- XRP has surged over 30% since the start of 2026, outperforming both Bitcoin and Ethereum and briefly overtaking BNB by market cap.

- Exchange reserves have dropped to an 8-year low while XRP spot ETFs recorded over $46 million in daily inflows, signaling rising spot demand.

- Technical indicators show a bullish structure with strong accumulation, suggesting XRP could maintain momentum if broader market conditions remain supportive.

Ripple’s XRP has come out swinging in early 2026. At the time of writing, the token was changing hands around $2.39, up roughly 31% since the new year kicked off. That rally hasn’t happened in isolation either. As Bitcoin pushed up toward the $94.5k resistance zone, XRP quietly stole the spotlight, outperforming both BTC and Ethereum over the past several sessions.

The momentum was strong enough to reshuffle the leaderboard. XRP briefly overtook Binance Coin by market capitalization, locking in the fourth spot among the largest crypto assets on CoinMarketCap. For long-time holders, it felt like a shift they’d been waiting on for a while.

Exchange Reserves Tighten as Volatility Breaks

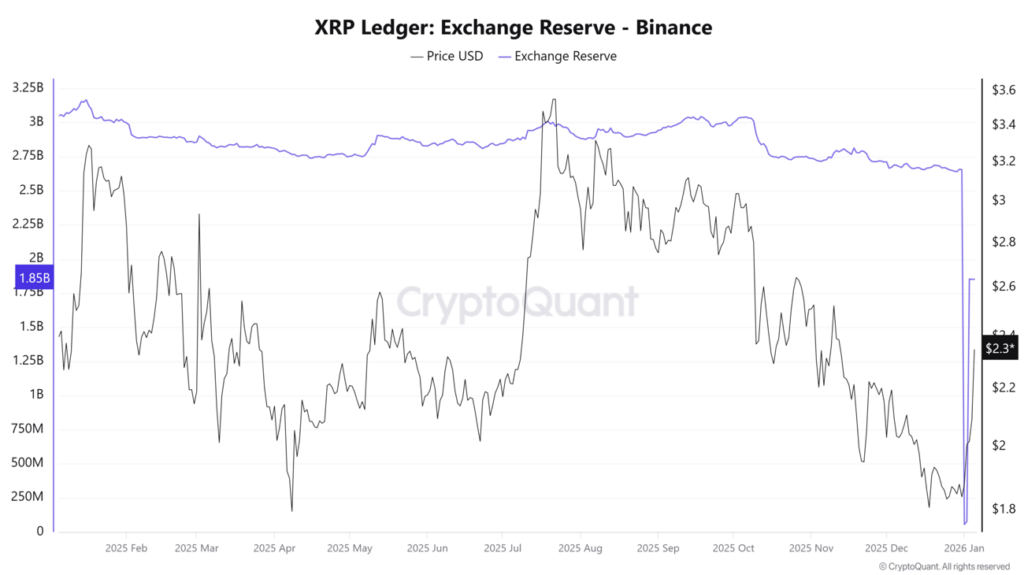

Behind the price move, supply dynamics have been doing some heavy lifting. Data from CryptoQuant shows XRP exchange reserves dropping to their lowest level in eight years, down around 57% compared to October 2025. Toward the end of last year, XRP traded in an unusually tight range while tokens steadily flowed off exchanges, a combination that often precedes sharp moves when demand returns.

That said, shrinking exchange balances alone don’t guarantee a lasting rally. As AMBCrypto previously noted, spot demand and broader risk appetite still matter a lot. If Bitcoin stumbles or overall market sentiment flips risk-off, XRP’s momentum could cool faster than many expect.

ETF Inflows Add Fuel to the Move

Spot demand has shown up in another place too, ETFs. On January 5, XRP spot ETFs recorded a total net inflow of $46.1 million in a single day. Franklin’s XRPZ and Bitwise’s XRP product led the charge, pulling in $21.76 million and $17.27 million, respectively.

What’s notable is that inflows didn’t just appear out of nowhere. December already saw steady ETF demand, even while the broader market was weighed down by uncertainty and fear. That persistence suggests the recent sentiment shift may have deeper roots, with XRP positioned as one of the early beneficiaries.

Over the last 24 hours alone, XRP jumped more than 11%, making it the second-best performer among the top 20 cryptocurrencies. Its market cap hovered near $144 billion at press time, reinforcing the scale of the move.

Technical Structure Flips Bullish

On the daily chart, the technical picture has improved meaningfully. XRP broke above its local swing high at $1.96, flipping the short-term structure bullish. Bulls also managed to reclaim the $2.28 resistance zone, a level that had capped price action before.

Momentum indicators reflect that strength. The RSI has pushed into overbought territory, but so far there’s been no aggressive rejection below $2.28. Meanwhile, the Accumulation/Distribution indicator continues to climb, pointing to sustained buying pressure rather than a thin, speculative spike.

Taken together, ETF inflows, falling exchange reserves, and improving technicals paint a constructive picture. As long as broader market conditions remain supportive, XRP looks positioned to stay firmly bullish in the weeks ahead, even if short-term pullbacks show up along the way.