- XRP has fallen sharply from its July 2025 high, pushing market sentiment into Extreme Fear

- Negative funding rates show short positions dominating, which may build hidden upside pressure

- Analysts are watching key support near $1.78 and resistance around $2.00 for trend shifts

Ripple’s XRP has stayed under pressure since setting an all-time high of $3.65 in July 2025, followed by a steady and, at times, frustrating decline. An attempted rebound in early January briefly pushed the price toward $2.40, but momentum faded quickly and buyers failed to follow through. Since then, the asset has struggled to regain confidence.

Broader market uncertainty has only made things worse. Rising geopolitical tensions have pushed investors into a defensive stance, draining appetite for risk across crypto markets. As sentiment weakens, XRP has become a target for growing pessimism, although history suggests these moments don’t always last as long as traders expect.

Sentiment Hits Extreme Fear as Key Levels Come Into Focus

According to Santiment, XRP has now entered “Extreme Fear” territory based on social sentiment data. Retail traders have grown increasingly bearish after a roughly 19% drop from the January 5 high, and negative chatter has accelerated quickly. In past cycles, however, similar spikes in fear have often preceded rebounds, as prices moved sharply against retail expectations.

Santiment noted that heavy FUD around XRP has historically acted as a rally trigger rather than a breakdown signal. Analyst Ali Martinez echoed this view by highlighting key price zones to watch. He pointed to $1.78 as a critical support area, while identifying $1.97 and $2.00 as the next major resistance levels if price strength returns.

Distribution Phase Follows a Historic Rally

XRP is currently trading about 47% below its July 2025 peak, which comes after an explosive 600% rally that began in November 2024. CryptoQuant describes the current phase as a natural period of distribution and correction, something markets often need after such aggressive upside moves. In that sense, the pullback itself isn’t unusual.

What stands out is the timing of the bearish sentiment. Rather than peaking near the top, negativity intensified after XRP had already fallen more than 50%. That imbalance suggests fear may be overstretched, especially as positioning data begins to lean heavily in one direction.

Negative Funding Rates Could Flip the Script

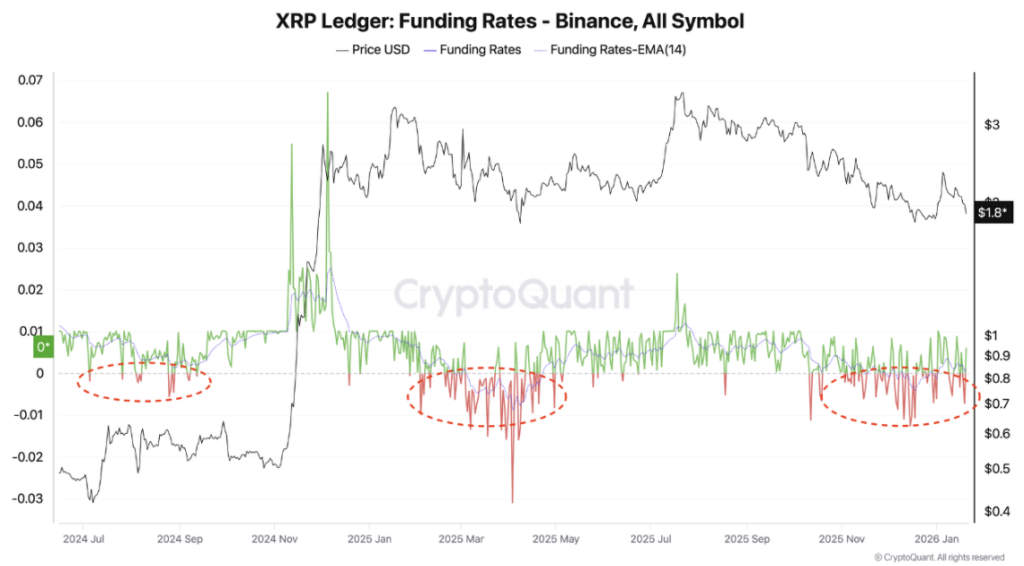

On Binance, XRP funding rates have remained mostly negative since December, signaling that short positions now dominate leveraged trading. Historically, markets tend to move against crowded consensus, and excessive short positioning can quietly build latent buying pressure. It’s uncomfortable while it lasts, but it can change quickly.

If XRP starts to rise, short sellers may be forced to close positions, accelerating upward momentum. Similar dynamics played out during the August–September 2024 period and again during the April 2025 correction. In both cases, negative funding rates were followed by sharp rebounds once sentiment flipped.

Taken together, analysts see the current setup as one that deserves close attention. If buying pressure begins to return, XRP could be positioned for an unexpected reversal, even as the broader mood remains cautious for now.