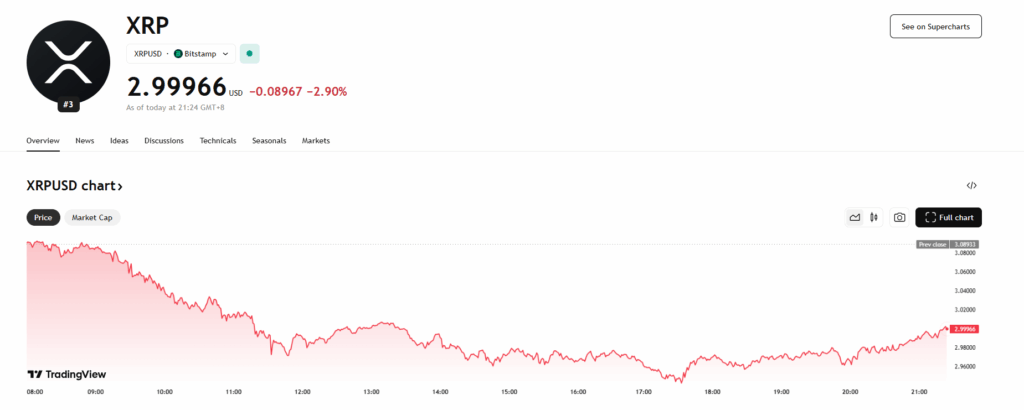

Ripple’s XRP has dropped below the $3 mark after holding above it for nearly two weeks, making it one of the weaker performers in the latest market pullback. The dip comes in sync with a broader crypto downturn: Bitcoin slid 3% to $115,000, while Ethereum retreated nearly 5% to the $4,300 zone after losing steam above $4,500. Despite this short-term weakness, XRP has drawn notable attention from large investors, who appear to be quietly buying the dip.

Institutional Buying Gains Momentum

Fresh data from Mitrade shows that institutional accumulation in XRP futures has already surpassed $3 billion. On top of that, XRP-based investment products attracted $37.7 million in inflows during Q1 2025. These moves suggest that financial institutions are using this correction to position themselves strategically, betting on XRP’s long-term upside. Interestingly, the buildup of positions has lifted market sentiment around Ripple’s token even as retail traders remain cautious about further downside.

Can XRP Push Toward $8?

Optimism is building among analysts who believe XRP could revisit levels not seen since its 2017 breakout cycle. Some are pointing to $8 as a realistic medium-term target if institutional inflows keep piling in, especially as markets prepare for developments in the ongoing SEC vs Ripple legal battle. A favorable ruling or clearer regulatory framework could act as a major catalyst, fueling a strong recovery and possibly even igniting a fresh bull cycle for the altcoin.

Risks of a Sell-Off

Still, not everything is rosy. With more than $3 billion in accumulation already recorded, any large-scale profit-taking by institutions could trigger steep sell-offs that would hit retail holders hardest. If XRP does climb toward $8, the temptation to book profits could weigh on price stability. Even so, many traders still see sub-$3 entries as an attractive long-term play, with the potential for outsized gains outweighing near-term risks.