- XRP rebounds 22% after sixteenth retest of the crucial $1.85 support.

- Binance’s XRP reserves fall by 2.7B, signaling accumulation pressure.

- XRP Spot ETFs record continuous inflows, boosting institutional demand.

XRP is back on the radar today as traders piled into long positions worth more than $72.5 billion around the $2.129 level, reflecting clear intraday bullish sentiment. The token recently rebounded sharply—about 22% in five sessions—after once again finding support at the crucial $1.85 zone, a level that has triggered strong reversals multiple times since late 2024. Despite falling over 40% since October 2025, this latest bounce suggests a potential trend shift may be forming beneath the surface.

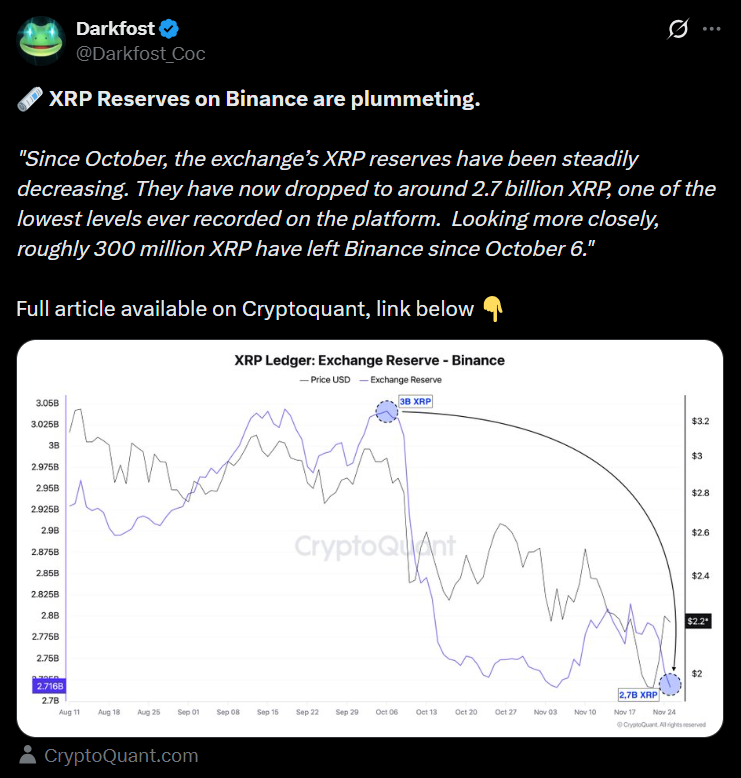

Binance Reserves Fall by 2.7 Billion XRP

A major catalyst behind this momentum is the steep decline in Binance’s XRP reserves. On-chain data shows that the exchange now holds 2.7 billion XRP, one of its lowest levels ever. Roughly 300 million XRP exited Binance since October 6 alone. Exchange reserve drops typically signal accumulation—large holders withdrawing tokens into private storage rather than preparing to sell. This trend aligns closely with XRP’s recent price recovery, reinforcing the idea that demand is quietly building behind the scenes.

Wall Street Demand Surges Through XRP Spot ETFs

XRP’s growing institutional appetite is another major factor. Since U.S. XRP Spot ETFs launched on November 14, they’ve recorded consistent daily inflows with zero outflows, according to SoSoValue data. This steady stream of capital suggests strong long-term confidence from traditional investors. With Wall Street money flowing into regulated XRP products, the asset’s liquidity and market depth continue to strengthen—even as retail sentiment remains mixed.

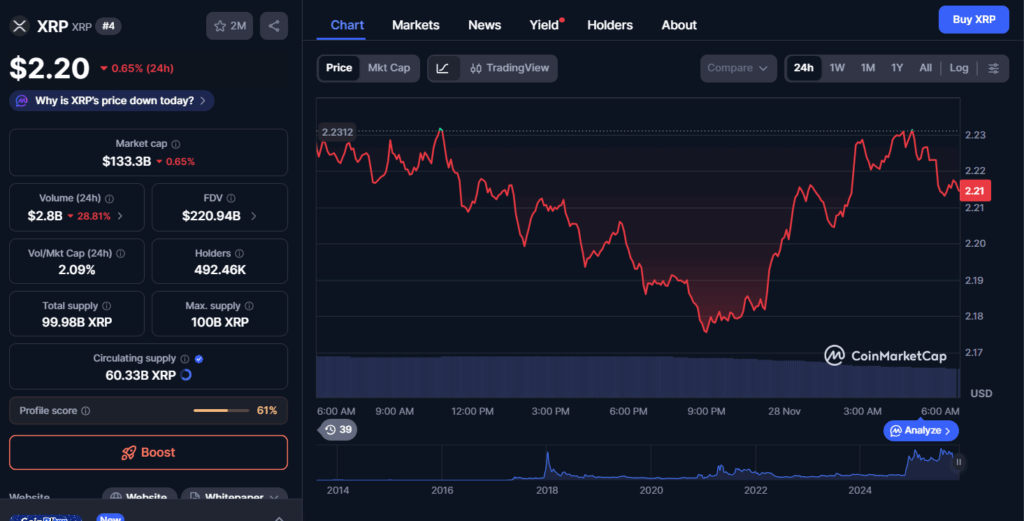

Key Price Levels and Market Structure

At press time, XRP trades near $2.20, up about 1%, while Open Interest climbed above $4.11 billion, indicating rising leveraged participation. Technical analysis shows the asset successfully defended the $1.85 support for the sixth time since December 2024—a zone historically followed by rebounds of 40–70%. Current liquidation maps place key trigger levels at $2.129 and $2.264, where bulls hold a clear advantage. The strong cluster of long positions below price highlights confidence that XRP likely won’t revisit the lows in the near term.