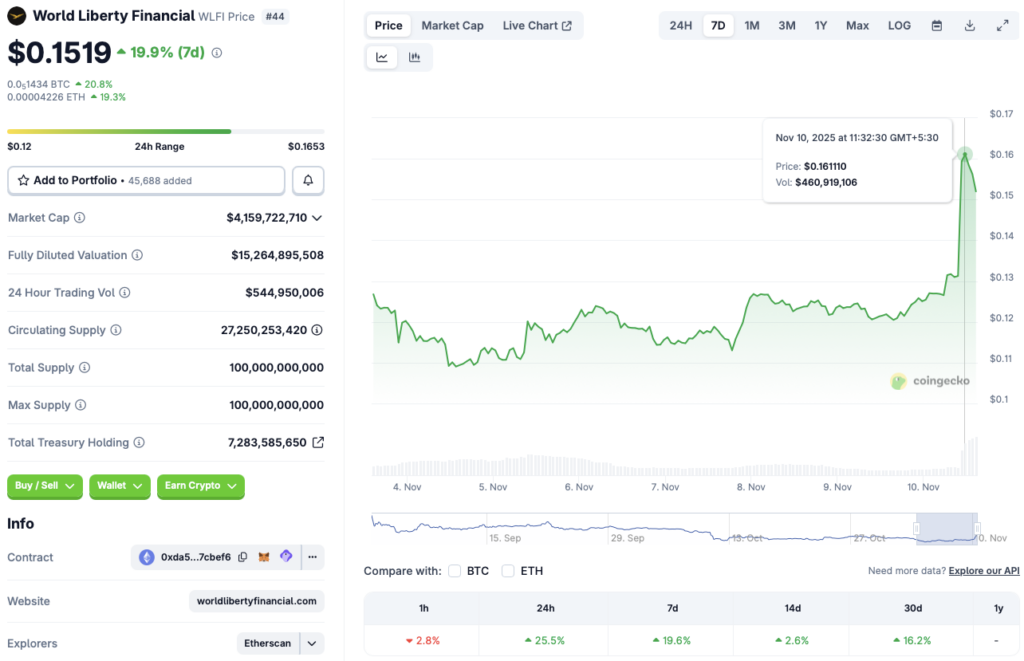

- WLFI is up 25.5% in 24 hours and 19.6% on the week but still trades 52.7% below its all-time high from September.

- The rally is riding optimism around the U.S. shutdown nearing its end and Trump’s $2000 dividend announcement, boosting retail risk appetite.

