- World Liberty Financial plans to use up to 5% of WLFI treasury tokens to support USD1 growth.

- USD1 has reached roughly $3B in market cap since launching in March.

- The proposal aims to boost adoption while increasing long-term value for WLFI holders.

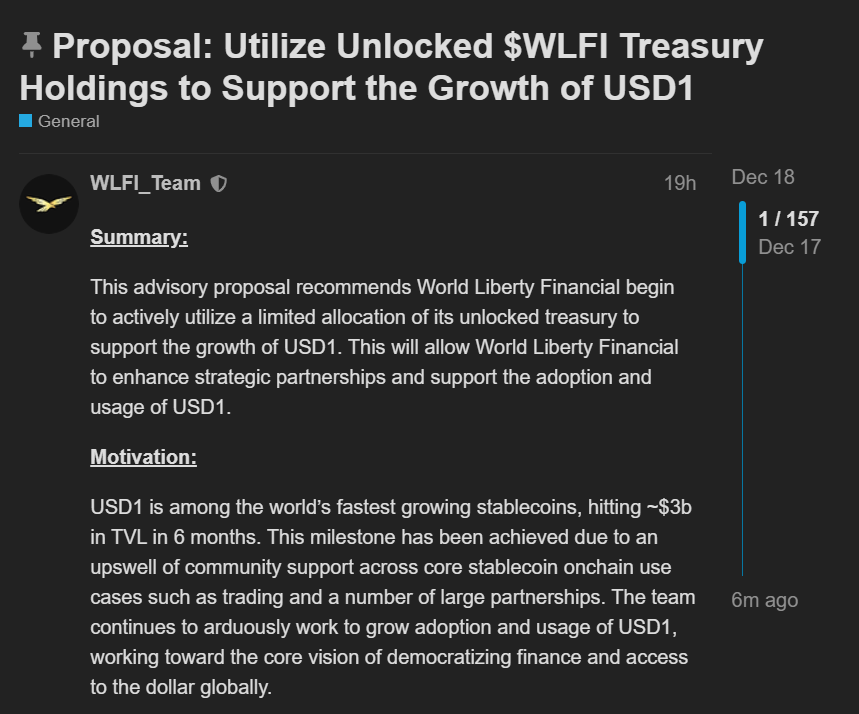

World Liberty Financial, a DeFi project backed by the Trump family, has put forward a proposal to deploy up to 5% of its unlocked WLFI token treasury to accelerate the growth of its USD1 stablecoin. The move comes as competition in the stablecoin sector intensifies and projects look for more creative ways to lock in usage and relevance. According to the proposal, the goal is simple but ambitious: expand adoption through targeted incentives while keeping transparency front and center.

USD1’s Rapid Growth Since Launch

USD1 launched in March and has already grown into a sizable player, reaching an estimated $3 billion in market capitalization. The team credits strong community engagement and a series of key integrations for the rapid expansion. Still, maintaining momentum in a crowded stablecoin market isn’t easy, especially as both centralized and decentralized alternatives compete for liquidity and mindshare.

How the Incentives Would Be Used

Under the proposed plan, WLFI tokens would be deployed across selected CeFi and DeFi use cases designed to increase real-world utility for USD1. Any partners receiving incentives would be publicly disclosed, a detail the team emphasized to address governance and transparency concerns. Rather than blanket rewards, the approach appears focused on strategic placements that can generate sustained activity.

Why It Matters for WLFI Holders

USD1 is positioned as the flagship product within the World Liberty Financial ecosystem, making its growth closely tied to the broader network’s success. Expanding USD1 usage could drive more integrations, higher transaction volume, and increased economic activity across the platform. The proposal argues that this, in turn, strengthens governance value for WLFI holders and enhances the ecosystem’s long-term influence.

Looking Ahead

If approved, the initiative could mark a more aggressive phase of expansion for World Liberty Financial. By tying treasury deployment directly to adoption goals, the project is signaling a willingness to invest in growth rather than sit on idle reserves. Whether the strategy delivers lasting impact will likely depend on partner selection and broader market conditions, but the intent is clear.