- Peter Brandt sees XRP forming a descending triangle with targets at $2.68 and possibly $2.22.

- Exchange supply is rising while whale demand weakens, pressuring price stability.

- Heavy long trader liquidations and growing FUD are reinforcing a bearish short-to-midterm outlook.

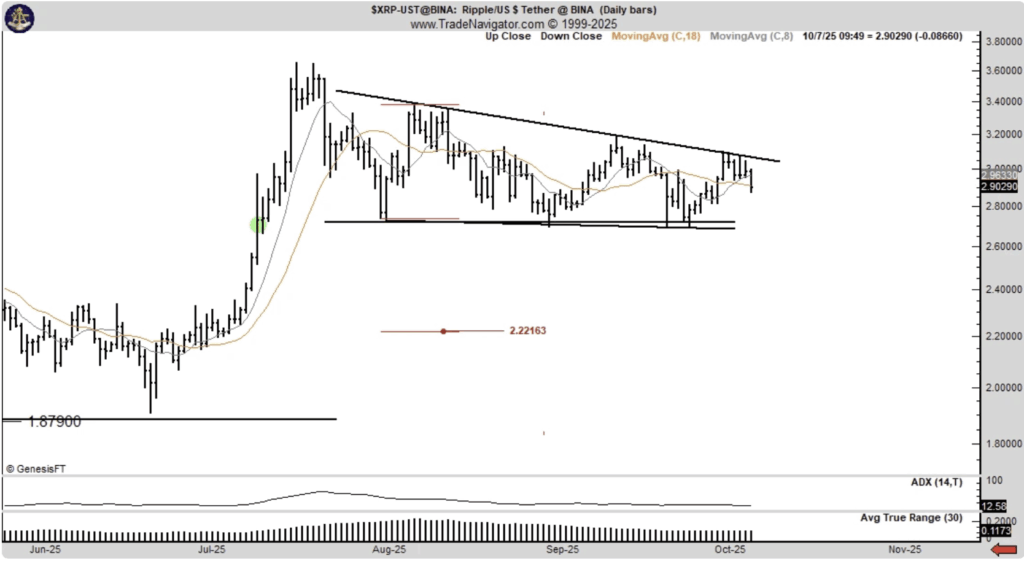

Veteran trader Peter Brandt is sounding the alarm for XRP, hinting that the token might be carving out a descending triangle pattern. According to him, the midterm target sits around $2.68, and if that level cracks, XRP could tumble further to around $2.22.

Looking at the weekly chart, Brandt pointed out a bearish RSI divergence, something that has historically preceded weaker price action. For traders who’ve been waiting on a clean breakout, this setup isn’t exactly comforting—it leans more toward caution than confidence.

Exchange Supply Surges as Whale Demand Fades

On-chain data from Glassnode showed that more than 320 million XRP poured into exchanges over the past week. That move bumped the total exchange-held supply to over 3.8 billion coins, which doesn’t paint a bullish picture.

The bigger issue? Whale demand hasn’t matched the increase in supply. Large holders seem to be stepping back while retail and short-term traders are doing the heavy lifting. That imbalance can create sell pressure, especially when markets are already looking shaky.

Liquidations Spark Downside Pressure

XRP also faced another blow from heavy long trader liquidations. Within just 24 hours, leveraged traders lost more than $23 million, with long positions making up over $21 million of that wipeout.

When longs get flushed out like that, it sets the stage for what’s called a long squeeze—a situation where selling accelerates because traders are forced to close positions. That dynamic has only added weight to the midterm bearish case.

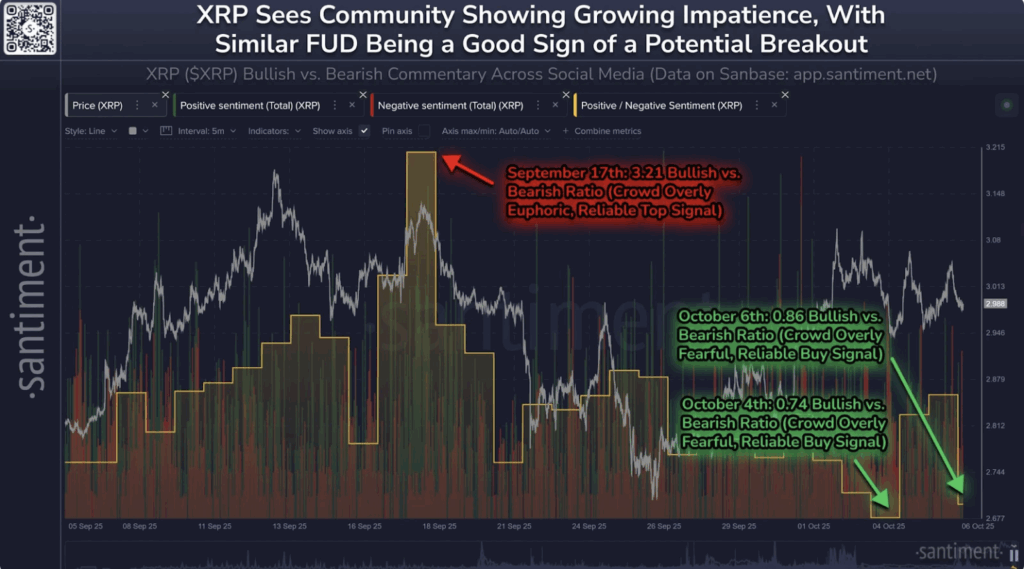

Community Sentiment and the Role of FUD

Adding to the mix is the mood across the XRP community. According to Santiment, chatter has grown more negative in recent days, with FUD (fear, uncertainty, doubt) starting to creep in. Sell orders have climbed as holders grow impatient, which naturally pressures the market.

Still, it’s worth remembering that XRP has a funny history of bouncing after periods of extreme FUD. In the past, heavy negativity often set the stage for sharp recoveries. Whether that pattern repeats here—or if Brandt’s descending triangle call plays out—remains the big question hanging over XRP right now.