- Gold climbed more than 1% on Wednesday, with spot prices hitting around $4,179 per ounce as traders positioned ahead of a key vote to end the record US government shutdown.

- Hopes for cleaner economic data and a possible Fed rate cut next month boosted safe-haven and rate-cut bets, even as gold ETFs continue to see outflows after last month’s record high.

- Despite some profit-taking, gold is still up more than 55% in 2025 and holding above the crucial $4,000 level, with many expecting consolidation now and another leg higher in 2026.

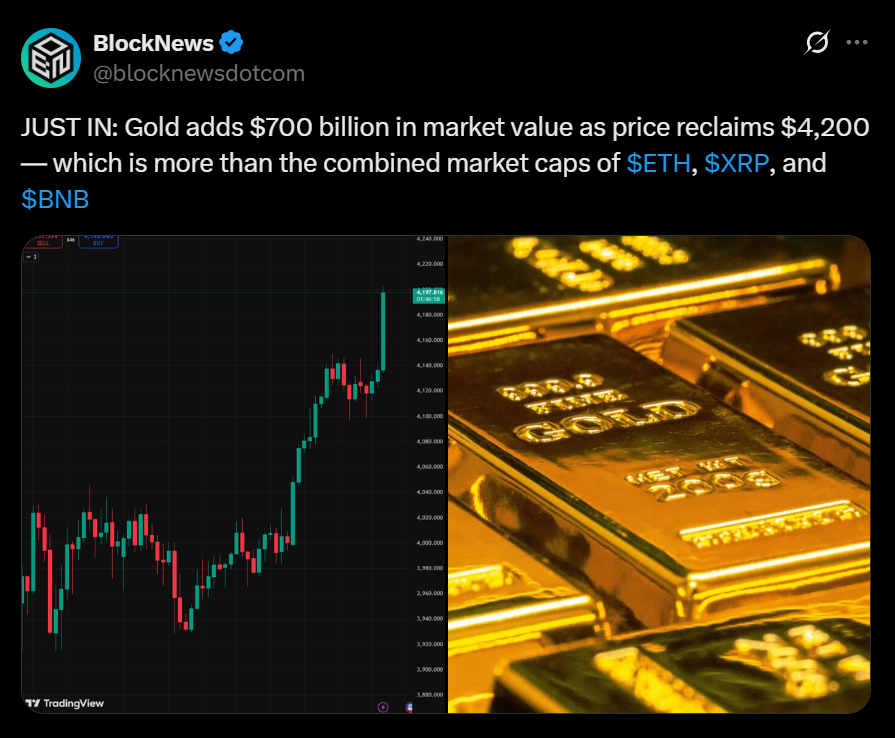

Gold caught a strong bid on Wednesday, with spot prices jumping around 1.3% to roughly $4,179 an ounce — the highest level since late October, when it briefly tagged an all-time high near $4,381. US gold futures also pushed higher, up about 1.6% to around $4,182 in New York.

The timing isn’t random. The US House of Representatives is set to vote on a funding deal that would finally end the 42-day federal shutdown, the longest in American history. The Senate has already passed the package, backed by a bloc of Democrats, so traders are treating an eventual resolution as the base case.

Why does that matter for gold? Once the government reopens, official economic data starts flowing again. If those numbers confirm what private surveys have been hinting at — softer growth and cooling inflation pressures — it strengthens the case for a Federal Reserve rate cut as early as next month. Lower real rates and more policy easing expectations are usually a tailwind for bullion, so traders are front-running that scenario.

As one veteran metals trader put it, recent price action suggests that even a small hiccup in the shutdown vote — a delay or messy politics — could cause both stocks and precious metals to wobble short-term. But for now, the market is leaning toward “shutdown ending + data clarity,” which keeps gold well-supported.

Profit-taking, ETF outflows… but gold still up 55% this year

Even with Wednesday’s pop, gold has actually cooled off a bit from last month’s blow-off rally. After tagging record highs near $4,381, the metal saw some classic profit-taking from funds that felt the move had gone too far, too fast.

That cool-down showed up in ETF flows as well. Gold-backed exchange-traded funds have logged three straight weeks of net outflows as some investors rotated into other trades, especially US equities and AI-linked names.

But zoom out and the bigger picture looks very different:

- Gold is still up more than 55% so far in 2025.

- It’s on track for its best year since 1979.

- The metal has repeatedly defended the key $4,000 level, which has now become an anchor zone for dip-buyers.

A mix of lower rate expectations, ongoing central-bank buying, and demand for portfolio “insurance” has kept a strong structural bid under the market. So even as some fast money exits, longer-term players are still treating pullbacks as opportunities rather than the end of the trend.

Safe-haven demand lingers as markets look to 2026

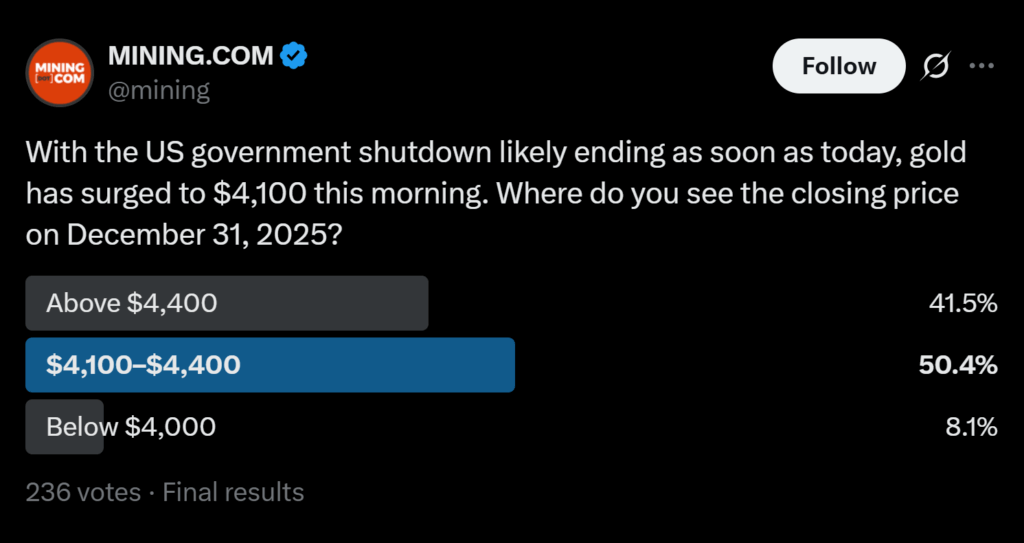

This week’s rebound back above $4,100 isn’t just about the shutdown or a single Fed meeting. Analysts note that the longest government shutdown in US history has left a psychological mark on investors and households, keeping safe-haven demand alive even as stocks grind higher.

One macro strategist described the move as a reflection of “deeper unease beneath the risk-on surface” — a sense that political dysfunction, sticky inflation risks, and fragile growth can flare back up quickly. In that environment, gold remains the go-to hedge.

Looking ahead, many expect bullion to consolidate for a while before attempting another sustained push higher in 2026. As flows broaden out across the US equity market and some money rotates out of crowded trades like gold and AI leaders into more beaten-down sectors, price action may get choppy.

But as long as gold holds above that $4,000 handle and the Fed leans toward easing rather than tightening, the underlying bull story stays intact. For now, Wednesday’s move is a reminder that even with profit-taking and ETF outflows, the metal is still very much in play as the market’s favorite safety valve.