- Whales are selling into strength, keeping XRP below critical resistance despite the lawsuit win.

- Ripple’s growth strategy is centered on infrastructure and institutional adoption, which moves price action slowly.

- Legal clarity has set a bullish long-term tone, but short-term price movement is dominated by profit-taking and consolidation.

While the SEC lawsuit resolution was widely expected to ignite a powerful XRP rally, the reality is more complex. Large holders — whales — are actively selling into strength, creating consistent downward pressure that retail buying simply can’t counter. This ongoing distribution has kept XRP locked below key resistance levels, notably around $0.75, with on-chain data showing repeated reversals instead of breakouts. Many of these big players had already priced in the lawsuit win, meaning their current moves are more about profit-taking than buying into fresh momentum.

Infrastructure Growth Over Quick Pumps

Ripple’s focus is on building long-term utility rather than chasing short-term price spikes. Its partnerships with central banks in the MENA region, CBDC projects in countries like Bhutan and Palau, and global payment infrastructure initiatives are all aimed at institutions — not speculative retail traders. While this strategy lays a strong foundation for XRP’s future, it doesn’t generate the kind of hype-driven surges meme coins or speculative plays enjoy. Utility growth is slow and steady, and markets often lag in pricing it in.

Legal Clarity Brings Long-Term Confidence

The final dismissal of appeals in the SEC case, confirmed by Ripple’s legal chief, brought complete regulatory clarity: XRP sales on exchanges are not securities. Judge Torres’ ruling solidified this position, removing a major overhang. However, instead of sparking a rush, the market reacted with a slow consolidation.

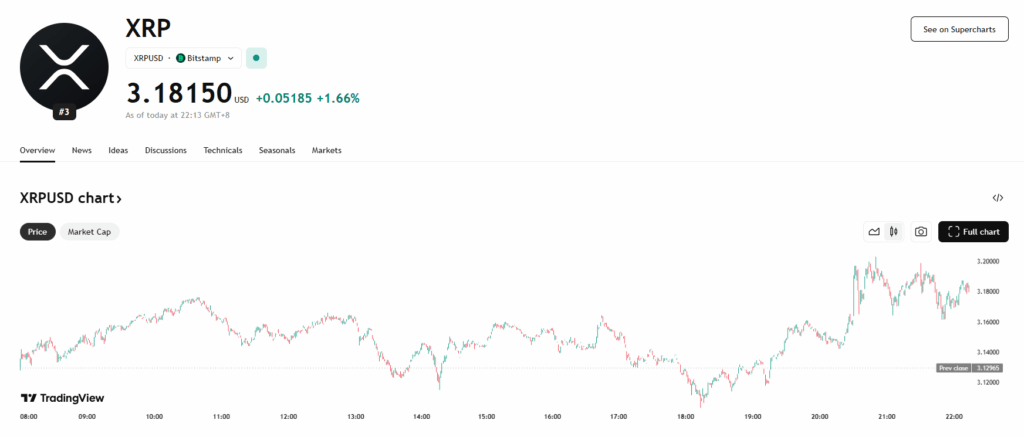

XRP saw a huge rally earlier in the year — climbing from $1.79 to $3.56 — but has since cooled to around $3.14 as whales rotate out and smart money repositions.