- Wintermute withdrew 24,124 AAVE, signaling strong whale accumulation around the demand zone.

- Spot Taker CVD and rising long dominance show buyers gaining control across spot and derivatives.

- A break above $179 could confirm AAVE’s rebound setup and open room toward higher targets.

Wintermute’s withdrawal of 24,124 AAVE — roughly $4.1 million — from Kraken on November 24 has stirred the market in a way that feels more intentional than reactive. This kind of off-exchange movement usually signals purpose, not hesitation, because Wintermute rarely pulls size without a reason baked in. And with AAVE sitting inside its demand zone, the action ends up reinforcing a quiet but steady build-up of whale accumulation. Traders are watching the momentum change closely, since large players tend to define the turning points in a choppy market, even when price action still looks trapped inside a broader downtrend.

Buyers try to take control as price rebounds

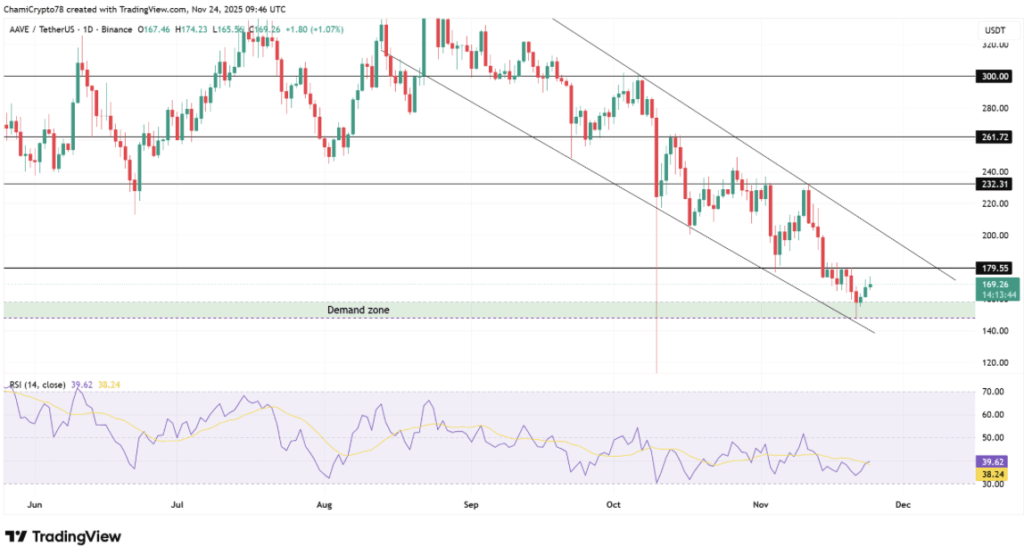

AAVE hovered near $169 at press time, bouncing cleanly off its $150–$160 demand zone that held firm after weeks of pressure. The chart still showed a descending channel weighing on price, although the recent reaction broke the pattern’s rhythm just enough to get attention. Buyers now face their first real test at $179, a stubborn resistance that has acted like a ceiling before. If price reclaims it with conviction, the path toward $232 opens up again, where earlier supply cut momentum short. Meanwhile, the RSI nudged up from 39 and moved closer to its average — nothing dramatic, but enough to suggest early momentum returning. There’s no major divergence yet, still the buyers’ activity around the demand zone shows they’re defending value areas with more aggression.

