- XRP fell to $1.22, a level last seen in November 2024

- The token is down over 40% in a month as crypto liquidity tightens

- Bulls argue a sub-$1 dip could reset the cycle and set up a future $5 run

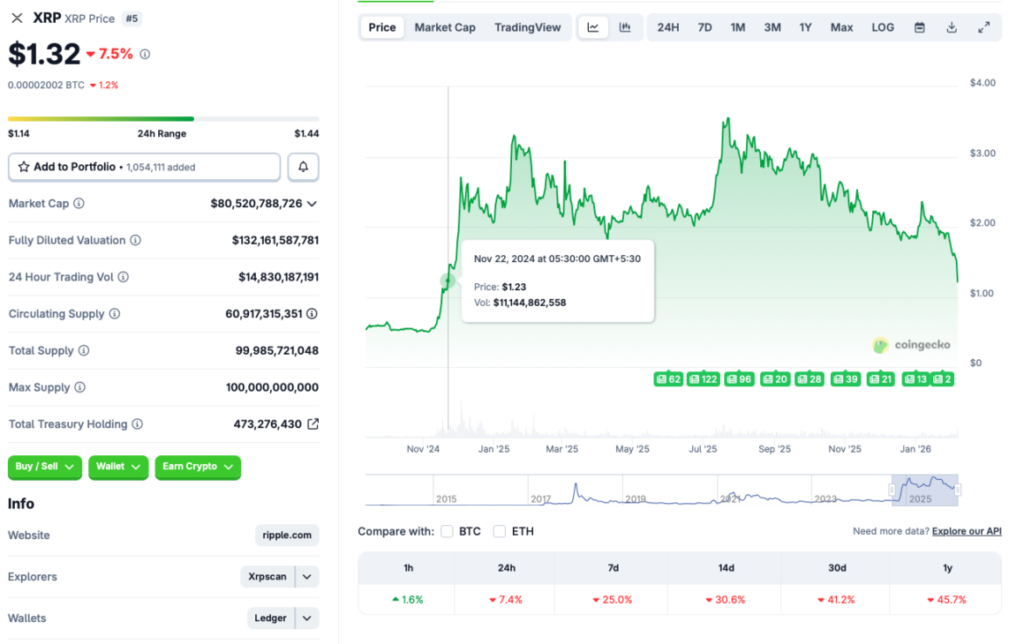

Ripple’s XRP dropped to around $1.22 earlier today, Feb. 6, 2026, revisiting price levels last seen in November 2024. Back then, XRP was just starting to regain momentum. The contrast is sharp, because 2025 was a strong year for the asset, with XRP reaching a peak of $3.65 in July before the trend flipped hard.

Since that peak, XRP has been grinding lower, and the decline accelerated after the October market crash. According to CoinGecko data, XRP is down about 7.4% in the last 24 hours, 25% on the week, 30.6% over 14 days, and roughly 41.2% across the past month. That kind of compression doesn’t just hurt price. It hurts confidence.

The Market Is Now Whispering About Sub-$1 Again

With XRP sliding this quickly, the fear is obvious. Investors are starting to ask whether the token could dip below $1 again, a level that tends to feel like a line in the sand even if it’s mostly psychological. In a weak market, those lines matter, because they shape how traders manage risk and where stop-losses cluster.

The bigger issue is that XRP is unlikely to decouple from Bitcoin in a real liquidity crunch. If BTC continues falling and breaks deeper into the low $60,000s or below, XRP will likely remain dragged along. Even strong narratives struggle when the entire market is in survival mode.

The Bull Thesis Still Relies on the “Reset Then Run” Pattern

Despite the bearish setup, some traders argue that a deeper dip could actually become part of the long-term bullish case. The idea is that Bitcoin historically pulls back hard before launching into new peaks. BTC fell to around $15,000 in 2022, only to push past $100,000 roughly two years later. XRP bulls believe the token could follow a similar pattern, especially once sentiment resets and liquidity returns.

That’s where the $5 target comes from. Not because XRP is showing strength today, but because traders are projecting what a future bull cycle could look like after a painful washout. It’s less a forecast and more a narrative: break down, clear the weak hands, then rebuild higher.

ETF Narratives Still Sit in the Background

Another factor supporting the long-range optimism is the presence of spot XRP ETFs launched in 2025. Even though ETF inflows aren’t helping right now, supporters argue they could matter later once the bear phase ends. In the 2025 cycle, ETF flows played a major role in pushing Bitcoin and Ethereum toward new highs, and XRP bulls believe a similar pattern could emerge when risk appetite returns.

Telegaon analysts have also projected XRP could breach the $5 mark, reinforcing the idea that the market is still thinking in cycles, not weeks. But the reality is simple. Until the broader market stabilizes, ETF optimism is just background noise.

XRP’s Near-Term Story Is Pain, Not Potential

Right now, XRP is trading like a high-beta asset in a weak macro environment. The market is risk-off, liquidity is thin, and volatility is punishing everything at once. That doesn’t kill the long-term thesis, but it does make the near-term outlook brutally dependent on Bitcoin’s next move.

A future $5 run is still a narrative people will keep repeating. But first, XRP has to survive this phase without breaking investor belief completely. And in crypto, that’s often the hardest part.