- WLFI surged 16% in 24 hours despite broader crypto weakness

- A high-profile Mar-a-Lago event may be fueling short-term demand

- The token remains down 28% over the past month

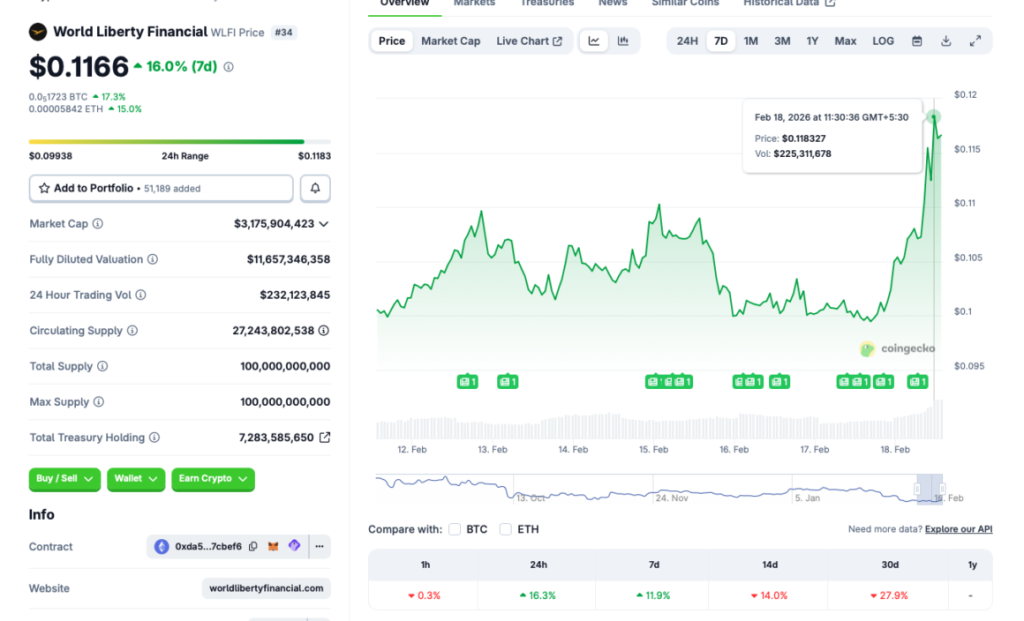

Trump family-backed World Liberty Financial (WLFI) just posted a sharp 16% gain in a single day, even as the wider crypto market continues to struggle for direction. According to market data, WLFI is up 16.3% over the last 24 hours and nearly 12% over the past week. That kind of move stands out, especially when Bitcoin is still fighting to reclaim momentum.

Zoom out a bit, though, and the bigger picture looks less explosive. WLFI remains down roughly 14% on the 14-day chart and nearly 28% over the past month. The rally feels powerful in the short term, but it’s happening inside a broader downtrend.

Mar-a-Lago Event May Be Fueling Speculation

One likely catalyst behind WLFI’s spike is an invite-only event scheduled at Mar-a-Lago, President Trump’s long-owned Florida property. Reports suggest around 400 attendees, including high-profile figures such as Coinbase CEO Brian Armstrong, NYSE President Lynn Martin, Nasdaq CEO Adena Friedman, and Goldman Sachs CEO David Solomon.

When that level of traditional finance presence overlaps with a Trump-linked crypto project, speculation follows quickly. Markets often trade ahead of visibility and access, not fundamentals. Even the perception of alignment between political influence and financial infrastructure can trigger aggressive short-term buying.

Controversy Still Hangs Over the Project

Despite the rally, WLFI is not without baggage. Critics have questioned President Trump’s involvement in crypto-related ventures, although he has publicly denied direct operational involvement in World Liberty Financial. That ambiguity alone keeps the narrative heated.

Recent reports that a royal UAE investor purchased a 49% stake in the project added another layer of attention. International capital, political connections, and crypto rarely mix quietly. The buzz may help with visibility, but it also raises regulatory and reputational questions that don’t disappear overnight.

Can WLFI Sustain Momentum in a Bear Market?

The bigger challenge is macro. Bitcoin continues to struggle with sustained upside, and most altcoins are moving in BTC’s shadow. In bear market conditions, short-term rallies often fade as liquidity thins and traders rotate back into safer positions.

WLFI’s resilience is notable, but sustaining gains in a fragile environment is harder than igniting them. If Bitcoin stabilizes or turns higher, WLFI could ride that wave. If BTC rolls over again, this rally may start to look like a sharp but temporary spike rather than a structural shift.