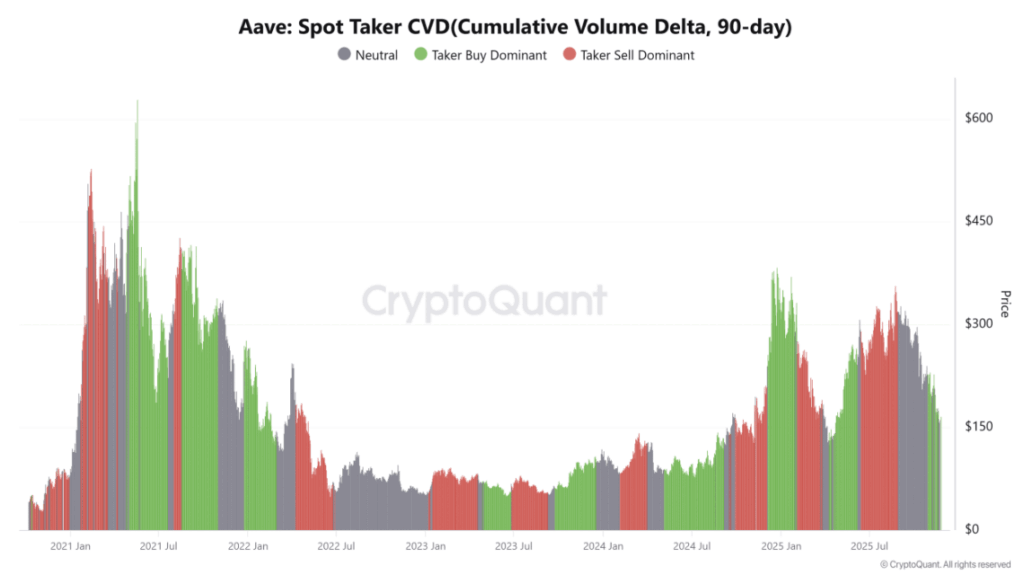

Buyer aggression shows up clearly in CVD behavior

Spot Taker CVD has been flashing sustained buyer strength through the 90-day window, showing that market buys outpace sell pressure with some consistency. This indicator tends to highlight conviction more accurately than passive order flow, and right now it’s tilting firmly toward buyers lifting offers and absorbing sell liquidity. That steady rise lines up almost perfectly with the bounce off the demand zone, giving more weight to the argument that a trend shift might be forming under the surface. Whale entries typically appear when spot buy pressure starts beating reactive selling — a rhythm that has been unfolding slowly. While the real confirmation hinges on a break above $179, CVD is already sending an early, confident signal.

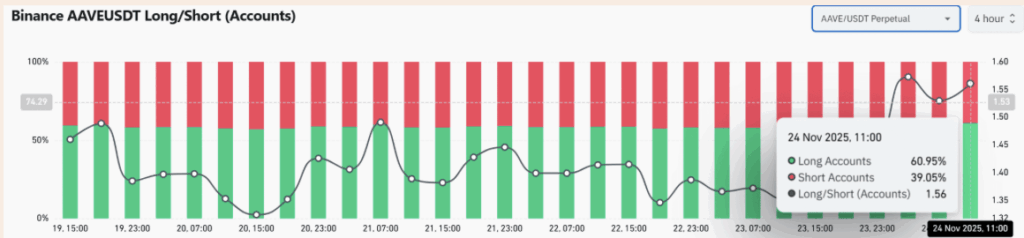

Long traders gain control on Binance

Binance’s Long/Short Ratio jumped sharply to 1.56, meaning long accounts now control nearly 61% of open positions. This is a notable change from the heavily bearish tilt that dominated the entire downtrend, and such shifts often surface near local bottoms. Liquidation data added more fuel, showing heavier short losses over the past few sessions — the kind of thing that forces traders to unwind bearish positions quickly. If price presses into the $179 resistance, the setup increases the chance of a short squeeze. This rise in long participation also lands right in sync with the whale-side accumulation that Wintermute kicked off with its withdrawal. Now the question becomes whether this combined weight can push AAVE into a proper breakout.

AAVE reaches a critical moment as signals align

AAVE sits at a pivotal point where whales accumulate, buyers control spot flow, and long traders dominate derivatives positioning all at once. These aligned factors strengthen the idea that AAVE is preparing for a larger rebound from its demand zone. A clean break and hold above $179 would confirm the shift and open a clearer path toward higher levels, potentially reigniting momentum that has been missing for weeks. Here is where the market decides whether this quiet buildup finally transforms into a stronger trend reversal.