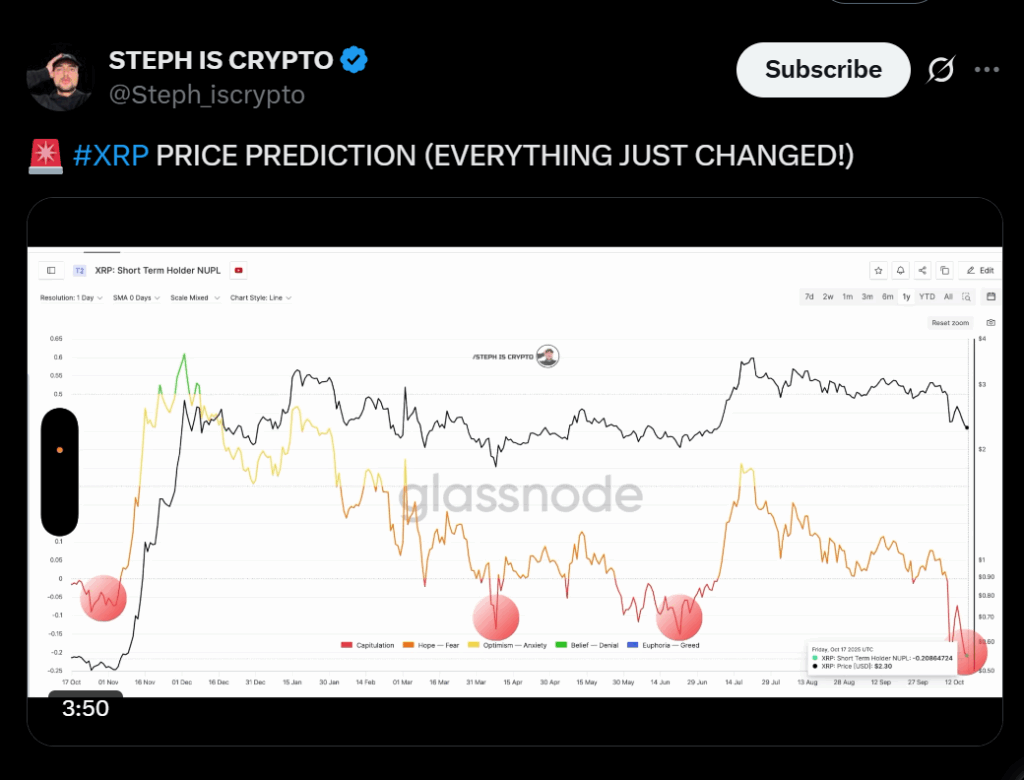

- NUPL ratio at record low (-0.2) indicates capitulation and possible bottom.

- Institutional treasuries exceed $2B, led by SBI and GUMI allocations.

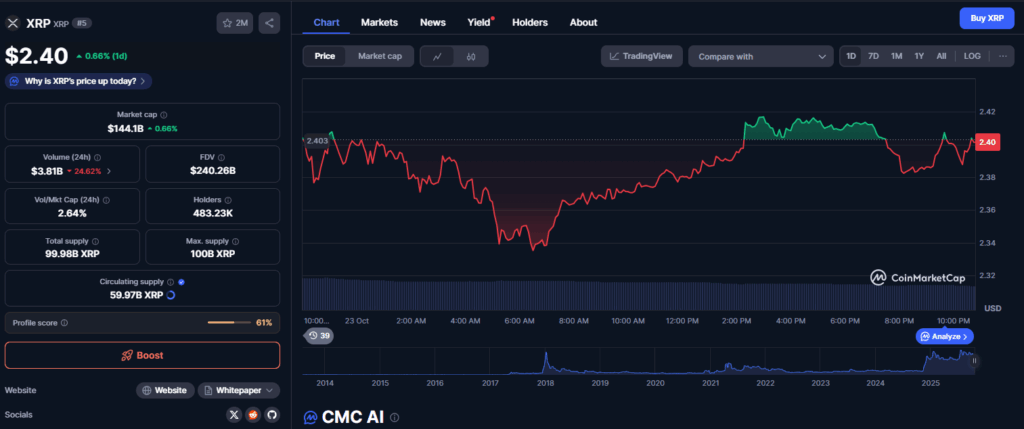

- XRP holds $2.40 and bounces off 0.618 Fibonacci support.

The XRP price outlook has turned sharply bullish as key technical indicators and institutional activity align for what analysts describe as a “potential launch phase.” The short-term holder NUPL ratio has dropped to -0.2, marking the lowest level ever recorded for XRP — a sign that short-term investors are capitulating at historic levels. In previous cycles, similar conditions preceded explosive rallies, with XRP rallying nearly 700% after comparable capitulation phases in 2024 and March 2025.

At the time of writing, XRP is holding near $2.40, about 10% above last Friday’s low, while testing the 0.618 Fibonacci retracement — a level where institutional buyers often accumulate. Technical charts show that this zone has repeatedly served as a springboard for multi-month uptrends, indicating that XRP may be entering the early stages of a structural recovery.

Institutional Buying Reshapes Market Dynamics

On the institutional side, more than 11 corporations have reportedly allocated a combined $2 billion in XRP treasury holdings. Japan’s SBI Holdings confirmed its Evernorth XRP investment, followed by GUMI’s $17 million position. This surge in corporate participation mirrors the Bitcoin corporate adoption trend of 2020, reinforcing the perception of XRP as a liquid cross-border settlement asset rather than a speculative altcoin.

Ripple’s internal treasury flows and new corporate onramps are creating a stronger base of non-retail demand, giving the asset a more stable long-term price foundation. Analysts say this is the first time XRP’s institutional base has matched its retail enthusiasm — a structural shift that’s fueling renewed optimism.

Technical Setups Support a $3.60 Price Target

Analysts like StephIsCrypto note that XRP’s weekly structure remains intact with higher highs and higher lows, despite recent volatility. A clean break above the $2.80–$3.00 resistance zone could trigger a short squeeze that targets $3.60, a key psychological and Fibonacci level.

The combination of record-low NUPL readings, rising institutional allocations, and retested Fibonacci support forms a historically strong setup for a continued rally. With sentiment shifting rapidly, XRP could mirror its 2024 recovery, when a similar structure led to a sixfold price increase within months.

2025 Outlook: The Stage Is Set for Acceleration

As 2025 nears its final quarter, XRP’s alignment of on-chain capitulation, institutional inflows, and technical resilience paints a scenario where “everything just changed.” Analysts argue that short-term fear has likely created an ideal accumulation phase, and that XRP could soon enter the markup phase of its next cycle.

If macro conditions hold steady and corporate treasuries continue expanding, a move toward $3.60 and beyond by year-end remains firmly within reach.