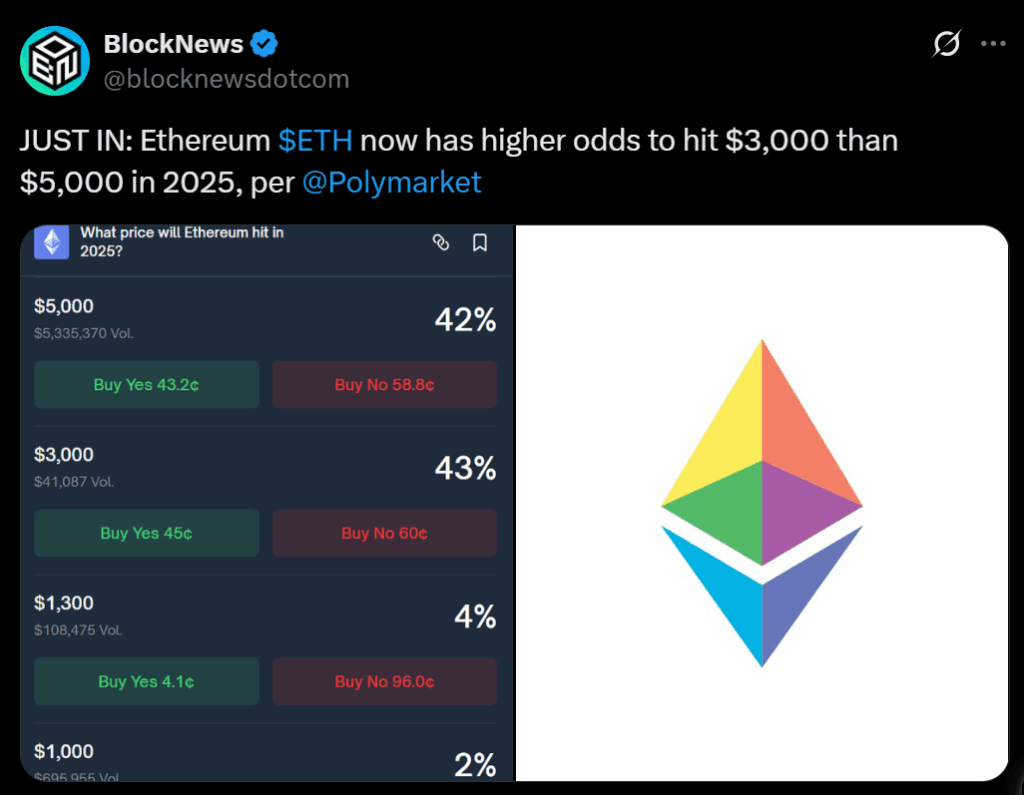

- Polymarket odds lean slightly toward ETH hitting $3K over $5K in 2025.

- Risk-off sentiment, uneven ETF flows, and softer L1 economics weigh on price.

- Sustained ETF inflows or calmer macro conditions could flip the odds quickly.

Prediction markets are hinting at caution. On Polymarket, traders currently see a slightly higher chance of Ethereum hitting $3,000 than $5,000 before 2026—roughly 43% versus 42%. It’s a tight race, but the lean is telling. While sentiment flips intraday, the tone has turned defensive. The reasons? A risk-off market backdrop, uneven ETF flows, and softer post-upgrade token economics are all weighing on ETH’s near-term outlook.

Risk-Off Tape and Proximity to $3K

The market tone has soured. Bitcoin and Ethereum both printed new multi-week lows as equities wobbled under tariff and banking jitters. Ethereum’s been hovering in the upper $3,000s—around $3.9K—making a drop toward $3,000 a shorter slide than a leap to $5,000. In a headline-driven, choppy tape, proximity matters. On top of that, leveraged traders have been caught offside, with spikes in liquidations amplifying every dip. As liquidity thins, these cascades make round-number retests—like $3K—more likely.

ETF Flows Still Mixed

Spot ETH ETFs have been a bright spot, but not a steady one. Some sessions have seen hefty inflows—$236 million in a U.S. trading day, and roughly $488 million across Hong Kong listings last week—but the pattern isn’t consistent. Unlike Bitcoin’s early ETF wave, Ethereum’s flow profile is whipsawing between inflows and outflows. That lack of a relentless bid keeps traders from pricing in a sustained move toward $5K. Until the ETF flows stay green week over week, the upside narrative feels capped.

Dencun’s Aftermath and the Fee Burn Slowdown

The Dencun (EIP-4844) upgrade, while great for user costs, changed Ethereum’s on-chain economics. Lower data fees for Layer-2s mean less L1 gas burn, and in turn, less ETH permanently removed from circulation. Fee revenue has dropped from its peaks to single-digit millions per day in 2025. Net supply has even flirted with mild inflation during quieter stretches. It’s a UX win, but it dulls the old “ultrasound money” momentum. Meanwhile, Solana’s ultra-low fees still pull retail users off Ethereum—great for multichain growth, but another drag on ETH’s narrative.