- Plasma XPL launched with $2B liquidity, a global neobank app, and heavy institutional backing.

- Its core features—PlasmaBFT, EVM compatibility, and a native Bitcoin bridge—make it uniquely optimized for stablecoin payments.

- With cashback, yield, and zero-fee global transfers, Plasma is positioning itself as the default chain for stablecoin adoption worldwide.

Plasma, the stablecoin-native Layer 1 blockchain, has exploded onto the scene with a debut that turned heads and rattled expectations. With $2 billion in stablecoin liquidity active on day one, a fully diluted valuation that surged 17x from its ICO price, and a neobank app promising to bring digital dollars to every corner of the globe, Plasma is not here to play nice. It is here to rewrite the rules. So, let us take a closer look at the architecture, ambition, and audacity behind the project that wants to become the default highway for Money 2.0.

What Is Plasma?

Plasma is a layer-1 blockchain designed with a singular focus: optimizing stablecoin payments and making access to digital dollars seamless for anyone, anywhere. Unlike general-purpose blockchains, Plasma has structured its infrastructure around the realities of stablecoin adoption, aiming to eliminate friction in transactions and expand the use cases of internet-native money.

Its native token, XPL, is the fuel powering the network’s staking-based consensus mechanism while also serving as a medium for governance, rewards, and network participation. Plasma is not just building a blockchain but a whole financial ecosystem where stablecoins are the foundation for saving, spending, transferring, and earning.

Notably, the project is backed by heavyweight investors and advisors, with notable figures in the crypto and tech space adding credibility and momentum. But beyond hype, Plasma is pushing for a stablecoin ecosystem designed for real-world adoption at scale.

Core Components

Plasma is built on three foundational pillars, each engineered to deliver speed, scalability, security, and developer accessibility. These components include:

PlasmaBFT

At the heart of Plasma is PlasmaBFT, a pipelined implementation of the Fast HotStuff Byzantine Fault Tolerance protocol. Unlike traditional consensus mechanisms that process proposals in sequential steps, PlasmaBFT parallelizes proposal, voting, and commit stages into concurrent pipelines. This design delivers sub-second finality, high throughput, and deterministic settlement, which are essential for payment-heavy workloads where speed and certainty matter most.

Essentially, the mechanism ensures both safety and liveness under partial synchrony, meaning the network remains reliable even under network delays or high demand. This makes PlasmaBFT particularly suited for global-scale stablecoin transactions, where speed and efficiency are non-negotiable.

EVM Execution Layer

Plasma’s execution layer runs on Reth, a high-performance Ethereum client written in Rust. This brings full Ethereum Virtual Machine (EVM) compatibility to Plasma, allowing developers to leverage familiar tools such as Solidity, MetaMask, and Hardhat without additional complexity.

Notably, this seamless compatibility dramatically lowers the barrier for developer adoption, enabling the creation of scalable, EVM-native applications directly on Plasma. It effectively blends the efficiency of a purpose-built chain with the familiarity of Ethereum’s developer ecosystem.

Native Bitcoin Bridge

Plasma introduces a native Bitcoin bridge to overcome the limitations of wrapped BTC. This bridge is trust-minimized, non-custodial, and secured by a network of verifiers that will decentralize over time. Users can deposit native BTC into the bridge, mint pBTC on Plasma, use it in smart contracts, and redeem it back into native BTC via threshold signatures.

This functionality enables programmable Bitcoin finance, BTC-backed stablecoins, and cross-asset flows, all within a single environment. It is important to highlight that the native Bitcoin bridge is a strategic addition that opens opportunities for new types of decentralized finance applications, making Bitcoin interoperable without compromising decentralization or security.

How Does It Work?

Plasma functions as a high-performance blockchain where stablecoins are at the core of every transaction. Its consensus mechanism relies on staking XPL tokens, securing the network while incentivizing long-term participation. Users access the network through Plasma One or compatible wallets, which connect them to the broader ecosystem of services. Plasma One integrates wallet, bank, and card functionalities into a single interface, allowing users to save in stablecoins, pay merchants, send funds globally, and earn yield in real time.

