- XRP is consolidating around $1.87–$1.88 after a steep decline from July highs

- CoinCodex expects a brief move above $2 in mid-January 2026, followed by volatility

- Macroeconomic uncertainty remains the biggest obstacle to a sustained XRP recovery

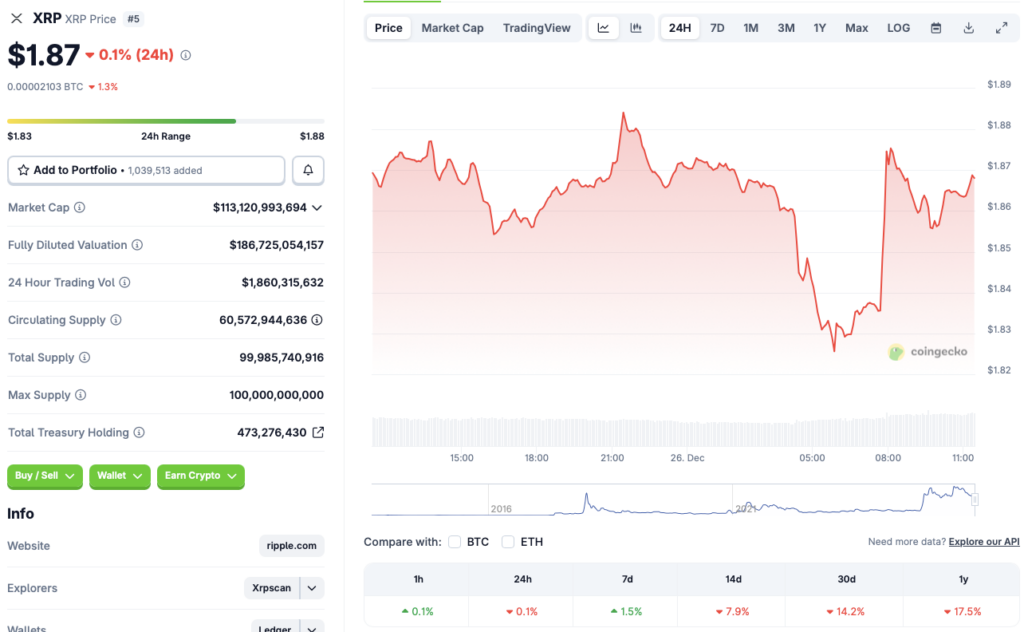

Ripple’s XRP token appears to be stuck in a tight consolidation range around $1.87–$1.88, showing little momentum despite brief weekly gains. According to CoinGecko data, XRP is up 1.5% over the last seven days, but remains under pressure across longer time frames, down 7.9% in the past two weeks, 14.2% over the last month, and 17.5% since December 2024. With price action flattening out, investors are now asking how long it may realistically take for XRP to reclaim the $2 level.

XRP’s Strong 2025 Rally Has Fully Unwound

XRP began 2025 with significant strength, breaking above $3 in January for the first time in seven years and reaching a new all-time high of $3.65 in July. That rally was largely driven by optimism following the settlement of the long-running SEC vs. Ripple lawsuit, which removed a major regulatory overhang.

Since peaking in July, however, XRP has given back nearly half of its gains. The token last traded at $2 on December 15 before slipping steadily lower and settling into its current consolidation range. Even the launch of several spot XRP ETFs earlier this year failed to generate sustained upside momentum, suggesting that broader market conditions are outweighing project-specific catalysts.

When Could XRP Realistically Reclaim $2?

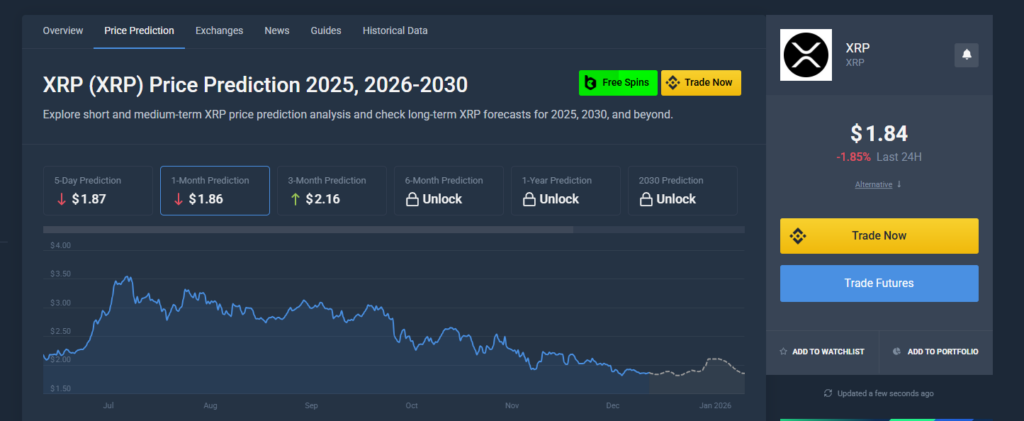

According to forecasts from CoinCodex, XRP is expected to reclaim the $2 mark around January 14, 2026. That move, however, may be short-lived, as the platform anticipates a pullback shortly after. CoinCodex then projects another attempt to move above $2 in late February 2026, indicating a choppy and uneven recovery rather than a clean breakout.

These projections reflect the current macro environment, where risk appetite remains muted. With interest rate cuts looking less likely in the near term and global economic uncertainty still elevated, capital continues to avoid speculative assets. This backdrop makes it difficult for XRP, and the broader crypto market, to sustain rallies without a clear shift in sentiment.

Macro Pressure Could Keep XRP Range-Bound

The wider crypto market has struggled for months as investors adopt a more defensive stance. Low odds of further interest rate cuts have reduced liquidity flowing into digital assets, and many traders are prioritizing capital preservation over upside exposure. Until those macro conditions improve, XRP may remain trapped below $2 despite periodic attempts to reclaim it.

For XRP to move decisively higher, the market will likely need a combination of improving economic data, renewed risk appetite, and stronger inflows into crypto ETFs. Until then, consolidation may be the dominant theme.