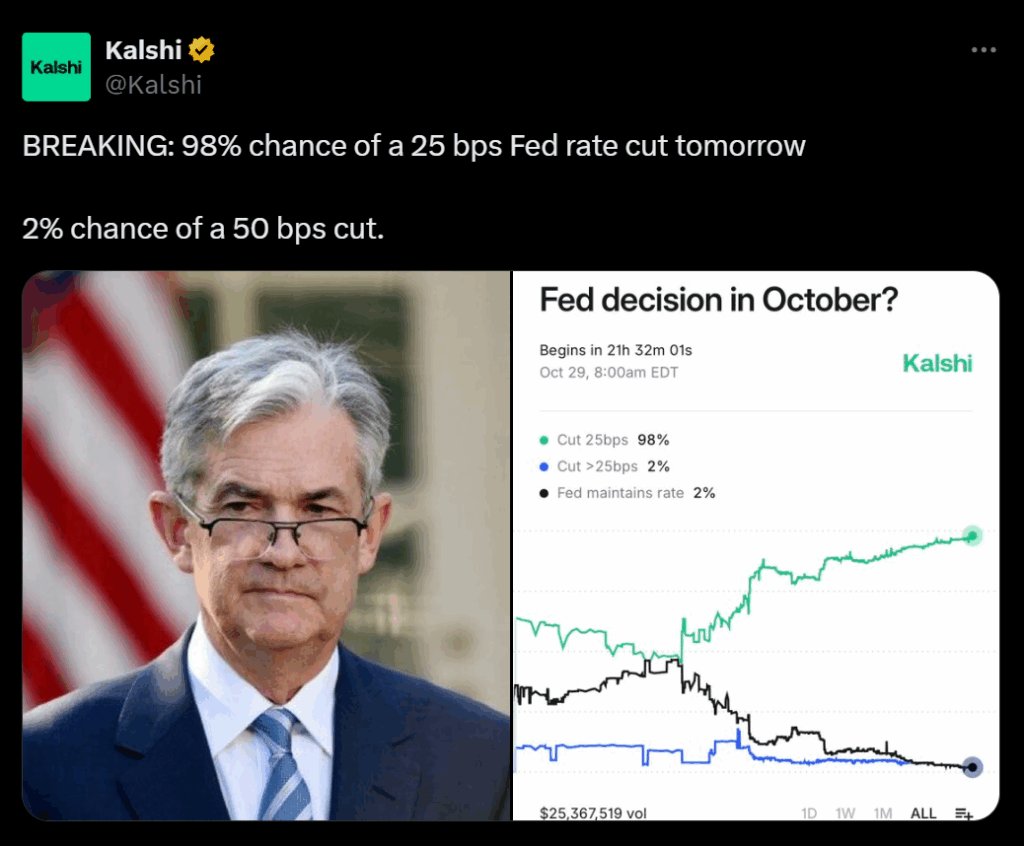

• The Fed is expected to cut its benchmark rate from 4.1% to 3.9% on Wednesday.

• The ongoing government shutdown has disrupted critical data on inflation and jobs.

• Another cut is projected for December — here is how missing data could change that path.

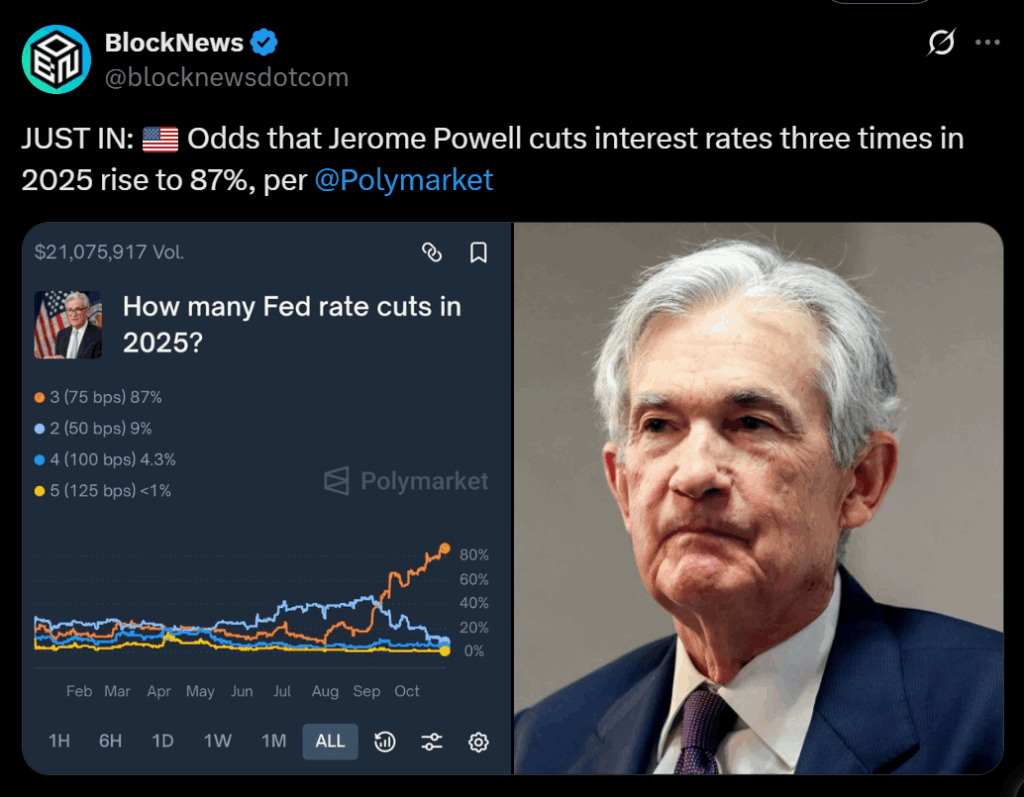

The Federal Reserve is widely expected to cut its benchmark interest rate on Wednesday for the second time this year, trimming it from 4.1% to around 3.9%. Analysts also project a third cut in December, as policymakers aim to stimulate the job market and shield the economy from slowing momentum. The move comes amid softening inflation and rising unemployment claims, signaling cooling demand across key sectors.

Shutdown Leaves Fed Flying Blind

A major complication looms over the decision: the ongoing U.S. government shutdown has blocked access to critical data on hiring, inflation, and consumer spending, leaving the Fed to operate without its usual economic indicators. September’s jobs report has been delayed indefinitely, and the White House recently warned that October’s inflation data may not be compiled at all. Without these metrics, officials must rely on secondary or private data to gauge economic conditions — a risky setup during a policy pivot.

Why the Rate Cut Matters for Consumers

A cut in the key rate directly impacts borrowing costs for mortgages, auto loans, and credit cards. Since Fed Chair Jerome Powell signaled earlier this year that rate reductions were on the table, the average 30-year mortgage rate has already fallen from 6.6% to 6.2%, offering relief to homebuyers and borrowers. Lower rates also tend to support asset markets, but if inflation reaccelerates, the Fed could face renewed political pressure for its easing stance.

What Comes Next

The Federal Open Market Committee (FOMC) will announce its decision Wednesday afternoon, followed by Powell’s press conference. The Fed’s final meeting of 2025 is scheduled for December, when another cut was expected — though the shutdown’s duration and its effects on spending could alter that plan. With roughly 750,000 federal workers going unpaid and consumer spending at risk, the Fed’s cautious tone this week may reveal how far it’s willing to go to keep the economy on track.