- 93.92% of XRP supply is in profit, echoing past cycle tops.

- NUPL readings mirror 2017 and 2021 peaks, raising top risks.

- A breakdown below $3.05 could send XRP toward $2.39, while a breakout might open the door to $6.

XRP has blasted past the $3 mark, putting almost 94% of its entire circulating supply into profit, according to Glassnode. In just nine months, the token has climbed over 500%, rising from under $0.40 to a recent high of $3.11. For many investors, it’s been one of the strongest runs in years, with nearly everyone holding XRP now sitting on gains.

But history shows that such high profitability often comes with risk. Back in early 2018, when more than 90% of XRP holders were in profit, the coin topped near $3.30 before collapsing 95%. A similar setup unfolded in April 2021, when profitability levels above 90% came just before an 85% crash from the $1.95 peak. With 93.92% of supply in profit today, traders are starting to wonder if this cycle is setting up the same way.

NUPL Flashes Warning Signs

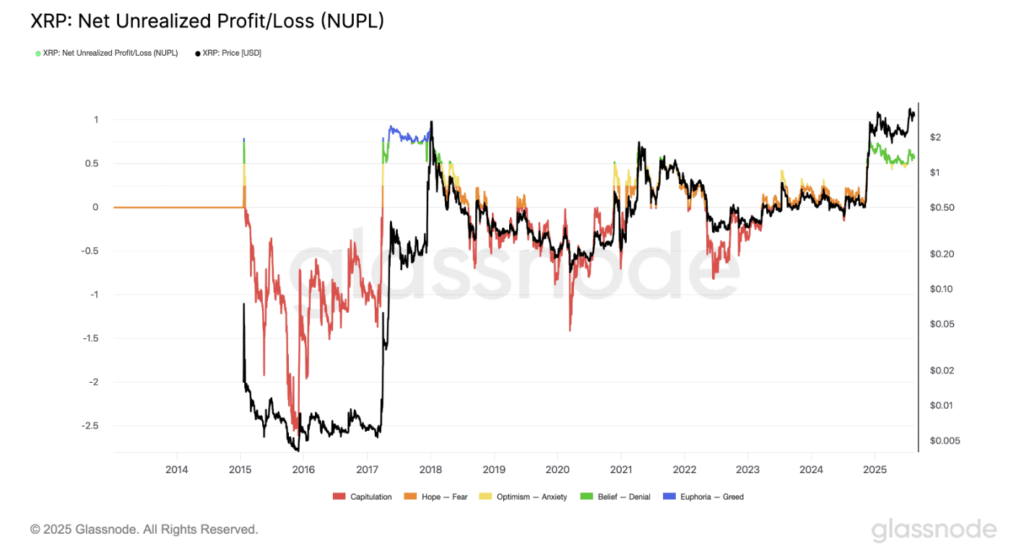

Another red flag comes from XRP’s Net Unrealized Profit/Loss (NUPL), which measures the difference between paper gains and losses across the network. The indicator has entered the “belief–denial” zone—a level historically linked to market tops. In late 2017, XRP’s NUPL spiked in this range right as the token peaked above $3.30. The same thing happened in April 2021, just before XRP crashed from $1.95.

Currently, the NUPL reading suggests investors are sitting on heavy profits, though not quite at “euphoria” levels. Still, if it creeps higher into greed territory—the first time since 2018—the risk of large-scale profit-taking could grow quickly. To avoid that, XRP will need strong inflows, possibly from institutions and altcoin market momentum, to absorb the selling pressure.

Bearish Setup Signals Possible 20% Drop

On the charts, XRP is consolidating inside a descending triangle pattern after its break above $3. This formation, usually bearish, is defined by lower highs pressing against a flat support near $3.05. Earlier this month, XRP slipped below that line in a fakeout before bouncing back. But repeated retests raise the odds of a real breakdown.

If XRP closes decisively under $3.05, technicals point to a drop toward $2.39—a 23.5% slide from current levels—by September. On the flip side, bulls still have a chance. A breakout above the descending resistance line would invalidate the bearish pattern and could trigger a push higher, with some analysts calling for a rally up to $6.

The Crossroads for XRP

Right now, XRP sits at a crucial crossroads. Nearly everyone is in profit, which historically has marked cycle tops, while NUPL indicators flash warnings. At the same time, institutional interest and broader market strength could keep the rally alive. Whether this ends with a sharp correction or a breakout to new highs may depend on how much fresh demand enters the market in the coming weeks.