- Mike Novogratz argues the fast-gains era is cooling as risk-averse capital grows

- Memecoins will still thrive because casual traders treat them like play money

- Serious capital and speculative chaos can coexist without canceling each other out

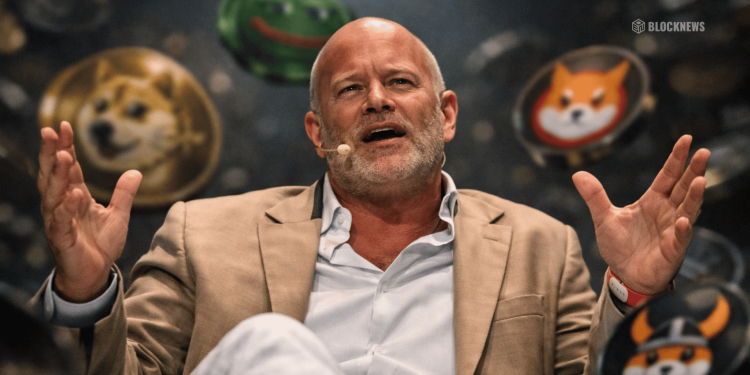

Galaxy Digital CEO Mike Novogratz has been floating a familiar idea lately: crypto’s most extreme speculative era may be winding down. In his view, more cautious institutional capital is entering the market, and that changes everything. It reduces the appetite for wild, fast moves, pushes the market toward infrastructure, and forces crypto to behave more like a mature asset class than a casino.

It’s a clean story, and it’s attractive to regulators and risk models. It suggests crypto is growing up. But it also assumes speculation is something the market “outgrows,” and that’s where the argument starts breaking down.

Memecoins Don’t Run on Institutions, They Run on People

Here’s what most commentators skip. Memecoins aren’t powered by pensions or hedge funds. They’re powered by casual traders, trenchers, and people who want to gamble $5 or $50 because it’s fun. That kind of participation doesn’t disappear just because the market gets more regulated or more institutional.

There will always be a layer of crypto where the point isn’t utility. It’s entertainment. People buy memecoins the same way they buy lottery tickets, not because they believe in a protocol roadmap, but because they want to feel early, or because they want to tell a friend they “caught one” before it ran. It’s not rational capital. It’s social capital, and it’s addictive.

Mature Money and Degenerate Money Can Exist at the Same Time

The presence of serious investors doesn’t erase the existence of speculative noise. It just changes the shape of the overall market. Risk-averse capital can improve infrastructure, increase compliance, and pull more attention toward long-term projects, and that’s a net positive for the industry.

But the crowd that wants a quick 20x on a Friday night isn’t going anywhere. It’s part of how markets work. Even in traditional finance, there are serious long-term allocators and there are people buying options contracts like scratch tickets. Crypto just makes that dynamic louder and faster.

The Market Will Mature, but the Casino Doesn’t Close

What’s more likely is not the death of speculation, but a split. One part of crypto becomes more institutional, more regulated, and more tied to real-world assets, tokenized finance, and infrastructure. Another part stays chaotic, meme-driven, and socially fueled. And that second part will still generate volume, headlines, and occasional absurd rallies.

Trying to “ban” memecoin behavior out of crypto is like trying to ban gambling out of human nature. It doesn’t work. It just moves around, adapts, and finds a new wrapper.

Speculation Isn’t Leaving, It’s Just Evolving

The idea that speculation will vanish is wishful thinking. Speculators aren’t going away. They’re just expanding their toolbox. Some will move into more strategic plays, some will stay in pure memes, and many will do both depending on the mood of the market.

Where serious money sees a gradual march toward utility and real-world integration, retail still sees dice to roll. That duality is messy, sometimes embarrassing, and often irrational. But it’s also part of what makes crypto feel alive.