- Cardano buzz grows around a possible Tier-1 stablecoin launch, with Hoskinson linked to Ripple talks.

- BitMine added $821M in ETH, bringing holdings to 2.83M and staking for yield.

- Polymarket odds show 64% chance of Bitcoin hitting $130K this month as bullish bets intensify.

Crypto markets stayed heated over the past 24 hours as fresh headlines drove momentum across Bitcoin, Ethereum, and Cardano. From major treasury moves to rising altcoin intrigue, the day brought both bullish conviction and speculative edge. So, let us take a closer look at what shaped the markets today.

Cardano’s Stablecoin Moment Nears the Edge of Breakthrough

Cardano’s stablecoin market sits at around 38 million dollars, but excitement is building that the long-awaited breakthrough could be near. Influencer Dan Gambardello hinted in an X post, that a top-tier stablecoin might soon launch on the network, adding fuel to growing speculation. Meanwhile, founder Charles Hoskinson reportedly met with Ripple executives to explore bringing the RLUSD stablecoin to Cardano, though no timeline is confirmed.

For now, the network’s stablecoin landscape is led by smaller projects like Moneta (USDM) and Djed (DJED). Yet the absence of a major player underscores Cardano’s next critical step toward deeper DeFi integration. A successful launch of a Tier-1 stablecoin could be the turning point that transforms liquidity and utility across its ecosystem.

BitMine’s Massive Ethereum Play Turns Heads

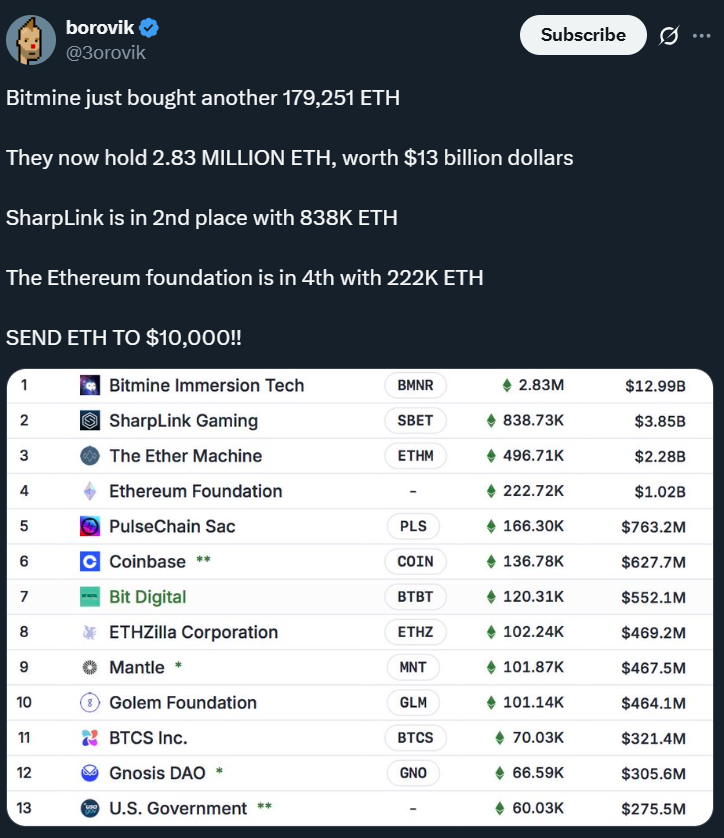

Crypto mining titan BitMine made waves after adding 821 million dollars worth of Ethereum to its reserves, boosting its total holdings to 2.83 million ETH valued at 13.4 billion dollars. The company’s strategic accumulation signals a bold bet on Ethereum’s long-term dominance and staking yield potential. BitMine’s stock climbed over 4 percent following the announcement, drawing sharp attention in financial circles.

The firm’s goal to control as much as 5 percent of Ethereum’s total supply positions it as a major influence on network economics. Beyond mining, BitMine’s diversification into ETH staking highlights how corporate treasuries are evolving from passive holders into active network participants — a move that could reshape institutional engagement in crypto.

Traders Bet Big on Bitcoin’s $130K Target

Prediction markets are buzzing with optimism as Polymarket now assigns a 64 percent chance that Bitcoin will reach 130,000 dollars in October. The surge in bullish contracts reflects a wave of trader confidence following Bitcoin’s new all-time high above 125,900 dollars.

This spike in speculative activity comes as futures open interest climbs and ETF inflows stay robust. While traders are betting on another leg up, analysts warn that overly aggressive positioning could spark volatility if momentum cools. For now, the mood remains firmly risk-on as Bitcoin’s dominance continues to rise.

Final Thoughts

To conclude, crypto markets are entering the final quarter of 2025 with undeniable energy. From corporate accumulation to ecosystem expansion and high-stakes speculation, the past 24 hours underscored how quickly narratives can shift. So, if momentum holds, October could set the tone for an explosive end to the year.