- XRP has reclaimed the $2 level after strong weekly gains

- Analysts see potential upside toward $2.42–$2.50 in early 2026

- Broader market fragility could still trigger another correction

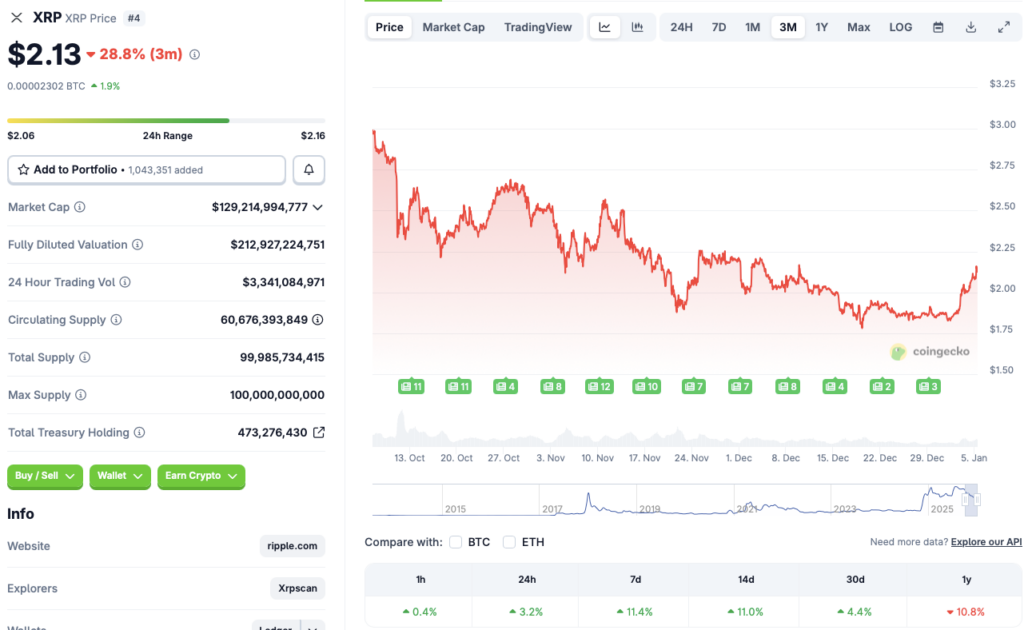

XRP has officially reclaimed the $2 price level after posting gains across nearly all major time frames. According to CoinGecko data, the asset is up 3.2% in the last 24 hours, 11.4% over the past week, 11% in the 14-day charts, and 4.4% over the previous month. Even with the rebound, XRP remains down 10.8% since January 2025, leaving investors focused on whether this move marks a trend shift or just a relief rally.

XRP’s 2025 Run Set the Stage

XRP delivered one of its strongest performances in years throughout 2025, despite losing momentum toward year-end. The token broke above $3 in January for the first time in seven years and went on to print a new all-time high of $3.65 in July. Much of that upside was driven by the settlement of the long-running SEC lawsuit and the subsequent launch of multiple spot XRP ETFs in late 2025.

Those developments helped legitimize XRP in the eyes of institutional investors, similar to how ETF approvals boosted Bitcoin and Ethereum earlier in the cycle. While prices later cooled alongside the broader market, XRP entered 2026 with stronger structural support than in previous years.

Short-Term Price Outlook and Analyst Expectations

According to CoinCodex forecasts, XRP could continue trending higher in the near term. The platform projects a move toward $2.42 by January 24, followed by a modest pullback. Looking further ahead, CoinCodex expects XRP to test the $2.50 level sometime in March, though it does not anticipate a return to $3 in the immediate future.

The current rally appears closely tied to Bitcoin’s recent push above $93,000, which helped lift sentiment across the market. If BTC holds its gains, XRP could benefit from continued inflows, especially through ETF-related demand.

Risks Still Linger Beneath the Surface

Despite the positive momentum, the broader crypto market remains fragile. Macroeconomic uncertainty, shifting rate expectations, and lingering risk aversion continue to weigh on investor confidence. XRP’s rebound could stall if Bitcoin loses momentum or if global markets turn risk-off again.

For now, reclaiming $2 is a meaningful technical milestone, but sustained upside will likely depend on stronger market confirmation rather than XRP-specific catalysts alone.