- XRP remains under pressure short term, but 2025 has already marked a major recovery year

- ETF inflows into XRP products continue to build, even as BTC and ETH flows soften

- A potential Bitcoin rally in 2026 could provide the catalyst XRP needs to rebound

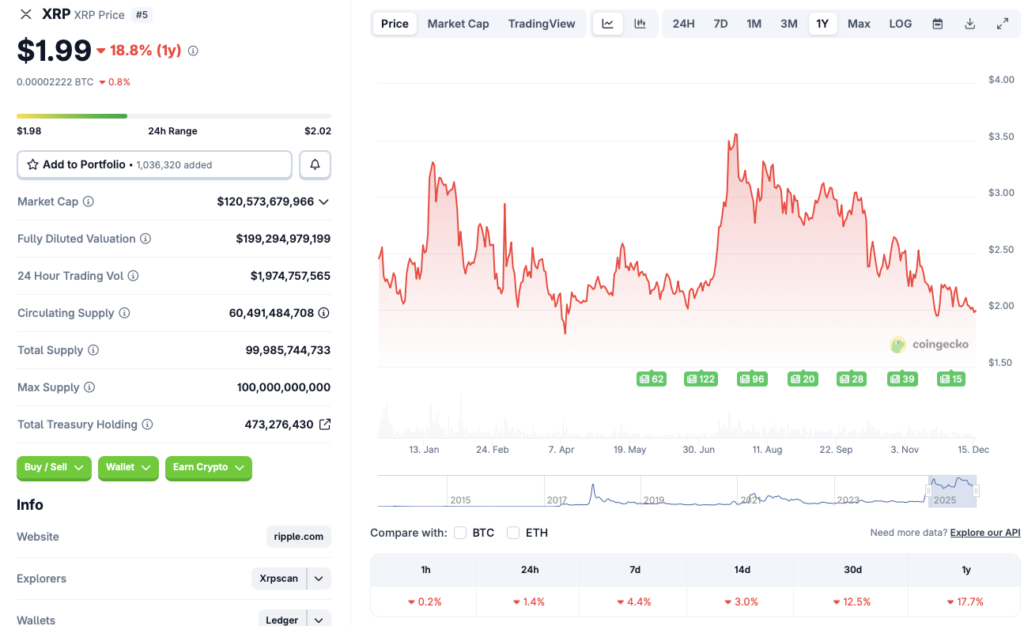

XRP has once again dipped below the $2 level, with CoinGecko data showing the token down 1.4% over the last 24 hours and more than 12% across the past month. The move adds to short-term pressure that has kept XRP stuck in a choppy range, even as broader crypto sentiment remains fragile. Still, zooming out tells a very different story.

Despite recent weakness, 2025 has been one of XRP’s strongest years since 2020. The token reclaimed the $3 mark earlier this year for the first time in seven years, a milestone that reshaped long-term sentiment even as near-term volatility returned.

ETF Inflows Keep Quietly Building Under the Surface

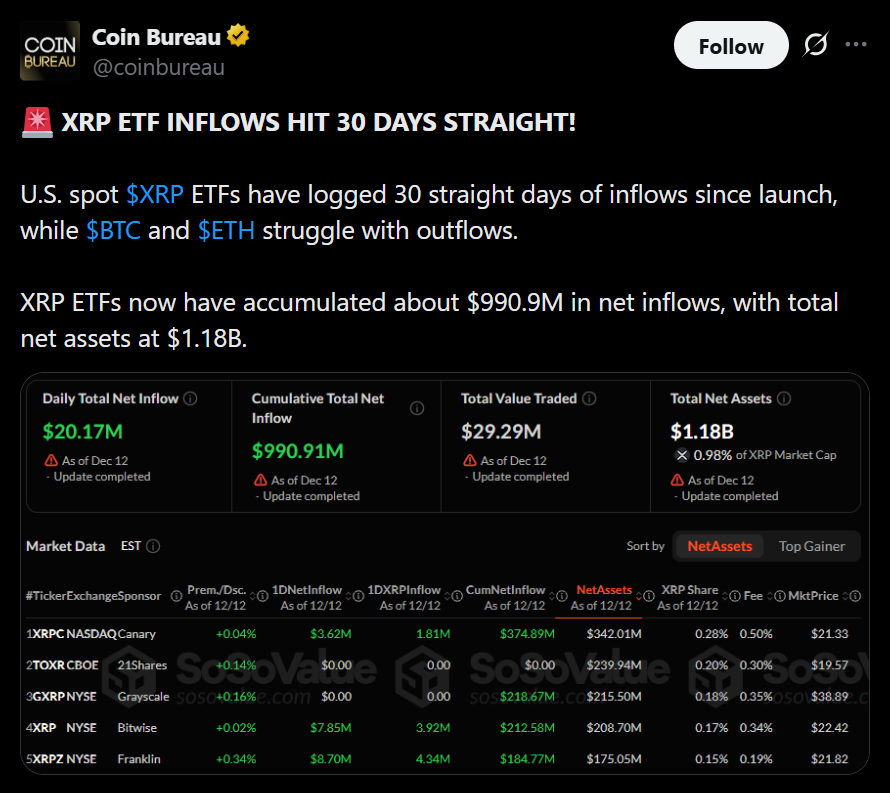

While price action has been shaky, XRP-linked ETFs are telling a much steadier story. XRP ETFs have now recorded inflows for 30 straight days, pulling in roughly $990 million in net capital and pushing total assets beyond $1 billion. That kind of consistency stands out, especially as Bitcoin and Ethereum ETFs have recently seen mixed or negative flows.

ETF demand played a central role in pushing BTC and ETH to new highs during this cycle. If XRP follows a similar path, sustained inflows could act as a delayed catalyst, supporting a rebound once broader market conditions stabilize.

Bitcoin’s Long-Term Outlook Could Lift XRP With It

Another factor quietly working in XRP’s favor is the longer-term outlook for Bitcoin. Both Bernstein and Grayscale expect BTC to reach a new all-time high in 2026, arguing that Bitcoin has shifted from its traditional four-year cycle into a longer five-year trajectory. Bernstein sees BTC reaching $150,000 next year and potentially $200,000 in 2027.

Historically, major Bitcoin rallies have lifted large-cap altcoins alongside it, and XRP has often followed that pattern. A renewed BTC surge could reignite risk appetite across the market, giving XRP room to recover lost ground.

Not Everyone Is Bullish Heading Into 2026

That said, optimism is not universal. Barclays has warned that crypto markets could face headwinds in 2026, pointing to weak spot volumes and fading demand. If that scenario plays out, XRP could struggle to regain momentum despite ETF inflows and long-term narratives.

For now, XRP sits at an important crossroads. Short-term price action remains soft, but institutional flows and longer-cycle expectations suggest the downside may be limited if broader conditions improve.