Behind the scenes, Plasma connects to liquidity providers, card networks, FX platforms, and banking partners to create a seamless bridge between crypto and traditional finance. This integrated approach eliminates the friction that usually comes with stablecoin transactions, from converting to fiat to onboarding users in regions without crypto-friendly infrastructure.

What Problems Does It Solve?

Plasma tackles several significant challenges in the stablecoin space. This includes:

- Accessibility – Many people around the world face barriers to accessing digital dollars. Plasma removes the need for specialized wallets or exchanges, making stablecoin access as simple as downloading an app.

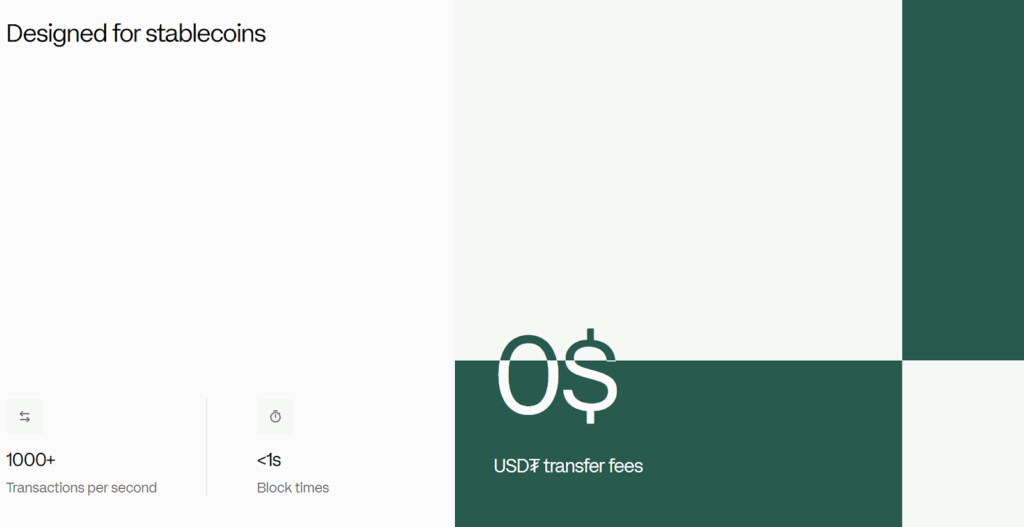

- Friction in Stablecoin Use – Current stablecoin systems often involve slow processing times, high fees, and complex interfaces. Plasma’s blockchain and app design streamline every step of the process.

- Lack of Localized Solutions – Stablecoin adoption suffers when products are not tailored to specific markets. Plasma focuses on localized onboarding and payment solutions to address real-world needs in markets where demand is strongest.

- Remittance Costs – Global remittances often involve high fees and slow transfer times. Plasma One enables instant, zero-fee transfers in USDT anywhere in the world, disrupting the traditional remittance industry.

- Fragmented Stablecoin Infrastructure – Plasma integrates onchain tools, payment rails, and end-user applications into one coherent system, removing the fragmentation that has slowed broader adoption of stablecoins.

Utility and Offerings

Plasma’s utility stack is built around stablecoin-native contracts and consumer-facing products. Key product offerings include:

XPL Token

The native token of Plasma is more than just a digital asset; it is the key to the network’s operation. XPL powers staking, secures the network, and provides governance rights to its holders. It is also a utility token for accessing services within the Plasma ecosystem, including Plasma One.

Plasma One App

Plasma One is the most tangible expression of the project’s vision. It combines multiple financial functions into a single platform: high-yield savings, instant spending, global payments, and remittances. The app is designed for real-world usability, with zero-fee transfers, fast onboarding, and cashback rewards making it a compelling alternative to traditional banking.

Cashback and Yield

Plasma offers up to 4% cashback on spending and over 10% yield on savings, creating strong incentives for users to adopt the platform. These features make stablecoin usage not just practical but financially attractive.