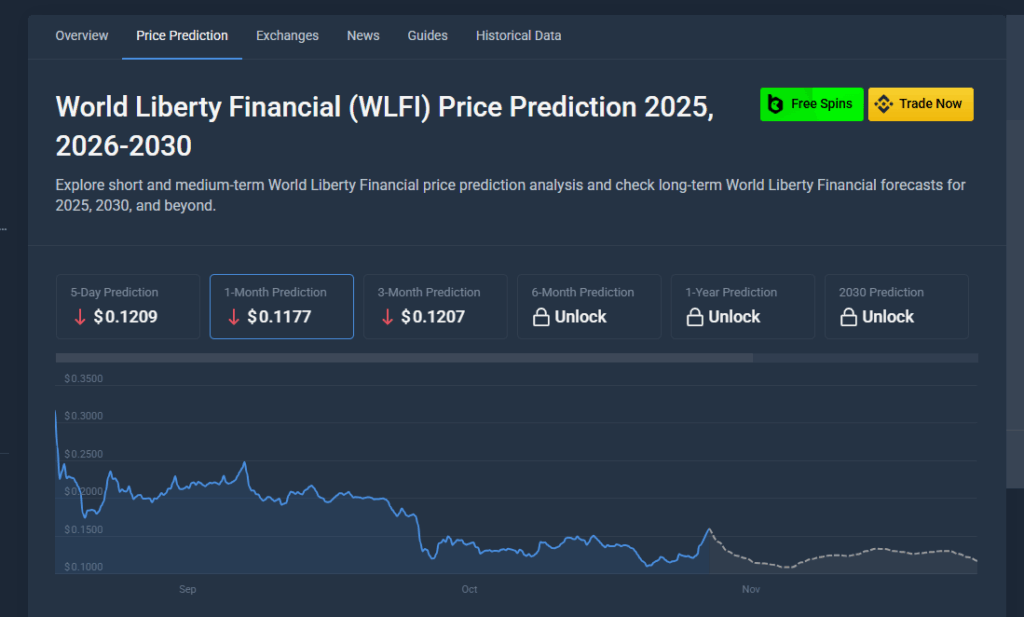

- CoinCodex forecasts a drop toward $0.092 by Nov. 20, signaling that a sharp correction remains firmly on the table despite recent gains.

Shaking off last month’s chaos, World Liberty Financial (WLFI) has jumped back into the spotlight with a sharp move to the upside. According to CoinGecko, WLFI has rallied 25.5% in the last 24 hours, 19.6% over the past week, 2.8% in the last 14 days, and 16.2% over the previous month. Even with that surge, the Trump-linked token is still down 52.7% from its all-time high of $0.3313, set on Sept. 1 this year, leaving plenty of room for volatility in both directions.

Interestingly, while social media continues to brand WLFI as a “Trump family coin,” the project’s own website distances itself from that label. It explicitly states that none of Donald J. Trump, his family members, nor any officer or employee of the Trump Organization or DT Marks LLC is involved with the token. That hasn’t stopped traders from tying WLFI to Trump’s brand narrative, though, and right now that narrative is doing a lot of the heavy lifting.

Can World Liberty Financial Sustain Its Rally?

WLFI’s latest move higher comes against the backdrop of a broader market rebound, helped by signs that the prolonged U.S. government shutdown may finally be nearing an end. President Trump has hinted that a resolution is close and that more details will be revealed soon, and markets tend to front-run any signal of political or fiscal relief. Risk assets, including speculative altcoins like WLFI, are naturally catching some of that optimism.

On top of that, sentiment has been buoyed by Trump’s recently announced $2000 dividend payment to all Americans, excluding high-net-worth individuals. Whether that money directly flows into crypto or not, it creates a psychological tailwind: retail investors feel slightly richer, and some portion of that renewed confidence often bleeds into high-beta assets. For a narrative-heavy token like WLFI, that’s more than enough to spark a sharp short-term chase.

WLFI Price Outlook: New All-Time High or Bearish Reversal?

From a pure price action standpoint, WLFI still has a long way to go if it wants to reclaim its peak. Sitting 52.7% below its all-time high of $0.3313, the asset would need an extended continuation of the current trend to print fresh records. If the current momentum persists, it’s not crazy to imagine another leg higher that tests or even exceeds that level, especially if the broader market stages a clean rebound from October’s wipeout.

However, not all analysts are buying into the continuation story. CoinCodex forecasts a bearish reversal, projecting WLFI to drop to around $0.092 by Nov. 20. From current levels, that would imply a pullback of roughly 39.4%. Given that October delivered the largest single-day liquidation event in crypto history, it’s fair to say the market is still on edge. Any renewed risk-off wave or disappointment around the shutdown outcome could hit speculative names like WLFI first and hardest.

Volatility Ahead As Market Tries To Recover

The wider crypto market is still trying to clean up after a brutal month. October, usually remembered as a bullish period, instead turned into a minefield of forced liquidations and cascading leverage unwinds. In that kind of environment, rallies tend to be fragile, and narrative-driven tokens move in exaggerated fashion as traders pile in and out at high speed.

WLFI sits right at that intersection of politics, macro headlines, and speculative appetite. If the shutdown truly ends, if the $2000 dividend fuels more risk-on behavior, and if the overall market stops bleeding, WLFI could squeeze higher and potentially revisit its peak. But if fear returns or profit-taking hits the tape, the CoinCodex scenario of a sharp correction suddenly looks very realistic. For now, WLFI is trading more on narrative and sentiment than on fundamentals, which means one thing above all: expect more volatility.