- Warsh’s past Fed rhetoric was more about positioning than real intent

- Balance sheet shrinkage faces hard limits that markets already absorbed

- Crypto and risk assets have proven resilient even as liquidity tightened

Kevin Warsh spoke loudly about the Federal Reserve’s balance sheet while angling for the top job, but that noise was strategic, not ideological. He needed a lane to signal seriousness without directly clashing with Trump’s public pressure on rates. Balance sheets were safe territory. Once seated, that incentive fades fast. Expect symbolic moves and careful language, not a structural rewrite of monetary policy that could rattle markets.

Why Aggressive Balance Sheet Cuts Make Little Sense

The idea that Warsh will aggressively drain liquidity ignores political reality. Trump wants strong markets, rising asset prices, and financial stability heading into election cycles. Warsh understands that shrinking reserves too far risks tightening conditions unnecessarily. Even from a policy standpoint, he has acknowledged that balance sheets influence asset prices. Picking that fight would undercut the very outcomes the administration wants.

The Plumbing Constraint Nobody Escapes

There is a practical floor under how much the balance sheet can shrink. Banks need reserves to function, settle transactions, and meet regulatory requirements. Adjusting that floor means rewriting rules and incentives across the financial system, which is slow and politically costly. No Fed chair, Warsh included, is eager to open that can of worms.

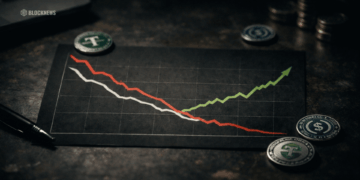

Markets Already Ran the Stress Test

The experiment already happened. Roughly $2.5 trillion came off the balance sheet alongside aggressive rate hikes. Equities pushed higher, speculative assets survived, and crypto continued trading as a liquidity-sensitive risk asset rather than collapsing outright. The takeaway is clear. Balance sheets do not mechanically dictate asset prices the way many assume.

Conclusion

Warsh’s nomination shifts headlines, not trajectories. It adds political optics to Fed leadership but does little to alter the underlying path for crypto, equities, or growth. Beyond giving traders a reason to unwind crowded trades, this appointment is unlikely to change how markets actually behave.