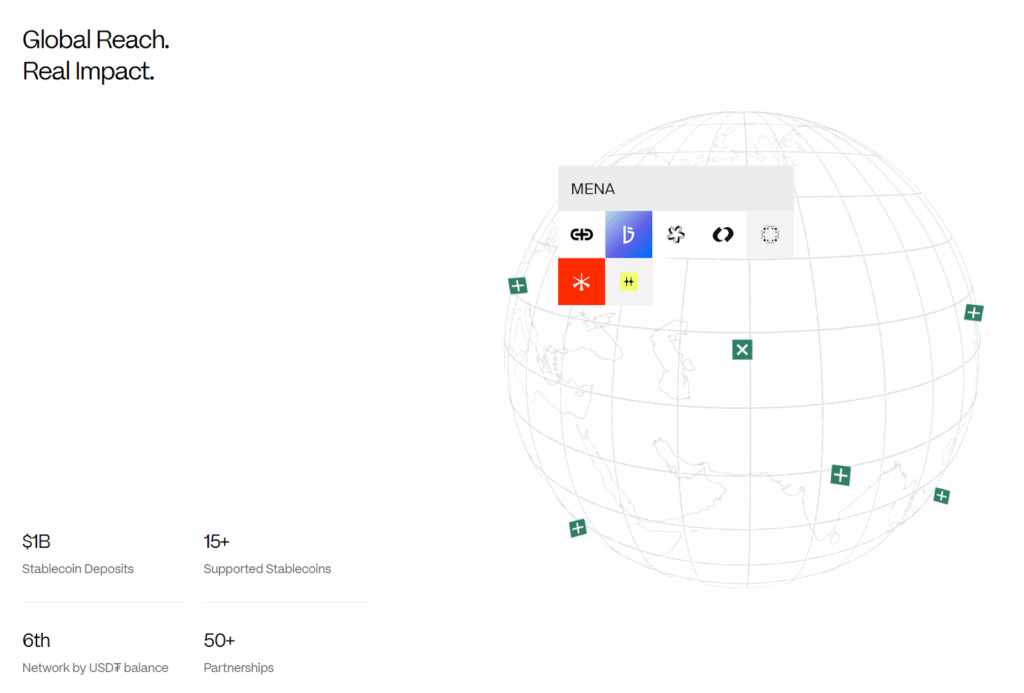

Global Coverage

The Plasma One card can be used in over 150 countries and at more than 150 million merchants. This global reach removes barriers for individuals and businesses seeking fast, borderless payments.

Zero-Fee Transfers

By enabling instant USDT transfers without fees, Plasma dramatically lowers the cost of cross-border payments and remittances, opening opportunities for financial inclusion on a global scale.

Developer Tools

Plasma provides APIs and SDKs for developers to build on its blockchain, ensuring that the infrastructure scales beyond its own products. This creates a broader ecosystem where others can leverage Plasma’s stablecoin-optimized architecture.

Key Milestones and Highlights

Plasma has gained significant momentum since inception. It raised billions in pre-deposits ahead of its ICO, secured strategic investors and advisors, and launched with substantial buzz around XPL. Its ecosystem strategy focuses on a mix of product launches, partnerships, and developer engagement.

Institutional interest is strong. Plasma has backing from Tether CEO Paolo Ardoino and PayPal co-founder Peter Thiel, both of whom serve as advisors. These relationships bring not only funding but credibility, opening doors to strategic integrations and adoption.

Roadmap and Plans Ahead

Looking ahead, Plasma has an aggressive expansion strategy. Key priorities include:

- Expanding Plasma One globally, with phased rollouts to ensure scalability and local market adaptation.

- Deepening integrations with payment networks, FX providers, and banking partners to expand coverage and liquidity.

- Introducing more features within Plasma One, including advanced DeFi tools and enhanced payment capabilities.

- Opening Plasma’s infrastructure to developers, institutions, and partners for broader ecosystem growth.

- Optimizing chain-level capabilities to further reduce transaction costs and improve speed.

- Establishing Plasma as the go-to infrastructure for stablecoin applications, with Plasma One as the benchmark product.

Final Thoughts

In conclusion, Plasma is a full-stack financial system built for the stablecoin era. With its technical precision, aggressive distribution strategy, and real-world utility, Plasma is positioning itself as the backbone of a new global economy. So, as it rolls out its ambitious vision through Plasma One, robust infrastructure, and innovative products, it will be interesting to see how quickly it can transform access to stablecoins worldwide.