- Egrag Crypto claims Cointelegraph headlines may precede XRP price drops.

- No hard proof of insider activity, but data shows a visible pattern.

- Community now pushing for transparency — and looking closer at every bullish XRP article.

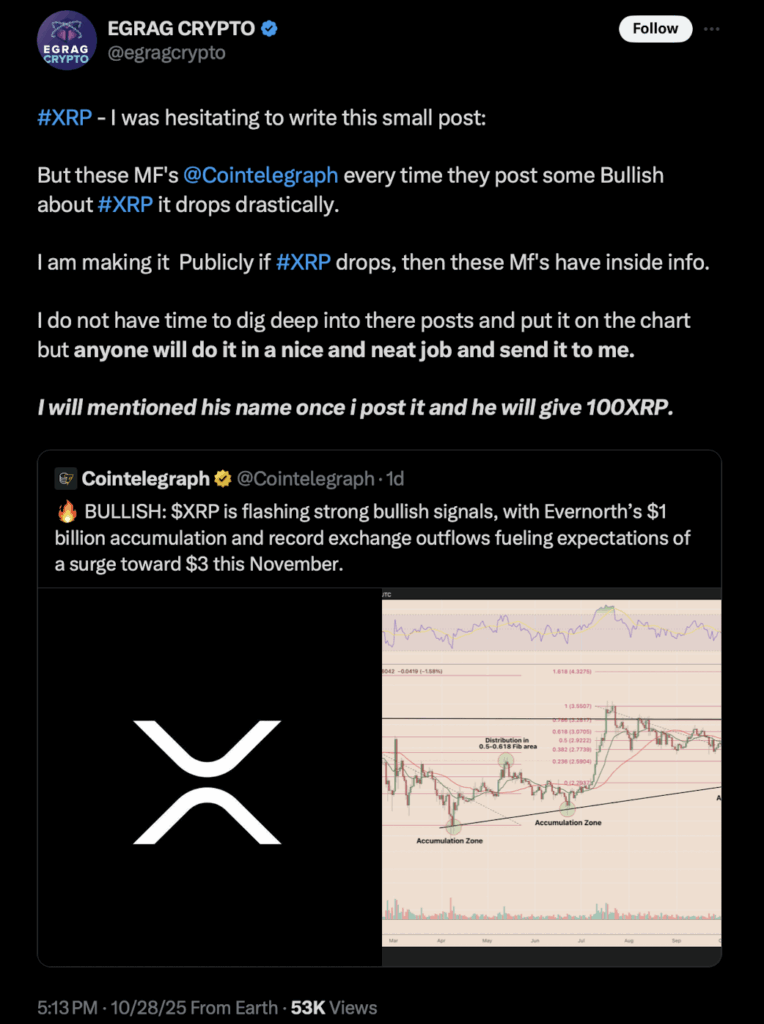

The XRP community is buzzing again, thanks to a bold claim from analyst Egrag Crypto, who suggested that major media outlet Cointelegraph might be influencing XRP’s price — or even trading on insider info. His recent post on X implied that every time Cointelegraph publishes a bullish story about XRP, the token’s price “drops drastically” soon after.

The comment was brief, but it hit a nerve. It touches a long-standing concern in crypto — that headlines and timing sometimes seem a little too convenient for certain traders.

Cointelegraph Headlines and the Price Drops

Egrag’s claim wasn’t pulled from thin air. Over the past few weeks, Cointelegraph released several optimistic stories about XRP, highlighting strong sentiment and growth across the Ripple ecosystem. But right after some of these posts went live, XRP’s price tumbled sharply.

For instance, between October 24 and 27, 2025, XRP traded between $2.39 and $2.65. Notably, right around the publication of one of Cointelegraph’s most bullish XRP pieces on October 25–26, the token saw sudden intraday volatility and a short-term sell-off.

Now, does that prove anything? Not really. But it’s a pattern you can actually see — and it’s enough to get people asking questions.

Market Reflex or Something Bigger?

The crypto market reacts fast — sometimes too fast. A bullish headline can set off traders who decide it’s a good time to take profits. Bots monitoring major news feeds can also trigger massive trades in seconds, creating what looks like manipulation when it’s really automated reaction.

To prove insider activity, though, you’d need timestamps, order book data, and maybe even wallet movements from large holders right before and after those articles go live. That kind of analysis isn’t easy — and so far, there’s no actual evidence that Cointelegraph or its staff did anything shady.

Still, Egrag’s comment reignited an old debate about transparency in crypto media and how headlines can influence trader psychology in ways that might not be so harmless.

A Community Call for Transparency

Instead of letting the debate fade, Egrag turned it into a challenge. He offered 100 XRP to anyone who can produce a detailed chart showing a consistent correlation between Cointelegraph’s XRP stories and market reactions. It’s a small bounty, but it’s sparked interest among analysts and data geeks eager to test whether the theory holds up.

If the data shows nothing but coincidence, fine. But if it reveals a recurring trend — well, that might force some uncomfortable conversations about how crypto media operates and who really benefits from market-moving news.

Headlines Still Move XRP — That’s Clear

At the end of the day, Egrag’s accusation doesn’t prove insider activity, but it’s hard to ignore how XRP’s price keeps reacting to major headlines. Maybe it’s human psychology, maybe it’s algo trading, or maybe it’s something deeper — we’ll see.

What’s certain is that every big XRP story now comes with a little extra tension. Traders are watching more closely than ever, waiting to see whether the next “bullish” headline turns out to be a trigger for another sudden drop.